Xi's China a boon for mining

This article from mining.com may be of interest to subscribers. Here is a section:

And Xi's enormous power also means his pet projects should receive the full backing of the state.

The One Belt One Road initiative to recreate the Old Silk Road connecting Asia with Europe was mentioned five times during the speech. (Mao Zedong and Deng Xiaoping received four mentions each)

Another mega-undertaking, Beijing-Tianjin-Hebei integration, which includes the Xiongan New Area, Xi mentioned twice.

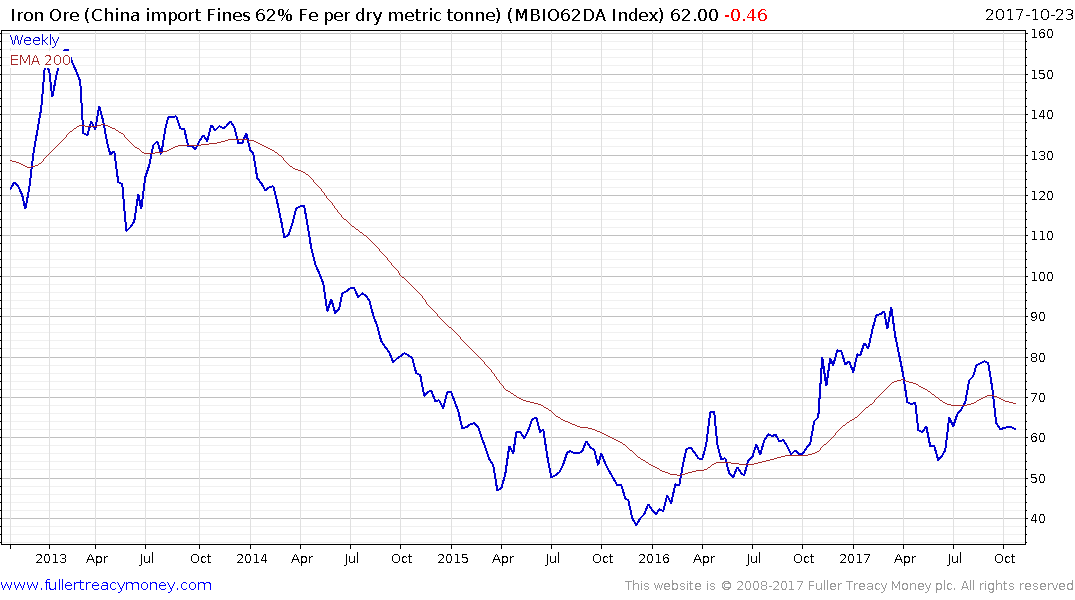

And even if the party's priorities are shifting away from market-orientated reforms, Beijing's transformation of its heavy industries coupled with programs to fight pollution has already benefitted mining.For instance, eliminating overcapacity has boosted profitability in the domestic steel industry and in the process steelmaking raw material prices have been dragged higher. At the end of last year consensus forecast for the iron ore price was $57 a tonne during 2017. Year-to-date it's averaging $71.

Building new cities is nothing new for China but the Xiongan New Area will move the administrative hub from central Beijing to a new city which will remove a substantial number of people in one fell swoop. This also means that the new city will need to be both architecturally secure and technologically capable enough to house one of the world’s largest and most ambitious bureaucracies.

Copper remains on a recovery trajectory and a sustained move below $2.90 would be required to question medium-term scope for additional upside.

Aluminium rallied over the last year to break a five-year downtrend and while somewhat overextended in the short term, a sustained move below the trend mean would be required to question medium-term recovery potential.

Iron-ore has been subject to a great deal of volatility this year but has paused over the last couple of weeks near $60 and will need to hold the $50 if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.

The Blackrock World Mining Trust trades at a discount to NAV of 8% and is currently testing the upper side of this year’s range near 400p. A sustained move below the trend mean would be required to question medium-term scope for additional upside.