China's Inward Turn

Thanks to a subscriber for this report from Citi which may be of interest. Here is a section:

In some ways this represents an important generational change in the way China will interact with the rest of the world. As far as we know, the term “international circulation” originated in 1988 when a government researcher, Wang Jian, made the case that China should adopt an export-led growth strategy, making use of its huge surplus labor to plug the economy into the international manufacturing process. In that sense, the de-emphasis of international circulation is an important historical shift. In a People’s Daily article in November 2020, Vice Premier Liu He set out a number of objectives relating to the DCS including: (1) the priority of upgrading of China’s technological capacity, including an enhancement of China’s supply chain resilience (though referred to in this article as “optimizing the structure of supply”); (2) the need for finance to serve the needs of the real economy; and (3) the promotion of further urbanization. Any mention of external demand comes last

Here is a link to the full report.

China’s stock markets are accelerating lower so that is a trend ending signal. The big question for all investors is at what point will the risk premium be fully priced in? The USA’s more aggressive attitude towards China is about the only bipartisan topic in the current administration. In fact the two parties seem to be competing for the mantle of biggest China hawk. China’s response to more activist counterparty risk is to look inwards and many people fear a repeat of the Cultural Revolution is already in play.

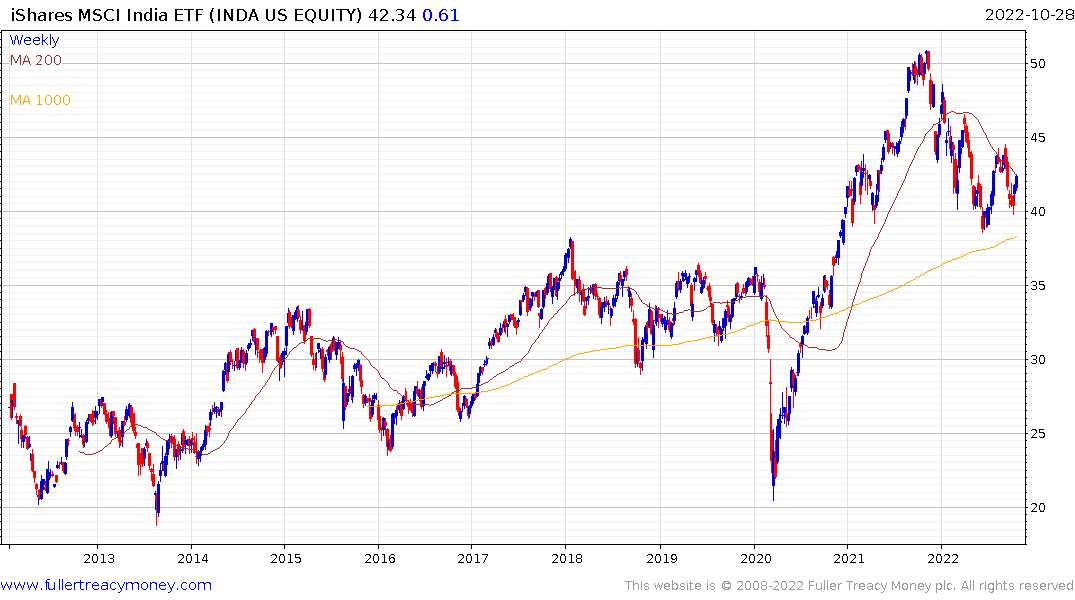

I have long been of the opinion that China is a trader’s market. Investors have needed to be gifted stock pickers to make money from the market over the last 20-years. There is no question that India is more chaotic but stock market returns over the last twenty years have outstripped China by any measure. That is likely to continue as the sanctions on chip development are an economic act of war since they are so broad in scope.