The Road Ahead

Thanks to a subscriber for this report from KKR which may be of interest. Here is a section:

In fact, China is responding to these changes in corporate behavior using a variety of techniques, including becoming a larger and more powerful domestic economy that relies on its own production (what President Xi Jinping calls “domestic circulation”). In the current environment China may also better leverage its higher interest rate curve (both real and nominal) to try to attract capital to support this more permanent shift towards a consumption economy. A more stable currency outlook is also helping. Our bottom line: Expect a heightened rivalry across multiple facets of the relationship, including some decoupling. However, given the absolute size of the opportunity in China, now is actually the time to think through different ways to harness China’s growth in thoughtful, risk-adjusted fashion, particularly investments that reward long-term, patient capital. Specifically, we think that further implementation of domestic circulation as a policy will lead to the rise of more domestic corporate leaders, and as a result, more – not less – corporations will look to find ways to serve this emerging consumption base.

China’s golden week ends today and the market opens back up tomorrow. Over the last month there have been significant announcements about investments in infrastructure, boosting the consumer economy and championing the green energy movement. These points all likely to become actionable in the 4th quarter.

The defining characteristic of China’s monetary and fiscal approach to the pandemic has been conservative to date. They have been eager to supply only as much assistance as was required. Now that the pandemic is all but conquered in China, attention is turning to how to come out of the contraction stronger.

This article from Quartz highlights how much investment is now pouring into the infrastructure sector. Here is a small section: “My impression is, and certainly from the commodities demand we’re seeing, is that it’s very much old-style infrastructure spending going on, regardless of the debt consequences.”

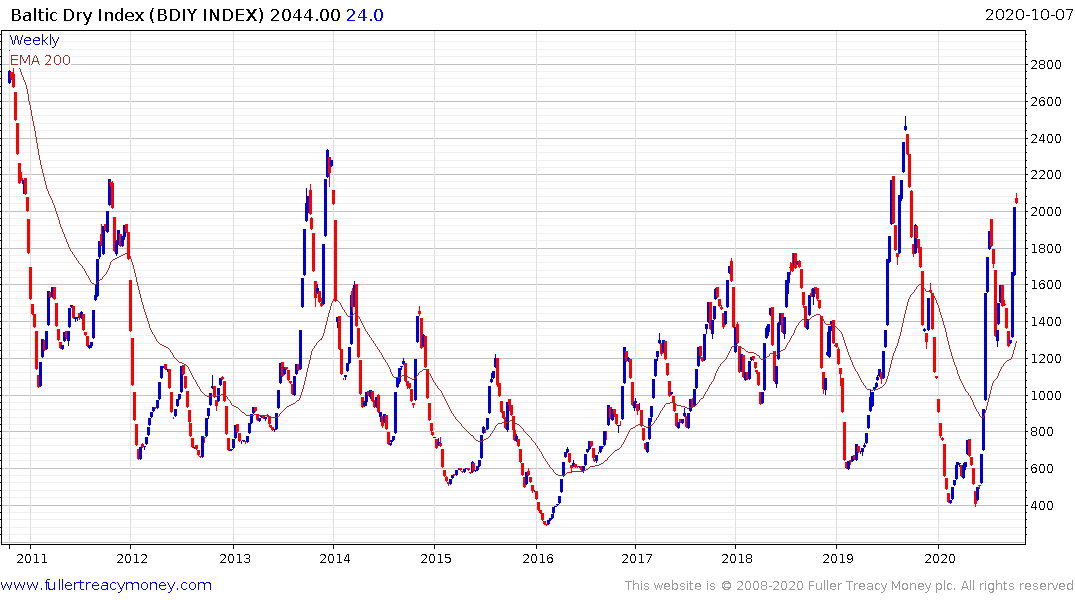

The Baltic Dry Index is back above the 2000 level. Every time it has popped above that level in the last decade it has failed to hold the move. Therefore, the breakout is not enough to confirm the return to demand dominance. If the breakout is sustained that will force a re-evaluation.

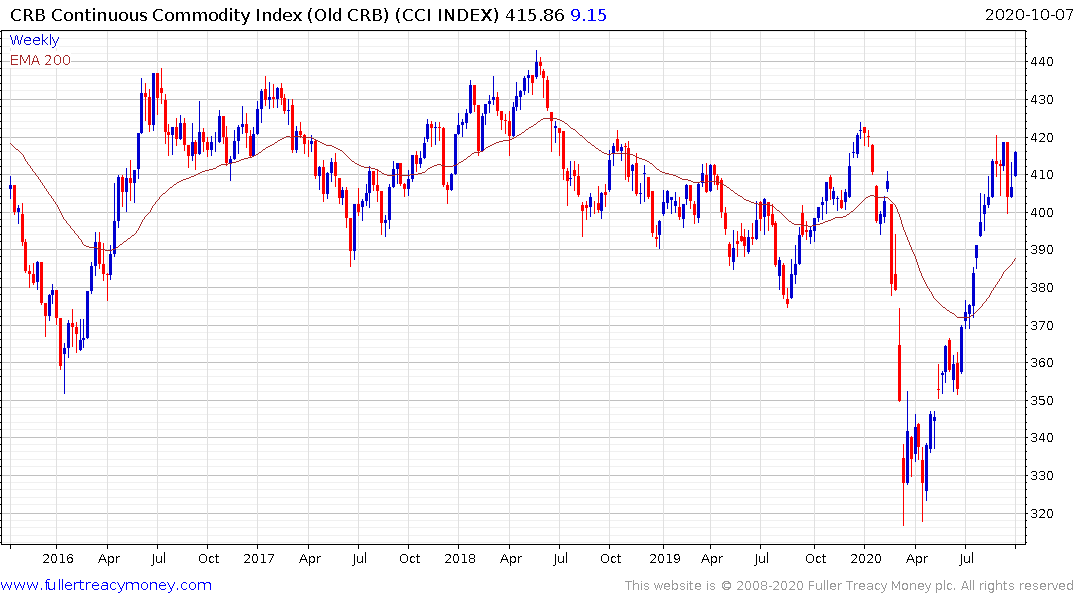

The Continuous Commodity Index has rebounded from the breakdown in the 1st quarter. It is now testing the downward bias to trading over the last few years. It’s looking positive right now by the trend of outperformance for the broad commodity sector is not quite confirmed.

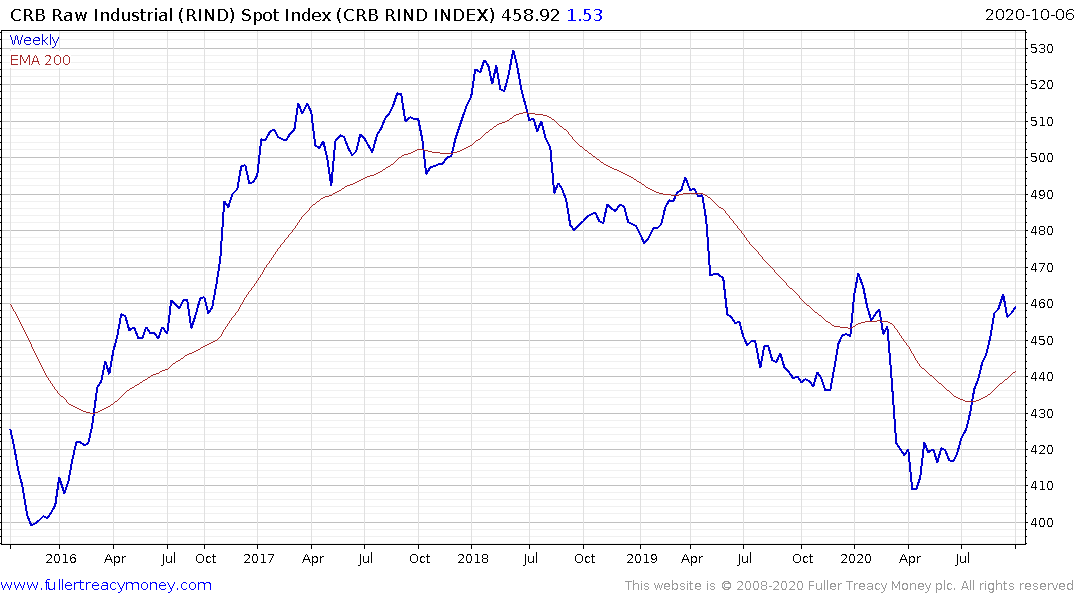

The Raw Industrial Spot Index found support in the region of the 2015 lows early this year and has since rebounded. The trend mean has now turned higher. Provided it finds support above the lows on a pullback we can continue to conclude the downtrend is over.

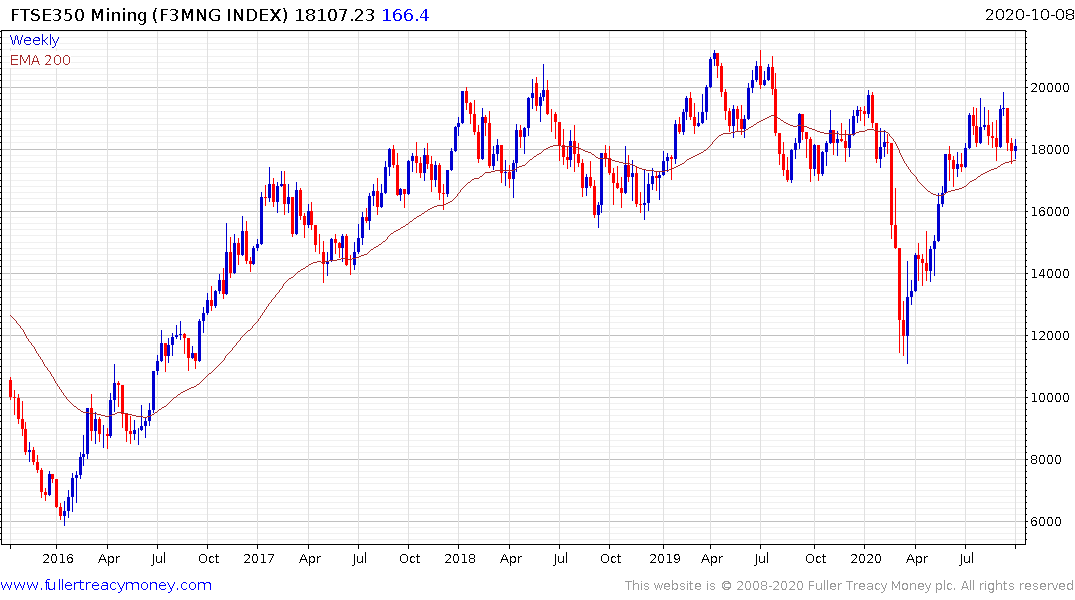

The performance of industrial miners is encouraging but continues to express the same indecision we see in the above charts. The FTSE-350 Mining Index continues to consolidate in the region of the trend mean but below the psychological 20,000 level.