Wheat Surges as Russia Warns on Ship Safety After Ditching Deal

This article from Bloomberg may be of interest to subscribers. Here is a section:

Crop traders have been focused for weeks on the approaching deadline of Nov. 19 for renewing the grain-corridor agreement, particularly as senior Russian officials repeatedly criticized the deal, suggesting that any extension would require difficult negotiations. Exports have also been slowed by a swelling backlog of vessels waiting to be inspected as part of the agreement -- Ukrainian President Volodymyr Zelenskiy said some ships had been waiting for three weeks.

Vessel and insurance rates to Ukraine stand to rise, said Michael Magdovitz, a senior commodity analyst at Rabobank. New deals from the country had already been drying up as traders didn’t want to risk getting caught short of the deal’s deadline, said Matt Ammermann, commodity risk manager at StoneX.

Russia, which leads global wheat exports, stands to offset some of the lost sales. Still, it will be key to watch how shipping costs across the entire Black Sea region are affected by the latest developments, Ammermann said.

At best this is a fresh example of brinksmanship by Russia in seeking to extract maximum benefit from the uncertainty around secure supply of wheat. At worst it is a prelude to intensifying the unconventional war effort by holding the world hostage with food insecurity.

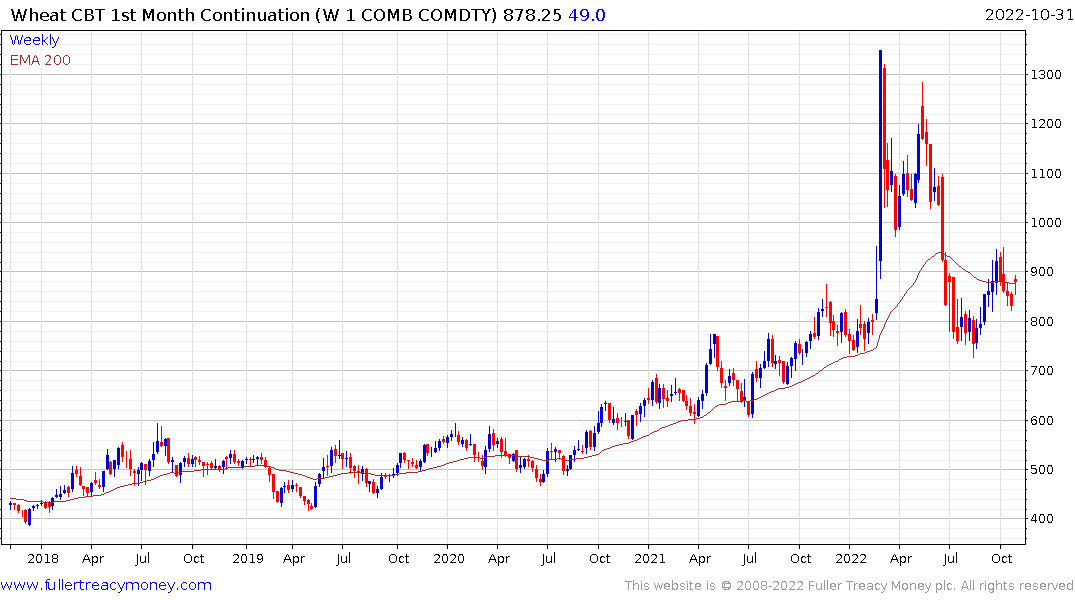

Sinking one grain ship would have a transformative effect on the price of wheat which rebounded today. The price peaked in February and dropped back to test the 800¢ level. Today’s action confirms a higher reaction low and suggests a higher plateau for trading as long as this uncertainty reigns.

Fertiliser and seed companies took their cue from this story and rebounded today. Mosaic and Nutrien are both firming from the region of their respective trend means.

Corteva is extending the breakout from its three-month range.

Bayer is also firming from the lower side of an almost two year base formation.

Bayer is also firming from the lower side of an almost two year base formation.

Glencore bought Viterra a decade ago and is a major trader of wheat. Tesla is also in talks with the company about taking a stake to secure long-term supplies of battery metals. The share is firming in the region of the yearlong range. https://www.ft.com/content/9b5b29a3-f2c9-4386-a01a-797aecce9631