Australia Stands Pat on Rates as Commodity Rebound Gathers Pace

This article by Michael Heath for Bloomberg may be of interest to subscribers. Here is a section:

Lowe’s key challenge -- like many of his developed world counterparts -- is generating inflation; part of that involves trying to tame a currency that’s up more than 10 percent in around nine months. The Aussie’s revival, even if partly justified by a jump in iron ore and coal prices and a better outlook for key trading partner China, puts pressure on services industries that are key growth drivers for the post-mining boom economy.

The new governor offered insights to his strategy in the RBA’s renewed agreement with the government, stressing financial stability concerns as part of monetary policy. The risk of further stoking Sydney’s housing boom should discourage him from further cuts, especially as the economy grew an annual 3.3 percent last quarter and unemployment has fallen to 5.6 percent amid rising terms of trade, or export prices compared to import prices.

Coking coal prices have surged more than 150 percent this year as output from China, the world’s biggest miner, tumbles under government pressure to cut overcapacity. Iron ore, Australia’s biggest export, has rebounded 30 percent, though analysts are skeptical about the rally’s durability. Still, the jump in prices for Australia’s biggest exports is a boon for the economy and a government struggling to rein in its budget deficit.

The recovery in commodity prices from depressed levels at the end of last year has been a benefit to just about all commodity exporters. Australia’s dependence of some of the major resources China’s economy requires not least iron-ore, coal and natural gas means that the rebound in all three has been a major influence on the advance in the stock market this year.

The S&P/ASX 200 Index has been in a choppy uptrend over the last year but has held a progression of higher reaction lows and bounced three weeks ago from the region of the trend mean. A sustained move below 5250 would be required to question current scope for continued higher to lateral ranging.

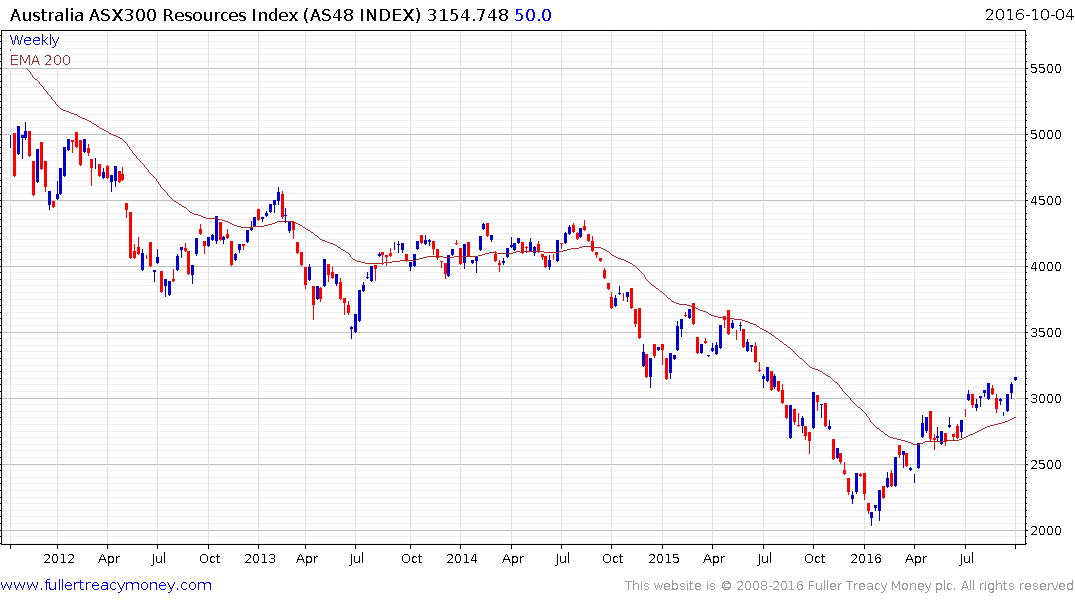

The S&P/ASX 300 Resources Index has also held a progression of higher reaction lows this year. Overall, the advance has been more orderly with a succession of similar sized ranges one above another. It broke out to new recovery highs today and a sustained move below the trend mean would be required to begin to question medium-term recovery potential.

The Australian Dollar trended lower against the US Dollar between 2013 and 2015 and has stabilised this year. With little chance of the RBA hiking interest rates any time soon, the potential for the interest rate differential to close further, if the Fed does indeed go ahead and lift short-term rates again, is increasingly looking like the base case. It will need to hold the region of the trend mean near 75¢ if potential for higher to lateral ranging is to be given the benefit of the doubt.

How much the Australian Dollar weakens, and most particularly if it breaks below the trend mean and retests the lows, could act as a headwind to foreign investors continuing to support the stock market. That would be even more important if currency weakness was associated with the progression of higher reaction lows on the above indices breaking.

Back to top