Email of the day on intermarket correlations

The January 2016 to April 2016 correlation between the CCI Index (especially oil component), and world equity markets, and the $US (inverse) has been widely noted. From late April the equities/dollar relationship has been maintained (both have mildly reversed) but unusually, the stronger dollar seems not to have had the same impact on commodity prices.

That a stronger dollar has not hit oil or gold is a little surprising. This is especially the case for oil, which also faces the prospect of increasing supply, but how can gold be expected to continue its advance?

Thank you for raising a question which I suspect many investors are puzzling over. I certainly have and I’m not sure there is a conclusive answer. In fact considering the lack of commonality I think the answer lies in treating each market on their individual merits.

It’s looking increasingly likely that the Dollar Index is in the process of forming a failed downside break which, if confirmed with a sustained move above 95, increases the potential for a retest of 100.

Let’s consider why Dollar fell so much in the first place. Certainly there was a lot of bullishness priced in after the Fed’s first interest rate hike in almost a decade but since then speculation, especially in the bond markets, that the Fed was overly ambitious has weighed on it. Today’s retail sales number highlights how pessimism about rate hikes might also now have overshot and bolsters the view the yearlong range between 95 and 100 represents a first step above the 8-year base.

If the Dollar continues to rally that would be coincident with the more positive view of US economic performance on both a relative and absolute basis. The USA is still by far the world’s largest economy, Europe is muddling along, China remains a wild card while other emerging markets have stabilised and commodity led markets should be doing better. The unweighted Continuous Commodity Index (CCI) halved between 2011 and January which illustrates just how much pessimism had been priced in. Massive rationalisation has occurred and demand growth might not be quite as bad as many had anticipated. The Index needs to hold the progression of higher reaction lows evident since the low if recovery potential is to continue to be given the benefit of the doubt.

Gold is a monetary metal with no yield. However since both Japan and Europe are experimenting with negative yields gold is a beneficiary. In an environment where central banks are casting about for solutions to debt problems there are obvious advantages to holding onto assets where supply cannot simply be printed into existence. That’s particularly true when they have been trending lower for four years rather than hitting new highs. There is no doubt the potential for additional Dollar strength represents a headwind for Comex gold but it will only bolster the attraction of the metal when denominated in other currencies. A sustained move below the trend mean will be required to question recovery potential.

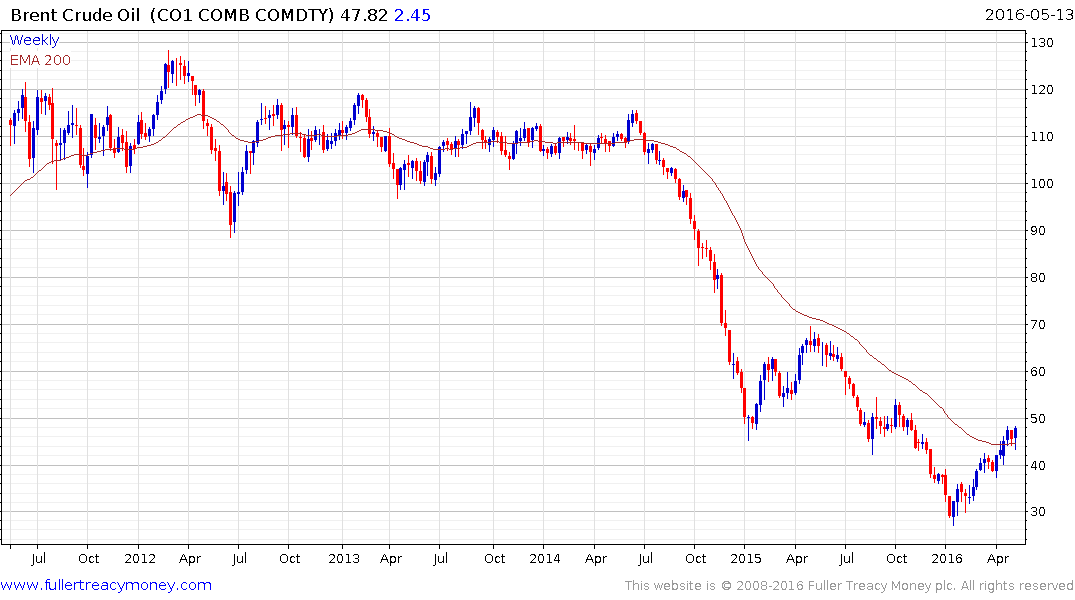

I agree there is no shortage of oil particularly as prices move back up to where unconventional supply becomes economic. It is currently possible to hedge Brent at $50 for March 2017 delivery or $51.40 for December 2017 delivery. That might not yet be economic for marginal producers but it’s a lot closer to where it needs to be than it was in January. Therefore it will be increasingly difficult for prices to rally as they pull away from relatively depressed levels. Energy prices are a significant input in the cost of producing just about all commodities, so I suspect oil prices will exert much more of an influence on the sector’s pricing than the Dollar.

Meanwhile the S&P500 is testing the upper side of its 18-month range and the short-term rally from the February lows has lost impetus. A sustained move below 2050 would confirm resistance in the 2100 area.