Golden era of bank growth over as regulation bites

This article by Michale Smith for the Australian Financial Review may be of interest. Here is a section:

The result itself was overshadowed by CBA's $5 billion capital raising, a move that had been widely expected since ANZ rattled the markets with a $3 billion raising last week.

The four major banks will have raised a combined $15.5 billion to shore up their balance sheets in the wake of unprecedented regulatory pressure. It is funding few bank executives believe they really need but they have little choice.

CBA is now back in pole position with a common equity tier 1 capital ratio of 10.4 per cent, compared with 9.2 per cent in June. The additional cover will cover changes to the risk weights for mortgages to fall into line with regulatory changes both in Australia and globally.

A$15 billion is a sizeable chunk of additional supply which will take the market some time to digest. However raising capital at record low interest rates, when the market still has appetite and when perceptions are that it is not strictly necessary is better than at the other end of the cycle.

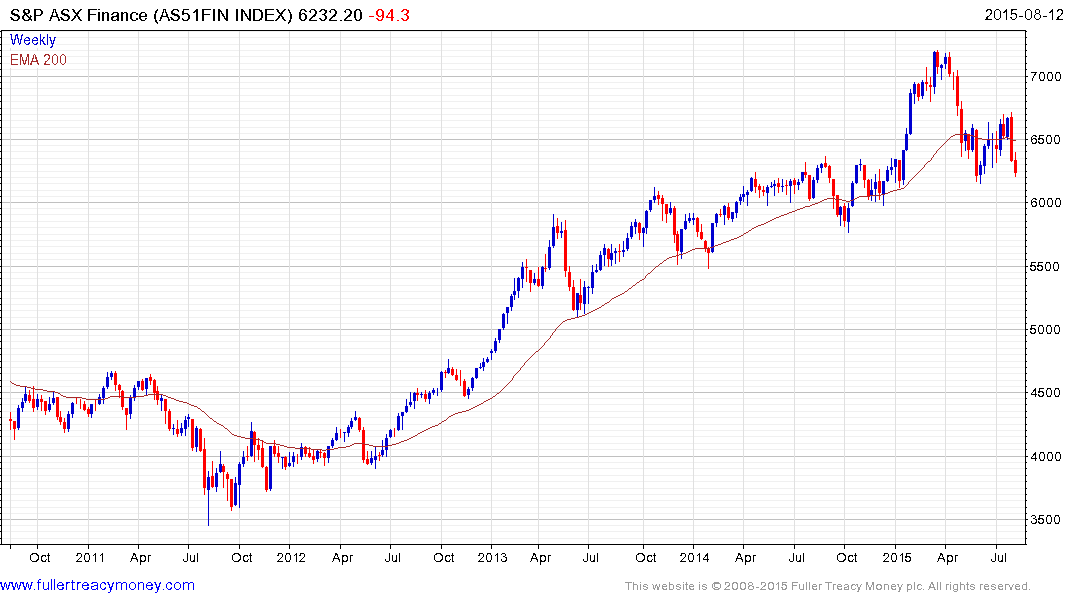

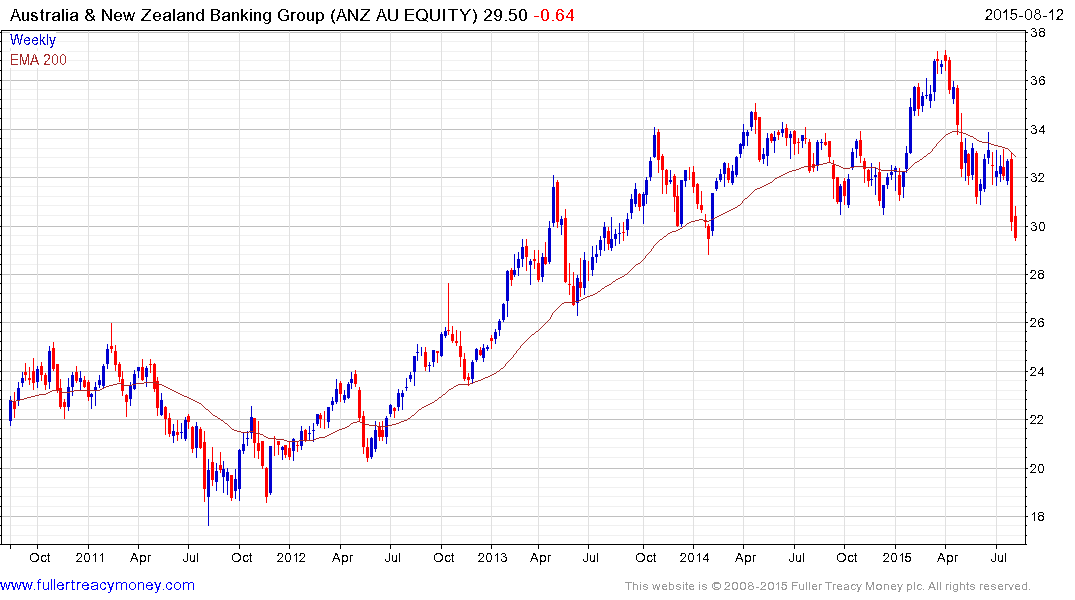

The S&P/ASX Financials Index encountered resistance in the region of the 200-day MA from last week and will need to sustain a move above it to suggest a return to demand dominance. The sector is being led lower by ANZ while CBA has held up better but for some reason did not trade today.

This spreadsheet of the constituents of the Financials Index highlights how high the dividend pay-out ratios for Australia’s major banks, insurers and brokers are. The average is in between 60% and 70%. By contrast Bank of America’s highest pay-out ratio in the last 13 years was 26.67 and is currently 0.21. However it is worth highlighting that US banks tend to have higher capital ratios even after the capital raising by Australian banks announced above.

Australia has a wonderful record of high yielding shares which are highly attractive for investors many of whom are more interested in income than capital appreciation. Their ability to sustain dividends will be an important factor in how investors view their prospects.

This article from the Wall Street Journal reports on the escalation of efforts to clamp down on foreigners buying previously owned single family homes. The numbers so far are small but it is worth monitoring. This is particularly relevant in an environment where there is potential for Chinese purchasing power to deteriorate somewhat which may affect demand in what is an elevated price environment.