Yield Grab Pushes Treasuries Curve Near the Flattest Since 2007

This article by Alexandra Scaggs and Taylor Hall may be of interest to subscribers. Here is a section:

The analysts expected a steeper curve after the Fed’s March meeting, when it lowered forecasts for 2016 rate increases, since the policy statement prompted traders to anticipate officials will let inflation quicken. That would erode the value of long-term debt most. Yet securities maturing in 10 years or longer have returned 5.9 percent since that meeting, while short-term notes have gained 1.3 percent, according to Bloomberg index data. That’s because long-term debt prices have been supported by investors searching for yield, the RBS strategists wrote.

“We’ve got a large wall of money from investors who need to hit a nominal yield target. As the market rallies, they need to reach farther out the curve to meet those targets,” Blake Gwinn, a U.S. rates strategist with RBS Securities, said in an interview. The market “hasn’t really behaved in the way we would have envisioned.”

Nobody knows what the net effect of the negative rate experiment, much of Europe and Japan are engaged in, is likely to be. The resilience of precious metals is probably one of the unintended consequences. The fact Australian 10-year yields are testing the historic lows and likely to contract further is another.

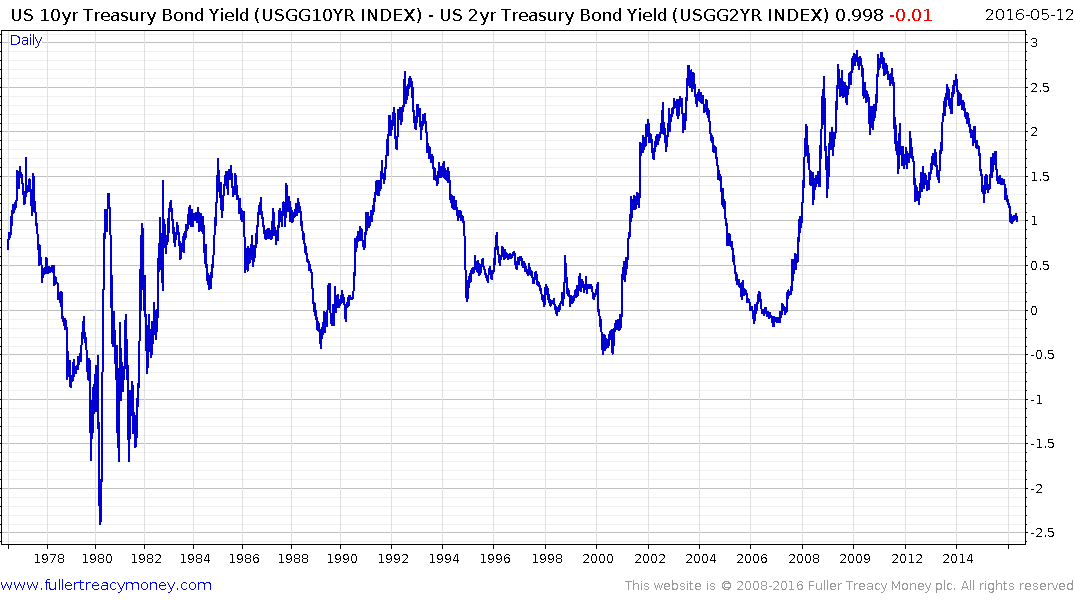

The relative value of US Treasuries, particularly on the long end of the curve, is another outcome. As the Fed considers how to raise rates they might think of that one as inconvenient. They have to be cognizant of the fact the yield curve spread is flattening. Since it has been one of the most reliable forward indicators of US recessions over the last 40 years, if it goes negative it will be a cause for concern.

Right now the spread is trading at 99 basis points but the trend is clearly for further contraction.

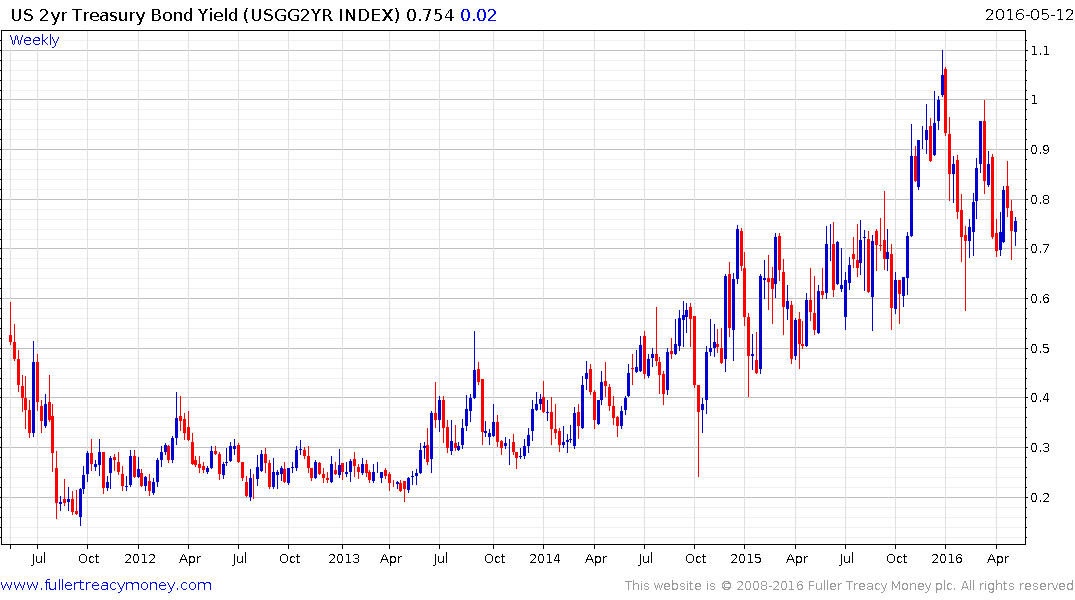

Considering the fact 2-year yields have been trending steadily higher for three years, there is scope for the short end of the curve to rise faster than the long end particularly if the Fed concludes the economy can withstand additional interest rate hikes. Considering what’s at stake, namely the integrity of one of the biggest liquidity fuelled rallies in history, what the Fed decides to do in the coming months is more important than ever.