When Older People Do Better Than Those of Working Age

This article by Jason Douglas and Jon Sindreu for the Wall Street Journal may be of interest to subscribers. Here is a section:

The average person 65 and older in the U.S. earns 77% of the income of the average citizen, up from 69% in 2008, at the start of the recession. In the U.K. the figure is 89%, up from 78%. In Spain and France, seniors now earn about 103% and 102% of the average worker’s income, respectively, according to an analysis of data from the European Union’s official statistics agency. That’s up from 86% in Spain and 96% in France in 2008.

This divergence between generations is in part a reflection of demographic shifts that have been brewing for years, as populations grow older and the wealthy postwar baby boomers in particular reach their golden years.

But it is also widening as a consequence of forces bearing down on the earnings of the young, creating a growing imbalance that threatens to undermine the promise that market economies will deliver rising living standards for successive generations. Younger workers are grappling with flat or falling pay, decreased job security and less-affordable housing, sapping the spending power that helps fuel the economy. As the elderly population increases, younger workers also face a rising bill for the extra tax dollars needed to fulfill past governments’ promises to retirees.

We don’t have to look far for a reason behind the surge in populist rhetoric across Europe and the USA this year. Whether it is the rise of right wing politics in France and Germany, the Eurosceptic referendum in the UK or Donald Trump in the USA there is a general sense that the measures implemented by governments to avoid a calamity in the financial sector have resulted in drops in living standards for many people.

The simple fact is that most countries can ill afford the benefits promised to pensioners. Some of the solutions include working longer, paying more taxes, accepting lower pay outs and achieving outsized growth. Some of these solutions are more palatable than others but the deflationary impact of technological innovation is unlikely to be affected by any of them. In order for that to be translated into outsized growth capable of paying for the bills as they come due some meaningful reform of the business, tax and market regulatory infrastructure is required. Right now there would appear to be scant appetite for the kinds of reforms required.

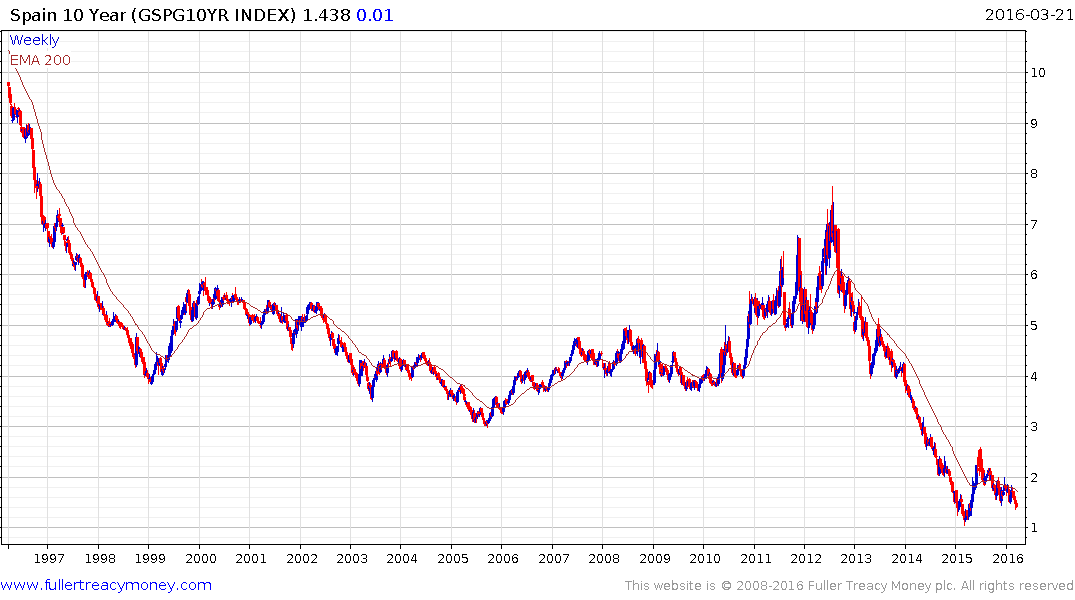

This is much more of an issue for continental Europe than it is for the USA because of unfavourable demographics. It represents an economic headwind not least because so much of their budgets must be allocated to pensions. Spanish 10-year government bond yields hit a low near 1% a year ago and are currently trading around 1.4%. A break in the progression of lower rally highs, currently near 1.6% would be required to signal a return to supply dominance beyond the short-term.

These structural considerations may also be an influence in the sluggish response of Eurozone stock markets to the ECB’s €90 billion a month purchase program. However if the Fed’s policy playbook is any guide it is only a matter of time before the central bank gains traction and investors begin to price in the insurance this policy affords the market. It also helps to explain why Mario Draghi felt compelled to chastise policy makers last week since his policies are unlikely to present a medium-term solution to the Euro regions problems.