The birth of the surplus

Thanks to a subscriber for this report from RBC which may be of interest. Here is a section:

Surplus about to increase significantly as higher discount rates are adopted…

In addition, we expect DB schemes are about to see a step change improvement driven by an increase in the assumed rate to discount the liabilities. Under IAS19, the assumed discount rate is a high quality corporate bond yield. However such corporate bonds are few and far between at durations in excess of 30 years. Therefore discount rates tend to be based on gilt yields at those long durations. Actuarial consultants are starting to encourage schemes to adopt a (higher) corporate bond yield at long durations. We expect schemes will increase discount rates by 0.3%, in line with the move by Tesco, and calculate that the aggregate surplus will improve by £41bn. The triennial funding valuation, which determines the employer contribution, should be unaffected.…which adds to mortality gains…

This positive thesis adds to our work on life expectancy. In Death of the deficit, we flagged that UK pension schemes are using older mortality tables which have not yet taken account of the slowdown in life expectancy improvement since 2011. We expect scheme liabilities will reduce by £12bn when the latest tables are adopted.?...leading to a surplus of £54bn

The combination of the expected imminent increase to discount rates and the adoption of the latest mortality tables would boost the aggregate FTSE100 pension position to a surplus of £54bn. We do not believe share prices have factored in this improvement and recommend investors buy a basket of pensions-exposed stocks highlighted in this report.

Here is a link to the full report.

The ultra-low interest rate environment which has led to a compression in yields across just about all asset classes has been a causal factor in the deficits many pension schemes now experience. Over the course of the last decade there have been a large number of reports predicting the low returns to be expected when yields are so depressed and asset prices already inflated.

An increasing discount rate would change that calculation from an actuarial perspective. With pensions moving into surplus for the first time in almost a decade they are benefitting from the same goldilocks scenario as the wider market because growth is improving but interest rates have not yet risen enough to be a headwind.

Of course, pensions funds will eventually take a hit when higher discount rates affect the relative value of their holdings. In the meantime, a number of the UK’s largest companies are benefitting from improved results in their pensions which removes a headwind from their balance sheets. However, clicking through the shares mentioned in the above report there is not a great deal of evidence the investment crowd puts much credence in the sustainability of the pension surplus; at least not yet.

The sectors with the clearest patterns of demand dominance are the banking and energy sectors.

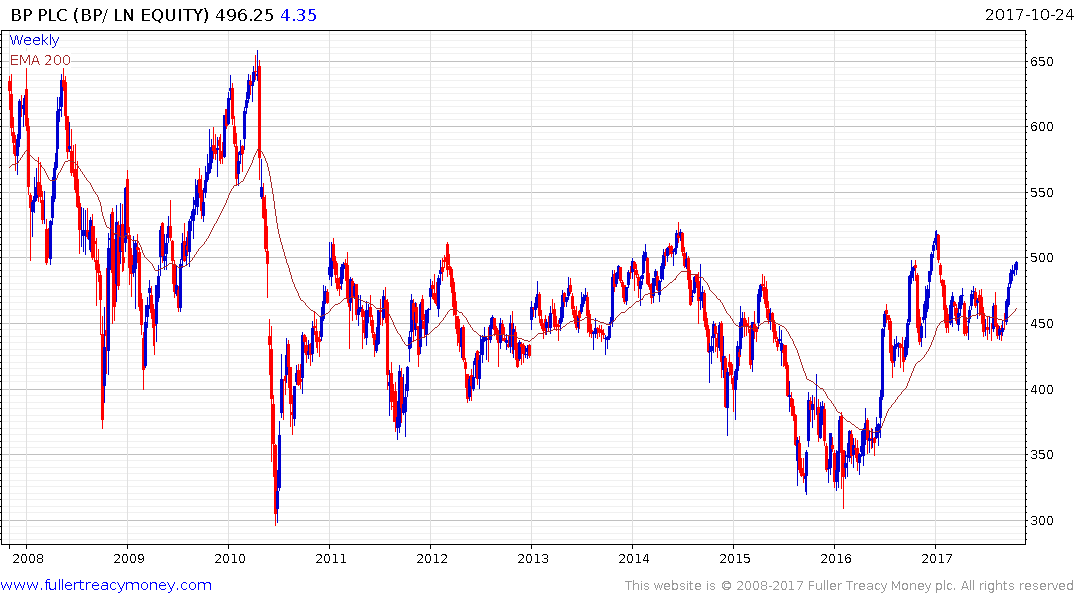

BP is testing the upper side of a lengthy base formation.

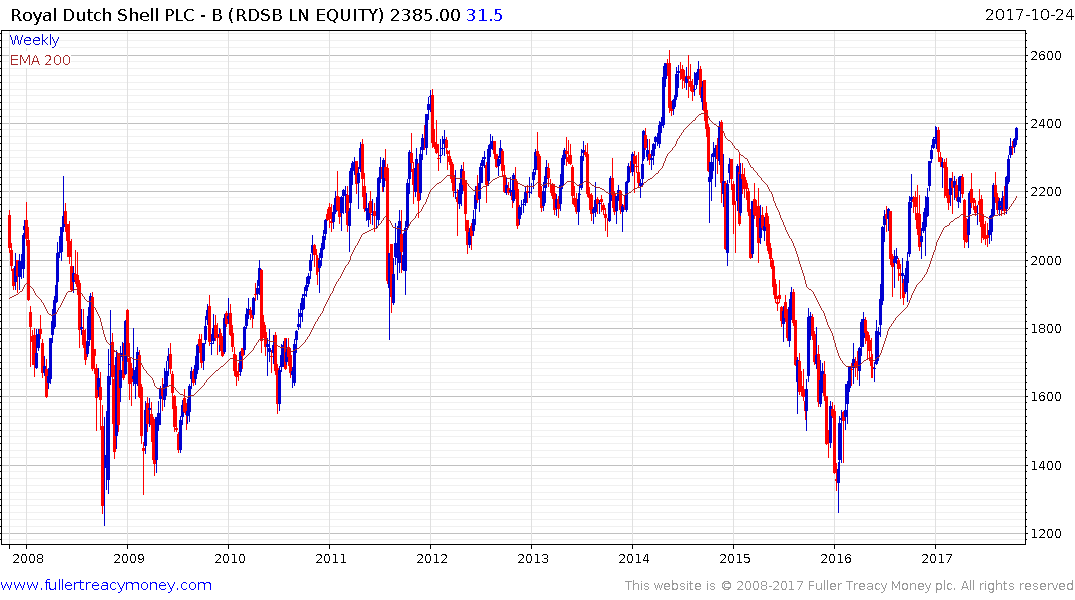

Royal Dutch Shell has rebounded impressively from the region of the trend mean to retest its high for the year.

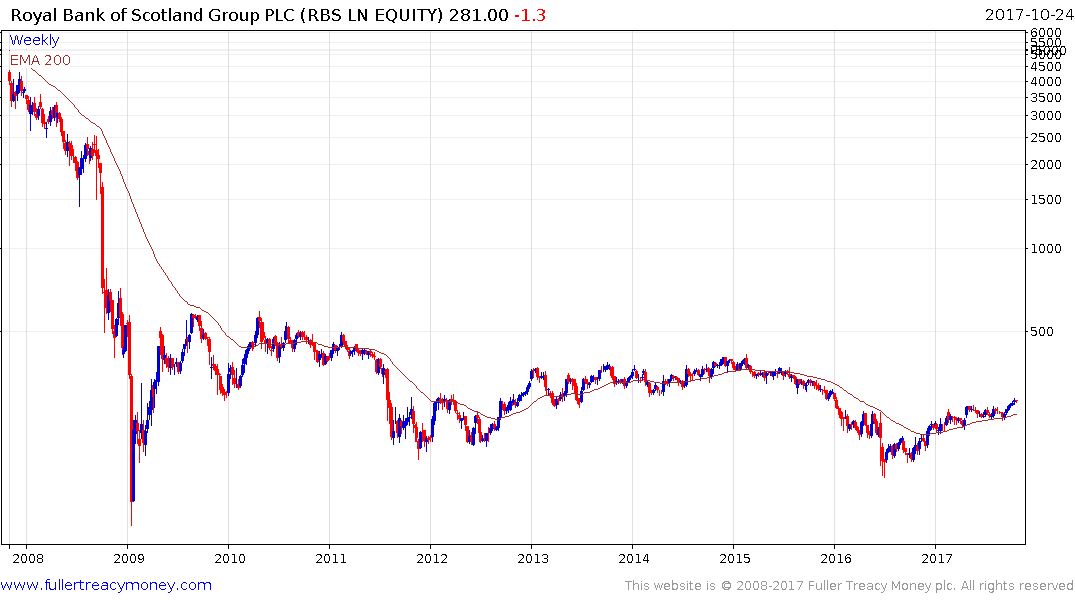

Royal Bank of Scotland moved to a new recovery high this week and continues to hold a progression of higher reaction lows.

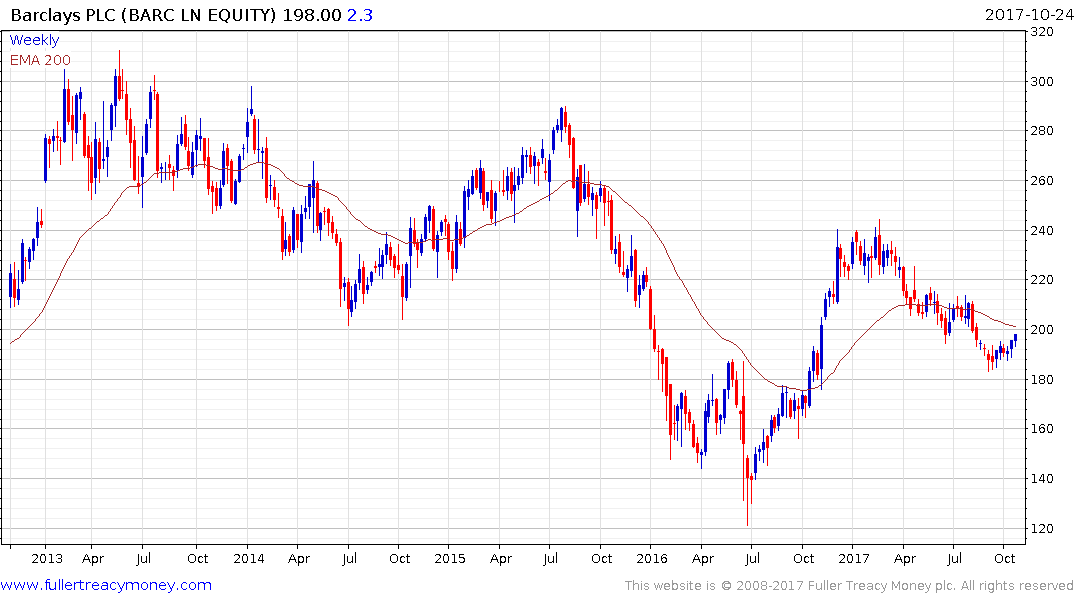

Barclays has firmed over the last month to test this year’s progression of lower rally highs.

International Consolidated Airlines broke successfully higher last week to post new recovery highs. It also has one of the biggest surpluses in its pension fund relative to its market cap. Both Tesco and BT Group have similar surpluses but BT Group continues to trend lower while Tesco is still in a developing three-year base formation.