Lithium Giant Albemarle Nears $4.3 Billion Liontown Takeover

This article from Bloomberg may be of interest. Here is a section:

A deal would cement the stunning rise of the Australian lithium sector, where the share prices of newly founded and previously little-known companies have soared more than 10-fold amid surging demand for the metal. The race for lithium has mining heavyweights, battery manufacturers and automakers from Rio Tinto Plc to Tesla Inc. chasing deals with firms with even early stage or pre-production projects.

Liontown, based in Perth, owns one of the most promising early-stage lithium projects in Australia, the world’s top exporter of the metal. It has supply agreements with major automakers including Tesla and Ford Motor Co.

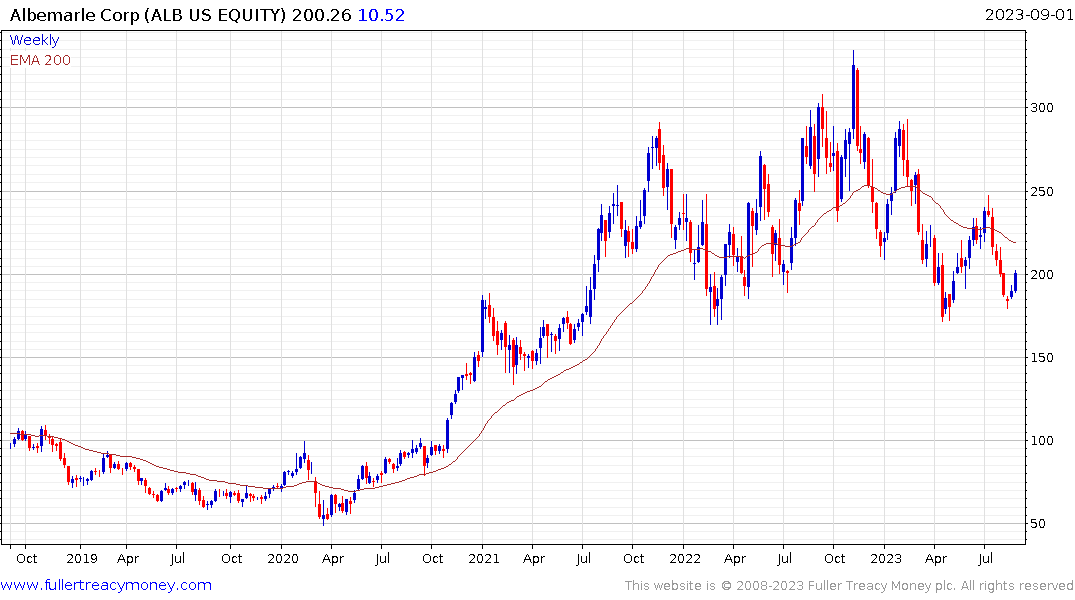

US-based Albemarle, which already owns stakes in lithium mines in Australia and has a processing plant there, offered to acquire all of Liontown’s equity at A$3 a share. That follows a bid of A$2.50 in March.

Mercedes Benz threw down the gauntlet today by announcing it is willing to compete on range with Tesla. It’s 450-mile quick charging model is expected to be on sale by early 2025. That story represents the promise of the lithium sector. Most automakers expect to release large numbers of new EV models over the next several years. That’s a demand driver for lithium.

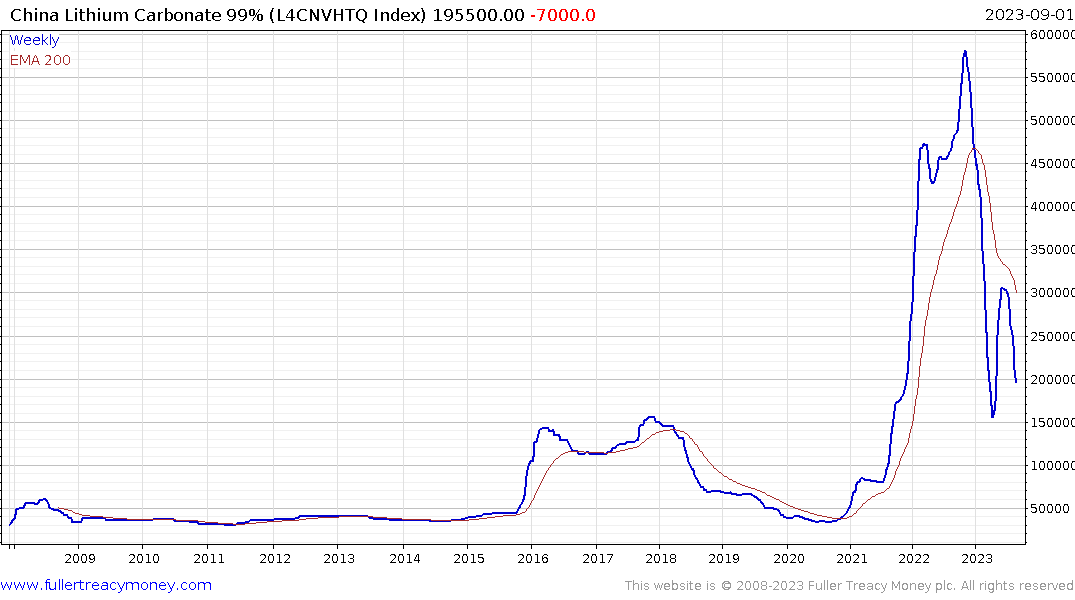

The challenge for the lithium sector is there has been a significant mismatch between supply and demand over the last decade. The first wave of new vehicles surprised miners. The surge of new supply outstripped demand for EVs. Then the surge of demand during the pandemic surprised miners. Now, China’s slow recovery has resulted in demand undershooting expectations. The result has been incredible volatility in lithium prices.

Right now the lithium price is testing the region of the 1000-day moving average. This level also coincides with peak of the first bull market in 2016/17. CNY200,000 a tonne is still expensive so it is an open question whether miners can display some discipline or demand will recover in time to continue to support prices at this level.

Right now the lithium price is testing the region of the 1000-day moving average. This level also coincides with peak of the first bull market in 2016/17. CNY200,000 a tonne is still expensive so it is an open question whether miners can display some discipline or demand will recover in time to continue to support prices at this level.

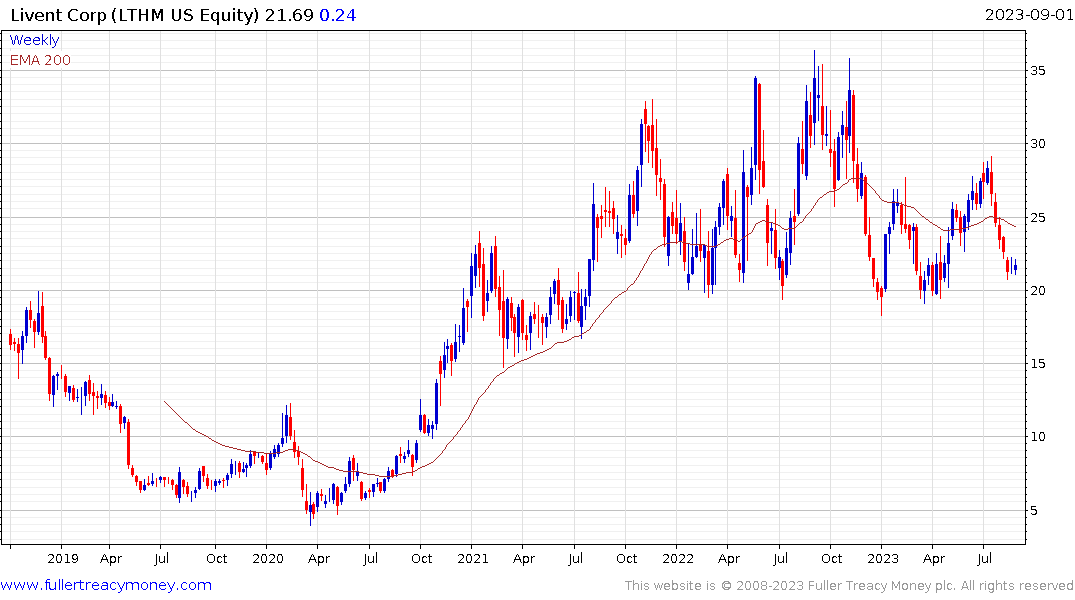

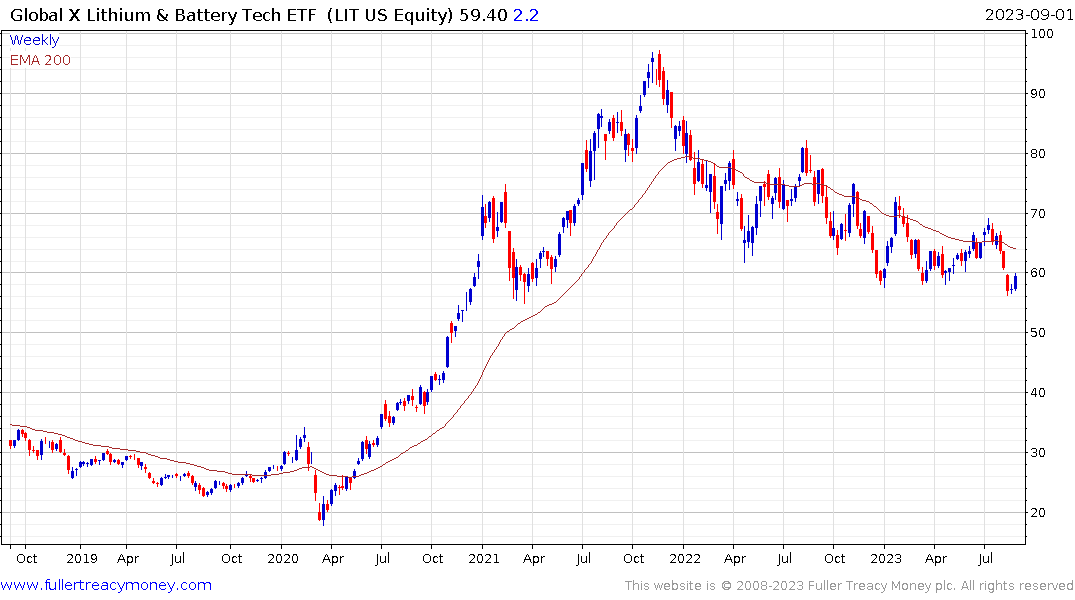

Albemarle is acquiring Liontown and Livent is in the process of acquiring Allkem. On aggregate the Global X Lithium & Battery Tech ETF is attempting to firm from the region of the 1000-day MA but will at least need to sustain a move above $65 to confirm a return to demand dominance beyond short-term steadying.