All eyes on the spending cap

Thanks to a subscriber for this note from Deutsche Bank focusing on the Brazilian market. Here is a section:

Speaking at the Senate Economic Committee on Tuesday, BCB President Ilan Goldfajn. Goldfajn repeated several statements that had already been published in the central bank’s Inflation Report last week, reaffirming the intention of making inflation converge to the 4.5% target in 2017. Goldfajn also repeated the remarks published in the Inflation Report about the three conditions for the authorities to initiate an easing cycle (namely limited persistence of food price shock, disinflation of IPCA components, and lower uncertainty about the fiscal adjustment implementation). The Goldfajn, however, added that the BCB “does not have a pre-established timetable for monetary easing,” as the COPOM decision will depend on several factors, including inflation expectations and forecasts. This comment suggests that the BCB has not yet made a final decision to cut rates, perhaps because market inflation expectations for 2017 have not converged to the 4.1% target yet. Despite Goldfajn’s cautious remarks, we still expect the COPOM to cut the SELIC rate by 25bps at the next meeting later this month.

Here is a link to the full report.

Brazil has a number of challenges facing the economy not least corruption and the low standards of governance in its state institutions which have contributed to low approval ratings for the government regardless of who is in power. Controlling inflation will be one of the key tests from an international perspective because of the impact that would have on the currency.

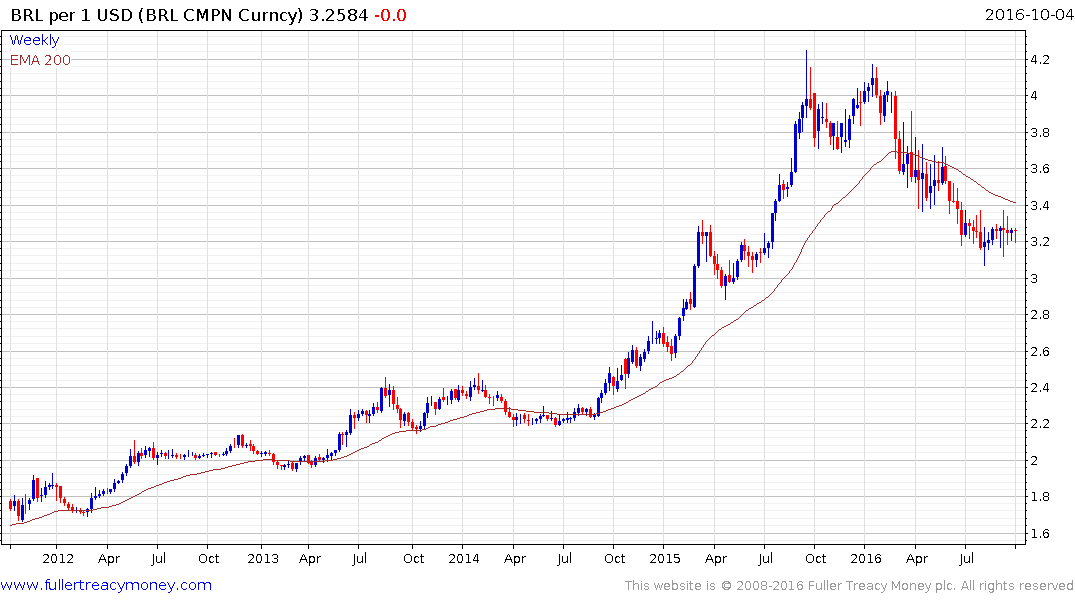

The Dollar hit a medium-term peak against the Real in September 2015 and has been ranging in what has been a relatively gradual process of mean reversion since August. A sustained move above the MA would be required to question the medium-term downward bias.

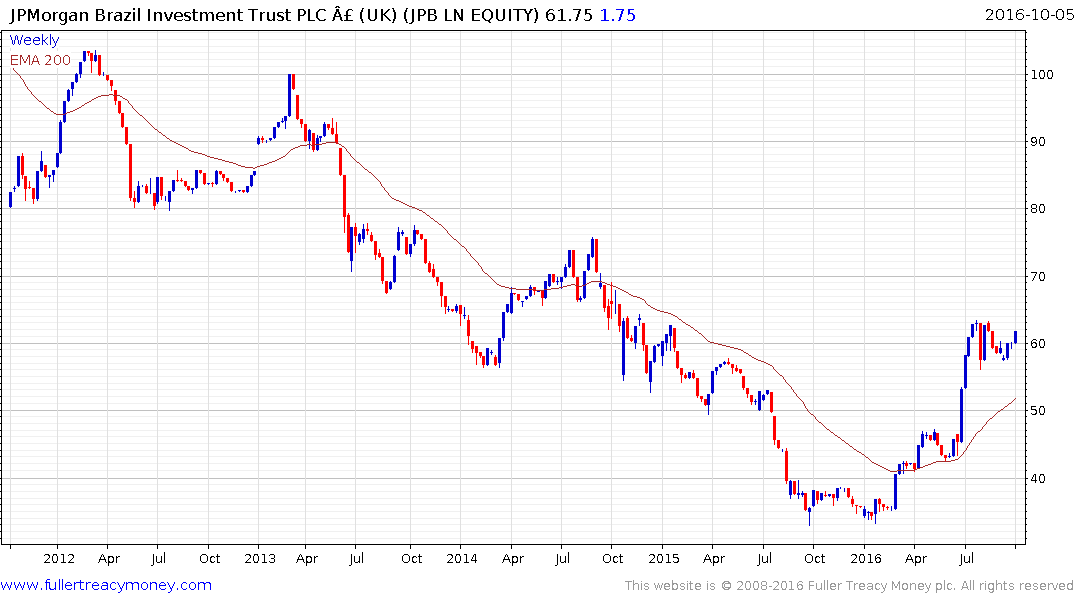

The revival of commodity prices and a firmer currency have attracted foreign investors back into countries like Brazil. The UK listed JPMorgan Brazil Investment Trust (JPB) is trading on a discount to NAV of 10.83% and remains on an upward trajectory while the US listed iShares Brazil ETF (EWS) is also trending higher in a reasonably consistent manner.

Following an impressive six-day rebound Brent Crude Oil is testing the June peak near $53. A short-term overbought condition is now evident but a clear downward dynamic will be required to confirm resistance in this area.