What the Federal Reserve Got Totally Wrong about Inflation and Interest Rate Policy: Getting Real About Rents

Thanks to a subscriber for this report from Cornell research Academy of Development, Law and Economics by Daniel Alpert. Here is a section:

The foregoing factors present perceptional problems especially when met with sizable gains in employment that would normally result in rapid household income growth. It is tempting to see rent and OER increases as only the result of higher levels of demand. But despite recent glimmers of meaningful wage growth (mostly in lower wage, lower hours employment sectors) and the longer term reduction in U-3 unemployment to historically low levels, median U.S. household income in 2018, adjusted for inflation, remained less than 4% higher than it was at the turn of this century, 18 years ago (see Figure 13).

So there is something else going on here. As Figure 5 illustrates, the contribution of rent and OER to core CPI inflation hit a historic high of 81% in the summer of 2017. While such contribution moderated some in 2018, it remains the lion’s share of core inflation and is again increasing in proportion.

This begs another question, what would be the level of core inflation without price growth in rent and OER? There was evidence at the end of Q4 2018 that rents declined nationwide on an annual basis for the first time in more than six years, according to the Zillow Group real estate database9. Now this data, if the trend continues, will take some time to percolate through to the BLS and BEA data - even longer for it to migrate from rents to OER estimates – but if it persists it will clearly result in materially lower inflation data in 2019. Far lower than the FOMC was banking on to support its monetary policy actions of 2018.

I found this to be a very interesting and educative report not least for its breakdown of the composition of CPI figures. The Fed dot plot which will be released on Wednesday, along with its rate decision, is being eagerly anticipated by investors for some perspective of just how dovish the Committee has become.

The housing markets in New York, San Francisco and Los Angeles are cooling following last year’s frenetic pace of buying. There is also some evidence of buyer slowdown in the high beta Las Vegas market. That suggests upward pressure on rents is likely to be less of a problem this year than last subject to how yields perform.

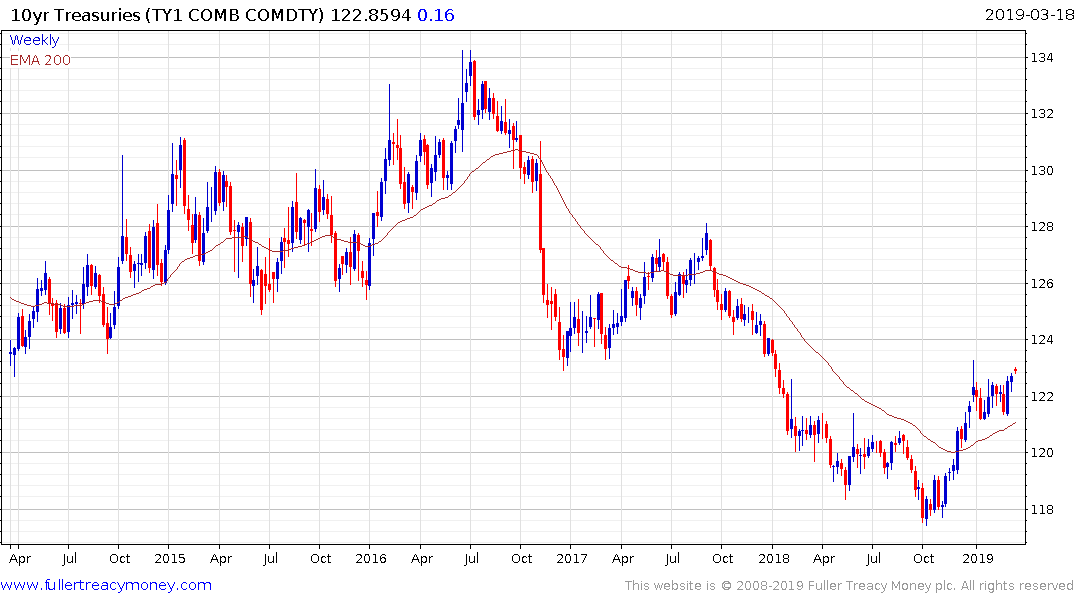

10-year Treasury futures are pausing at the upper side of the three-month range near 123 and an additional dovish catalyst will likely be required for a break above that level to be sustained.

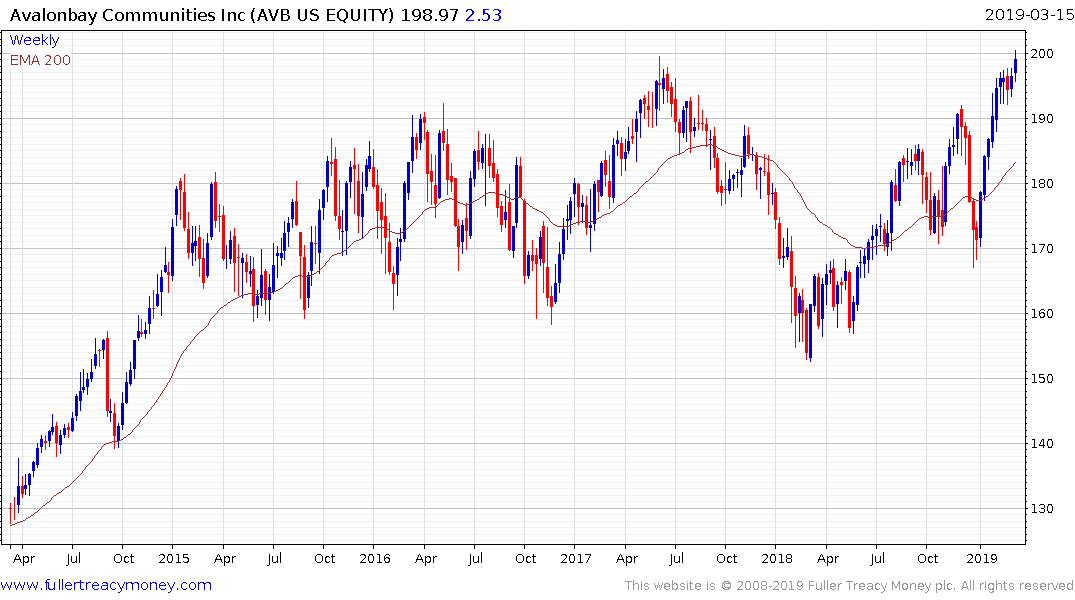

Among REITs focusing on apartment buildings, Avalonbay Communities is testing its highs following an impressive rebound from the December low.

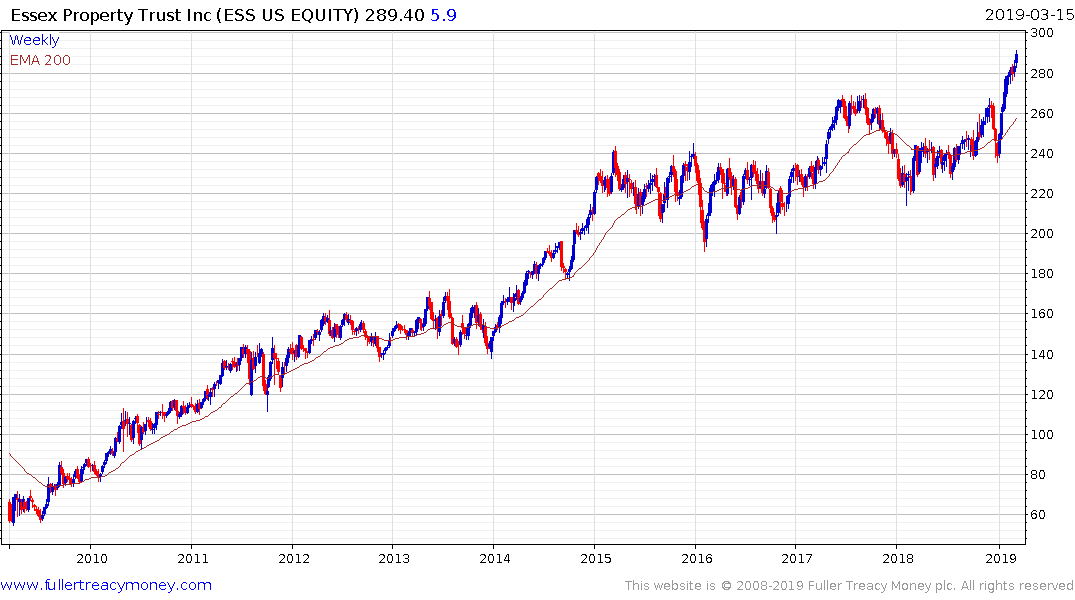

Essex Property Trust completed a four-year range in January but appears susceptible to some consolidation.

Apartment Investment & Management, Camden Property Trust and UDR Inc have similar patterns.

This article from the Financial Times, quoting the above report, may also be of interest.

Back to top