Brazil's Epic Era of Splurging Is Over

This article by Matthew Malinowski Dominic Carey for Bloomberg may be of interest to subscribers. Here is a section:

1. No work

Brazil’s economy bled almost 900,000 jobs over the last year. That's unheard of, even in the aftermath of the 2008 Lehman Brother’s crisis.2. Less money

For those who still have a job, real wages contracted as much as 5 percent in May from a year ago, before easing to a 2.4 percent annual drop in July. Annual real wages, as well as moving averages for retail sales and formal job creation have all contracted this year, according to government statistics. The declines are all worse than in 2009 when the economy also shrank, as the charts illustrate.3. No more retail therapy

As the labor market deteriorates, Brazilians have cut back the most on shopping since the start of the century. Retail sales in June dropped for the fifth straight month, the longest declining streak since 2001, data from the national statistics agency show.

During the boom in the balance of payments associated with surging commodity exports, Brazil went from being a serial defaulter to a creditor to the World Bank. However, the economic effect of the collapse in commodity prices has been exacerbated by the failure of successive administrations to improve governance. As a result the boom from massive surpluses has been wasted on corruption, vanity sports projects and inefficiency.

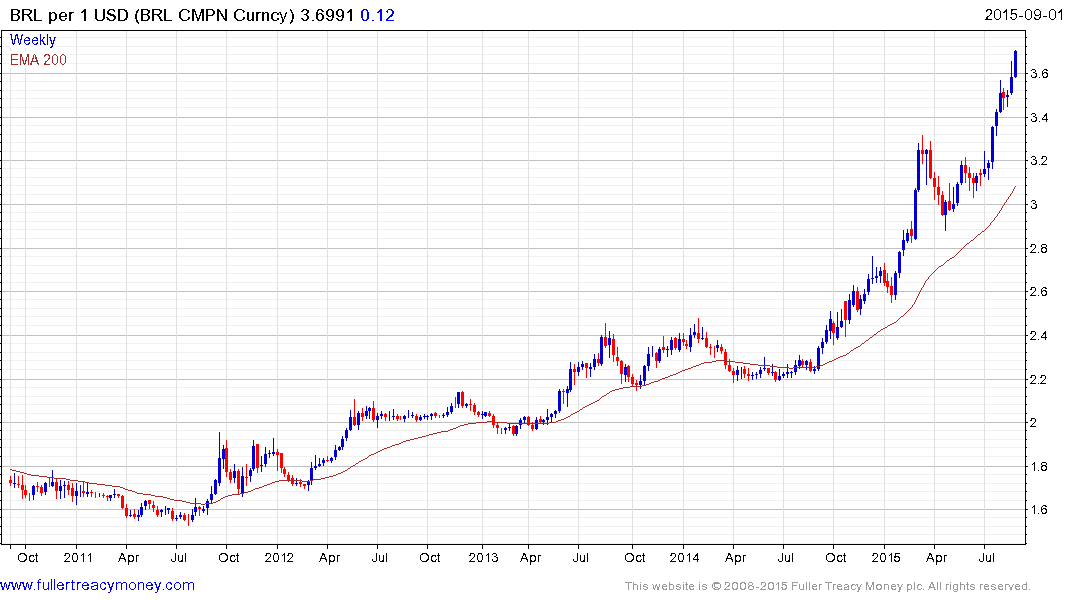

The US Dollar is accelerating towards the highs near BRL4 seen in 2002. This is still an orderly advance but a large overbought condition is evident. The first clear downward dynamic is likely to signal a peak of at least near-term significance.

The weakness of the currency has acted as a support for the Bovespa Index in nominal terms as it tests the lower side of a two-year range.

The US listing of Banco Itau offers a window on the impact of the currency’s sell off for foreign investors. It has accelerated lower and is now closing in on the 2008 low amid a deep oversold condition.