White House Is Not Fond of Hidden Retirement Fees

This article by Matt Levine for Bloomberg may be of interest to subscribers. Here is a section:

We don't have the rules yet, though there is already a rather enormous literature on what they will or should or won't or shouldn't say. But we do have the Council of Economic Advisers report, and it is pretty interesting! The main conclusion is that "conflicted investment advice" costs Americans about $17 billion a year.

The math here is:

There's about $1.7 trillion in individual retirement accounts invested in funds that pay brokers to recommend them.The people who invest in those funds could improve their performance by about 1 percentage point a year by switching to other funds that don't pay brokers.

You can invest only in a list of pre-approved, low-cost, fee- capped, diversified, probably mostly passive portfolios run by reputable managers, and if you lose money everyone will nod sympathetically and tell you it's not your fault.

?You can sign the omnibus liability waiver and invest in whatever you want, just go nuts, but if you lose all your money it's a felony to complain.

The Retail Distribution Review (RDR) was implemented in the UK at the end of 2012 with the aim of lending transparency to the fees charged by IFAs and other wealth managers. There have been far reaching results, not least that the fund platform sector, dominated by Hargreaves Lansdown and others, has benefitted while smaller, often 1 or 2 person, operations have come under severe pressure. Part of the reason for this is that the cost of services is now fully transparent and smaller operations have been struggling to justify their existence when compared to the range of services and economies of scale offered by larger organisations.

The USA is a large reasonably efficient market and the complexity of the tax systems necessitates that consumers become financially literate. There are more than 2300 funds in the USA that charge a front end load and a good number of those also charge a back end load. The evolution of ETFs has been a major headwind for high fee structures since many of the same results can be achieved with much lower management fees. If similar legislation to RDR is enacted the financial planning sector will have even greater reporting responsibilities, the threat of litigation will require even greater documentation of planning and a clear process driven approach regardless of the reality of the market. This will be of benefit to larger companies but this trend is already well developed.

Blackrock continues to lead the asset management sector higher and a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

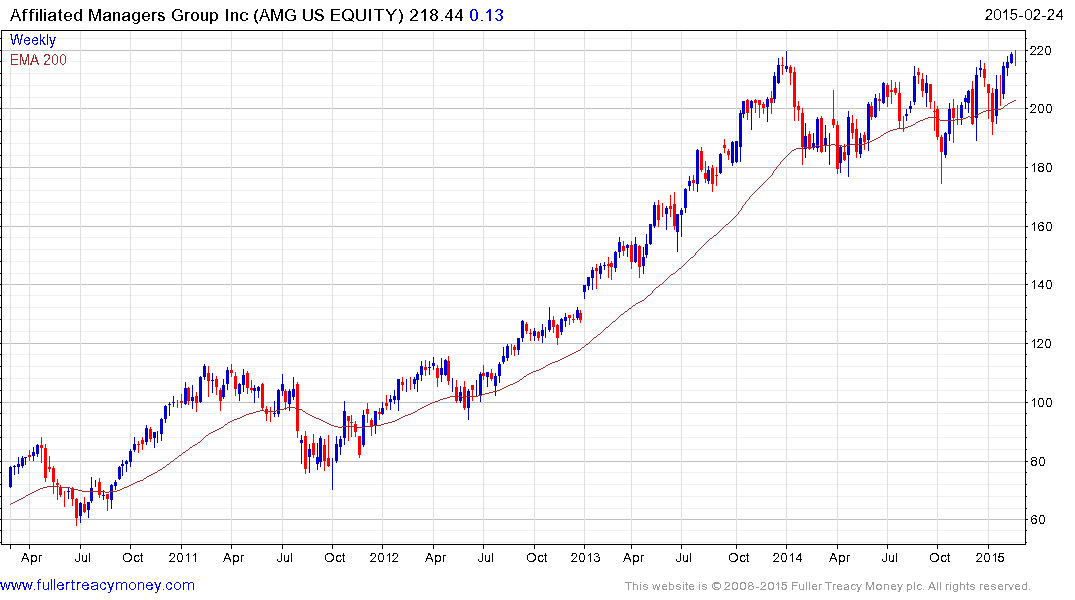

Affiliated Managers Group has been ranging for much of the last year and is currently testing the upper boundary. A clear downward dynamic would be required to signal more than temporary resistance in this area. Charles Schwab and T.Rowe Price share similar characteristics.

Back to top