Bitcoin Suffers Biggest Fall in Two Years Following China Currency Gains

This article by Martin Baccardax for Bloomberg may be of interest to subscribers. Here it is in full:

Bitcoin's value suffered its biggest single-day decline in two years Thursday, just hours after China's offshore yuan posted its biggest two day gain and days after the cryptocurrency touched $1,000.

The price of bitcoins against the U.S. dollar fell 13% in London trading, changing hands at around $950 each by 13:45 GMT. Bitcoins traded as low as $880 during a volatile session which saw it reach as high as $1137, according financial bookmakers IG.

The moves follow the biggest two-day gain on record for China's offshore yuan, which trades more freely than the domestically controlled currency of the world's second-largest economy. Speculation of government buying led the gains as investors bet authorities are determined to stem capital outflows and avoid a sustained decline in the currency ahead of the inauguration of President elect Donald Trump, who has vowed to label China as a currency manipulator.

The connection is relevant in the nearly all of the daily trading in bitcoin is linked to the yuan, which has fallen more than 7% against the dollar over the past year, as speculators attempt to skirt currency controls and ensure value.

The offshore yuan gain 1% to 6.7989 against the greenback in Asia trading, putting downward pressure on the dollar index and boosting the yen in foreign exchange trading. The move whipsawed the dollar index, a measure of its strength against a basket of six global currencies, from a near 14-year high on Tuesday to three-week low of 101.74 by the start of European trading before it recovered to 102.10 by 13:45 GMT

I have been pointing out in recent audios that China represents the majority of Bitcoin trading and what goes on in that country is likely to have a profound impact on the value of the cryptocurrency. In many respects we might look on Bitcoin as the anti-Renminbi because it tends to do best when Chinese investors are worried about the stability of their domestic currency.

With such a clear move to support the Renminbi today the rationale for paying ever higher prices for Bitcoin has been questioned and potential for at least a reversionary move is now underway. The large downside key day reversal suggests a peak of at least near-term and potentially medium-term significance not least because the price is still trading nearly $300 above the trend mean even following the decline.

The Offshore Renminbi has almost completely closed the overextension relative to the trend mean, posting a clear downside weekly key day reversal. This is a clear dynamic move in the market and confirms Dollar resistance in the region of CNY7. However it is questionable how much stronger the Chinese want to allow their currency to become. While some regrouping is likely required for the Dollar and ranging is to be expected, a sustained move below the trend mean would be required to question the medium-term bull market.

Predictably the surge in the yuan and the decline of Bitcoin has acted as a tailwind for precious metals and gold continues to unwind its oversold condition relative to the trend mean.

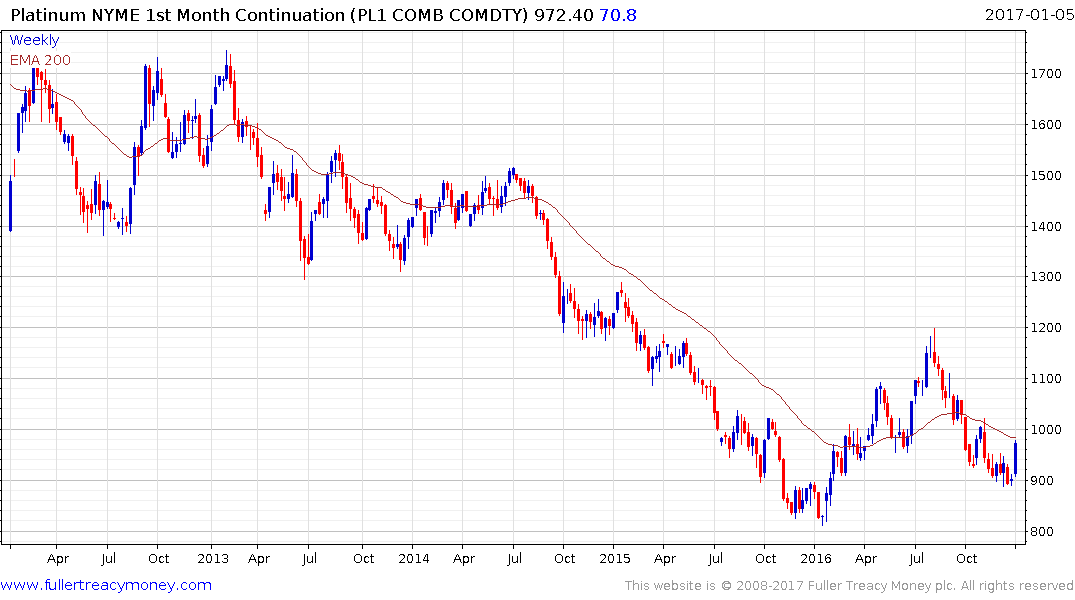

Platinum is outpacing gold’s bounce.

Meanwhile the VanExk Vectors Gold Miners ETF (GDX) has broken a four-month progression of lower rally highs and is now testing the region of the trend mean.

The Asia Dollar Index has also benefitted from efforts to support the Renminbi and potential for an unwinding of its oversold condition relative to the trend mean have improved.

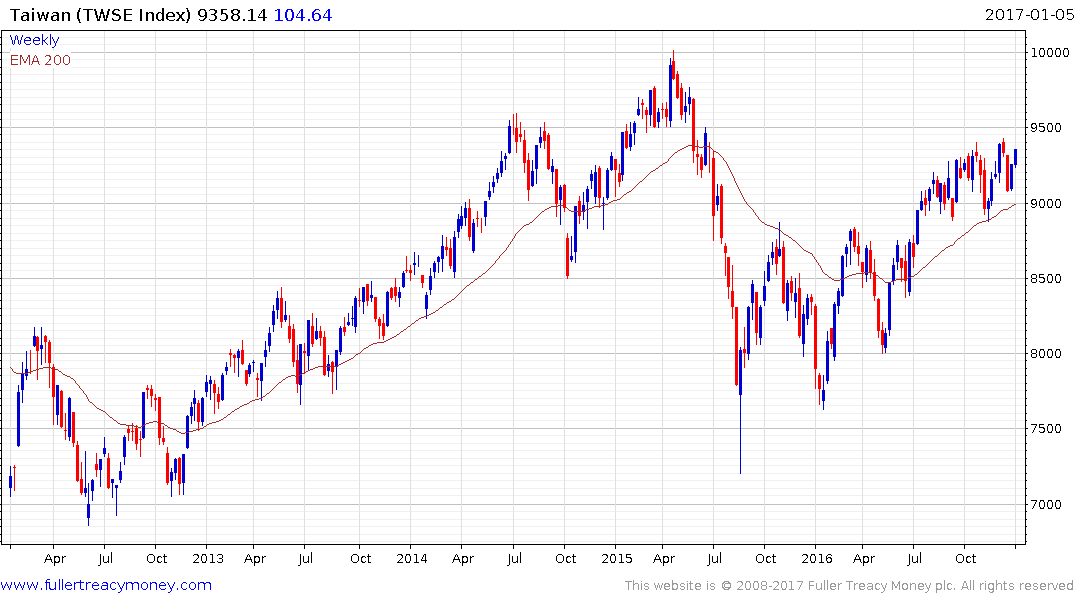

For example the Dollar is in the process of posting downside weekly key reversals against both the Singapore Dollar and the Taiwan Dollar which represents a greenlight for foreign investors to re-enter these markets.

The Straits Times Index is testing the upper side of a yearlong range while the TAIEX continues to hold a progression of higher reaction lows.

The Kospi has been confined to a volatile range for five years but has held a progression of higher reaction lows since late 2015 and is now testing the upper boundary.