China Burnishes Euro Appeal as Dollar Falls With U.S. Rate View

This article by Rachel Evans and Andrea Wong for Bloomberg may be of interest to subscribers. Here is a section:

It wasn’t so long ago that the euro seemed destined to fall to parity versus the U.S. currency within weeks.

Unprecedented stimulus from the European Central Bank spurred an exodus of capital from the currency bloc as investors looked elsewhere for yield. Policy makers’ commitment to bond buying through September 2016 has started helping the currency as traders bet the ECB will push on, while other central banks may look to ease further.

The euro climbed to a seven-month high among a basket of 10 developed-market peers as the gap between the yields on German bunds -- the euro area’s benchmark bond -- and Treasuries narrowed to the tightest since June.

“You’re seeing a short squeeze in the euro, and a bit of safe haven,” said Collin Crownover, State Street Global Advisors Inc.’s Boston-based head of currency management.

China’s move “rightly reduces the probability of the Fed going in September, although I don’t think it reduces it as much as what the market is pricing in.” A short squeeze is when traders betting on a weaker currency are forced to offset those positions at higher prices.

David and I were discussing this morning that it was an odd situation that the Dollar is weak in an environment where some deleveraging is evident. However that does not negate the fact that the Dollar experienced an impressive rally earlier this year and there is still scope for a reversion towards the mean.

The Euro continues to firm from the $1.10 area and a clear downward dynamic would be required to question potential for some additional higher to lateral ranging.

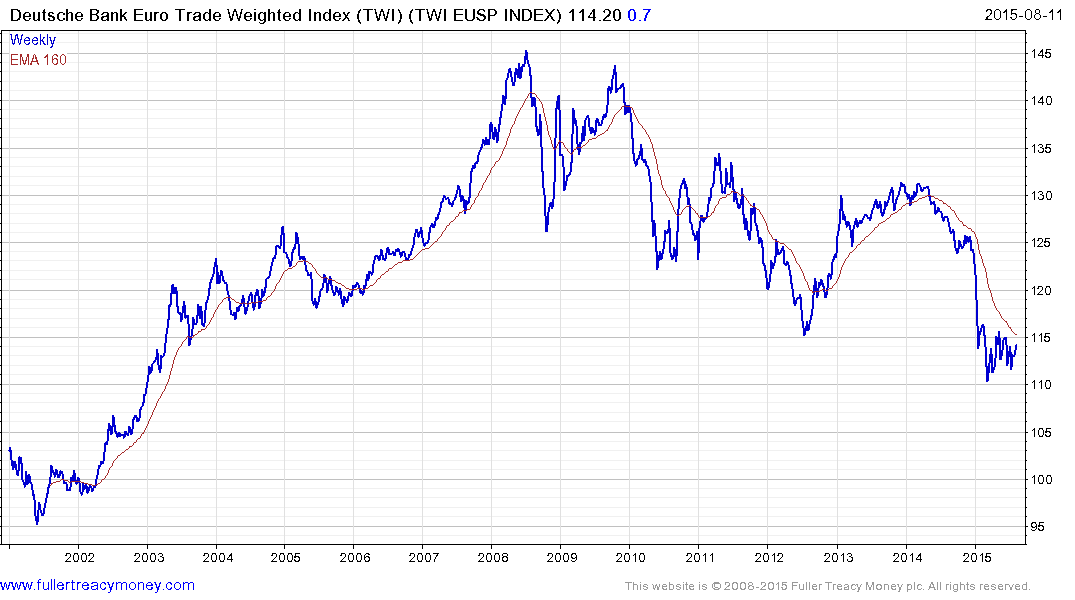

This Trade Weighted Euro chart highlights how far the Euro had fallen.

Back to top