Zulily Shares Jump After Alibaba Raises Stake in Online Retailer

This article by Kristen Haunss and Spencer Soper for Bloomberg may be of interest to subscribers. Here it is in full:

Shares of Zulily Inc. rose as much as 24 in premarket trading after Chinese e-commerce company Alibaba Group Holding Ltd. increased its stake in the U.S. online retailer.

Alibaba bought $56.2 million of stock, according to a regulatory filing. That brought the Chinese company?¡¥s stake to 11.5 million shares, or 9.3 percent, according to filings and data compiled by Bloomberg. Alibaba Chairman Jack Ma has set a goal of getting 50 percent of sales from outside China as the nation?¡¥s economy is projected to grow at its slowest pace since 1990.

Shares of Zulily -- which sells clothing, home decor and related items, mostly to women -- rose as high as $16.45 percent 8:25 a.m. in New York on Monday.The stock had dropped 82 percent since its all-time closing high of $72.75 on Feb. 27, 2014, after a November 2013 initial public offering. The shares dropped to a record low close of $10.82 on May 6 and then rebounded in the following two days as Alibaba added to its stake.

At the end of March, Zulily had 5 million customers who had made at least one purchase in the previous year, up 35 percent from the previous year. More than half of all the Seattle-based company?¡¥s sales are on mobile devices.

Zulily succeeded in the flash sale sector where may before it failed but has run into trouble as it grew because of its zero inventory business model. This means that the end user who successfully purchases items in one of its "events" may wait three weeks or longer to receive the goods. It is not yet apparent whether the company has come to terms with its logistics issues but its database of 5 million potential customers has obvious appeal for a potential acquirer.

The share bounced on Friday from the region of $10 and a sustained move below that level would be required to question additional potential for a closing of the overextension relative to the 200-day MA.

With Alibaba, Yelp and Zulily bouncing last week I thought it would be interesting to review the constituents of the social media sector of the Chart Library.

Zynga, online games, has been ranging below $3 since July and a sustained move above it would suggest a return to demand dominance beyond the short term.

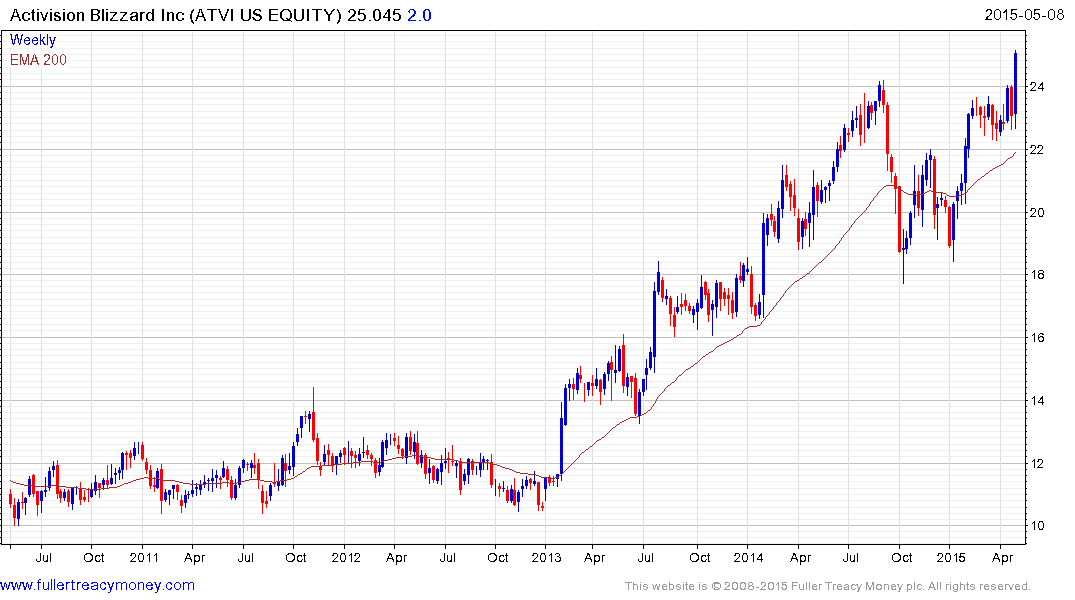

Elsewhere in the gaming sector both Electronic Arts and Activision Blizzard remain in reasonably consistent uptrends.

Twitter which has been a serial laggard among the large social media companies has returned to test the lower side of a yearlong range following a disappointing earnings announcement. The share will need to hold the $30 area to confirm base formation development is underway.

Facebook has returned to test the region of the 200-day MA.

Baidu has broken down and a clear upward dynamic will be required to check downward pressure.