U.K. Stock Gauges Hit Simultaneous Highs 1st Time Since '99

This article by Aleksandra Gjorgievska for Bloomberg may be of interest to subscribers. Here is a section:

“It’s not just the FTSE 100 -- this is a buy U.K. phenomenon,” said Alan Higgins, chief investment officer at Coutts & Co. in London. His firm oversees 14.6 billion pounds ($19 billion). “We have a really nice combination of sterling weakness, reasonably robust economy and generally not a bad environment for risk assets.”

The FTSE 100 and the FTSE 250 climbed 1.8 percent at 3:06 p.m. in London, while the FTSE Small Cap excluding investment trusts index advanced 1.7 percent.

The falling pound is helping the three gauges because their members get a big chunk of their revenues from overseas -- almost three-quarters for FTSE 100 companies, and about half for those on the FTSE 250, according to JPMorgan Chase & Co. and UBS Group AG. JPMorgan Asset Management has estimated the measure of smaller shares also gets about half of its sales from abroad.

The pound fell to its lowest level since 1985 on Tuesday, surpassing the bottom reached following the June 23 vote, after three senior figures in Prime Minister Theresa May’s administration said financial-services companies will get no special favors in secession talks. That increased concern that the nation is heading for an exit that would restrict access to the EU’s single market. May said on Sunday she will trigger the process of leaving the bloc by the end of March, which will mark the formal start of a two-year negotiation process.

Recent data have reinforced optimism that the domestic economy is weathering the aftermath of the vote. The construction industry unexpectedly grew in September, while a manufacturing gauge jumped to its highest level in more than two years. A Citigroup Inc. index tracking economic surprises in Britain is near a three-year high, and the International Monetary Fund upgraded its outlook for the nation, predicting growth of 1.8 percent this year from the 1.7 percent projected in July.

With the weekend announcement that the UK government is planning to begin negotiating to leave the EU in Q1 2017, and to a large extent signalling it is willing to risk the passporting rights of the City’s financial services companies, a high stakes period of brinksmanship is unfolding. That is putting pressure on the Pound and it extended its downtrend today by breaking to a new low. While a short-term oversold condition is evident a clear upward dynamic would be required to check the slide and signal of low of near-term significance.

While banks and fund houses are understandably upset at the prospect of losing the ability to market asset management products to Eurozone clients from the UK it is important to put what is at risk into perspective. The City of London is the world’s most significant financial services centre with major insurance, reinsurance, underwriting, property, legal, shipping, investment banking, M&A expertise, commodity trading, stock, bond and currency markets. None of these are likely to be overly affected by losing passporting rights to the EU since they are not MIFID businesses.

Asset management is the major sector at risk because companies would no longer be able to headquarter offices in the UK and have the right to sell funds to the whole EU. Of course fund houses in the rest of the EU would also have to open offices in the UK if they want to market their funds in the UK and let’s not forget that the UK represents a major financial market. Therefore in negotiating with the EU the UK still has a strong hand and the economy is being revitalised by the weakness of Sterling.

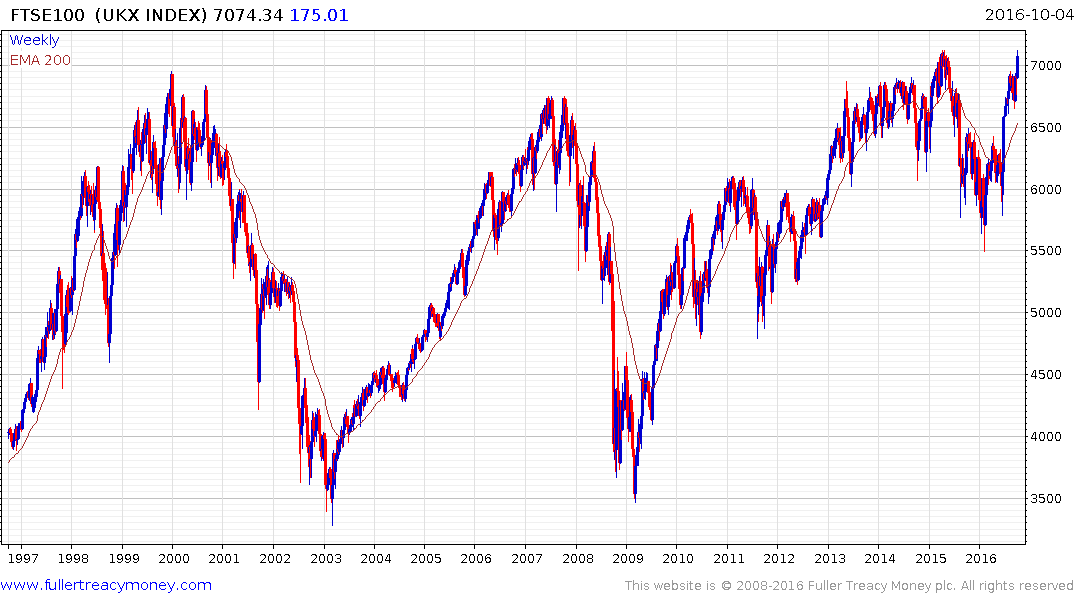

That is an additional factor in the relative strength of UK stock markets; at least in nominal terms. The FTSE-100 got within a point of the 2015 peak today and will need to sustain a move above 7100 to complete the almost 17-year range.

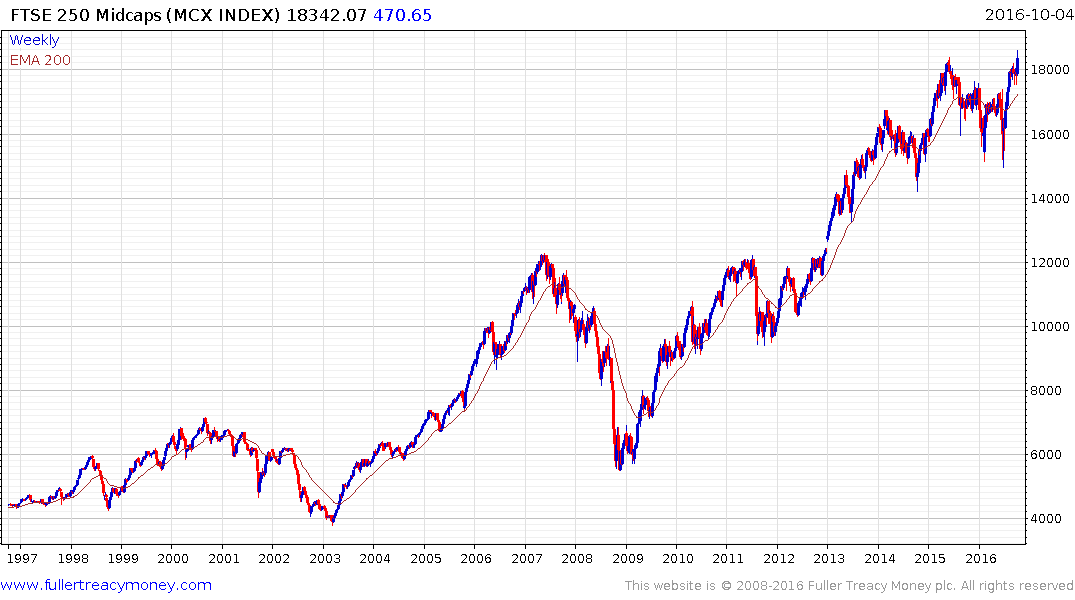

The FTSE 250 broke out of a short-term range to hit a new all-time today and a clear downward dynamic would be required to check upside momentum.

The AIM 100 Index of small caps is now testing the 2014 peak near 4000 following a rally where the index has advanced for 13 of the last 15 weeks. It is overbought in the short-term but, so long as it can hold the 3750 area during any consolidation, medium-term upside can probably be given the benefit of the doubt.