Email of the day on short covering

I hope you and the family are well. well done on your XXX trade. What would you do now if you are not in the shares? and why are the shares up 25 per cent today? Is that shorts closing out their positions, realisation that the company will not go bust or just volatility associated with the rights issue? Many thanks

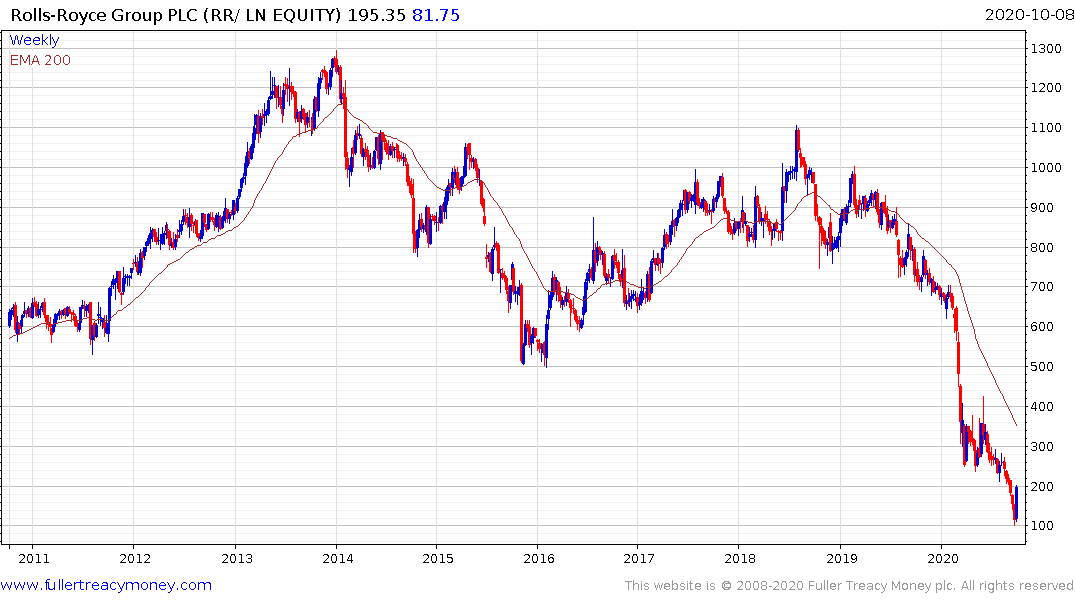

Thank you for this question which may be of interest to other subscribers. I agree the most likely reason for today’s significant additional surge today was because of short covering. It’s up almost 100% this week so buying the rebound requires one to have some tolerance of volatility. The only way to deal with that and not lose sleep is to control the size of the position.

The rights issue was fully subscribed and debt funding capital has been secured. There was never a credible chance the company was going to go bust but the confirmation of capital completely removes it. Stops were certainly triggered this week but the share has yet to break the sequence of lower rally highs. This is just the first rebound in what could be a Type-2 bottom. The failed downside breaks in May and July marked a loss of momentum. The current rebound may be another failed downside break.

Type-2 bottoms are characterised by massive reactions against the prevailing trend. They are often followed by ranges before the recovery continues. That’s a realistic potential outcome for Rolls Royce in my opinion.