Another Swing at the Plate

This updated report from KKR on the 2019 forecast published in January may be of interest to subscribers. Here is a section:

Here is a link to the full report and here is a section from it:

Looking at the big picture, our macro framework suggests that risk asset prices are now more appropriately valued on an absolute basis as well as relative to financial conditions. One can see this in Exhibit 1. As such, we are downgrading our tactical overweight to U.S. Equities back towards an equal weight position. With the proceeds, we take our Cash position to an equal weight position relative to our benchmark of two percent versus our January 2019 allocation of one percent. To review, we had upgraded U.S. Equities from 300 basis points underweight in 2018 relative to our benchmark to a 100 basis point overweight position in January 2019 based on our belief that investors were already pricing in a recession (whether or not one actually occurred). Today, after a solid 10% move up in the S&P 500 since January 1, 2019, we think that fear is no longer being discounted in global equity prices, U.S. ones in particular. We are not bearish, but we do not think that public markets will continue to appreciate in a straight line from current levels if earnings growth continues to disappoint.

Overall, we think that the environment for many risk assets seems fairly balanced. On the one hand, economic growth trends are quite weak, and our forecasting models continue to point towards a notable deceleration during 2019. On the other hand, central banks are now – without question – more dovish than most anyone in the investment community was thinking coming into this year. Importantly, inflation remains low, which we believe now provides many global central bankers with some much needed “air cover” to be patient amidst record low unemployment rates in countries like the United States, Germany, and the United Kingdom.

Against this backdrop, our asset allocation tilts towards investments that are linked to nominal GDP, have collateral against them, and generate upfront cash flow. As a result, we remain overweight Real Assets, Global Infrastructure in particular. We also remain constructive on more flexible mandates across both liquid and illiquid investments, and as such, maintain our increased allocations to both Actively Managed Opportunistic Credit and Special Situations. Finally, we continue to overweight Private Equity in size (300 basis points), as our work shows that the value of private investments grows more important later in the cycle (Exhibit 2).

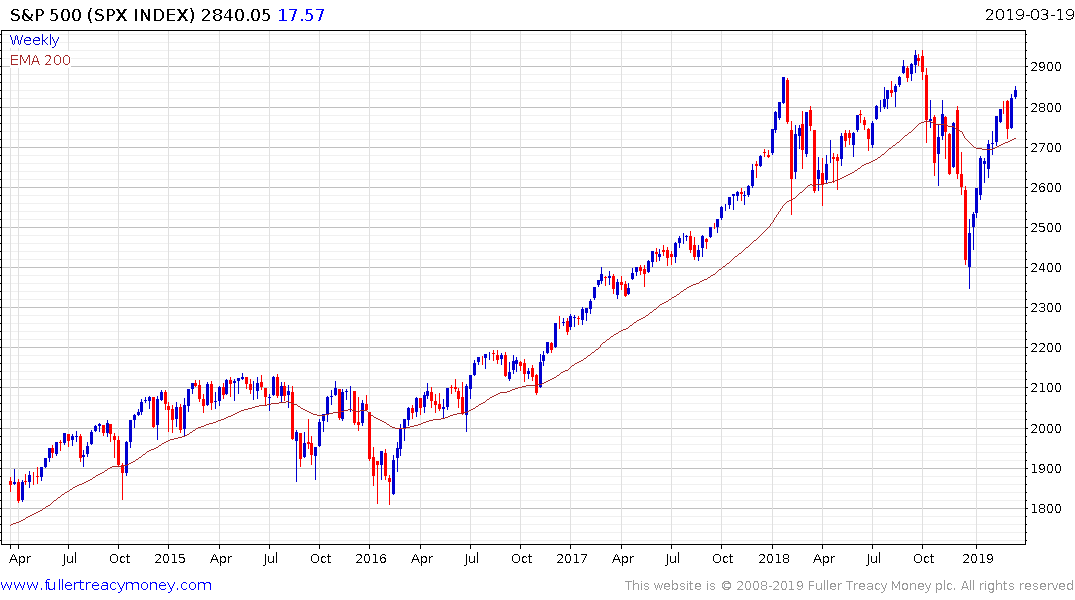

The rally that began on Boxing Day continues to impress with the S&P500 now trading back above the psychological 2800-point level. This move has now broken the sequence of lower rally highs and increases scope for the Index to consolidate above the trend mean.

Over the course of the last decade investors have learned to pay attention to central bank liquidity because it has such a profound effect on asset prices. The measure trended lower for just about all of last year and bounced in the first month of this year. A move above $20 trillion will be required to signal a return to central bank balance sheet expansion.

Meanwhile, China has cut taxes and is boosting the availability of credit through the banking system. India has cut interest rates and is also engaging in stimulus. European governments are increasingly flouting budget rules and the ECB has just launched another LTRO program and the Federal Reserve is walking back from its tightening bias. Japan is That is all positive for asset prices generally.

Nevertheless, it is probably too much to ask for the Index to make a straight run back to the September highs. It is just about approximating the January peak at present and amid a short-term overbought condition there is scope for a pause.

![]()

The Philadelphia Semiconductors Index is back above the psychological 1400-point level, which represented a major area of resistance in 2018. It will need to sustain a move above that area to reassert medium-term demand dominance.