Emerging Markets Charts & Views Seek opportunities, but be aware of short-term volatility

This report from Amundi may be of interest to subscribers. Here is a section:

Here is a link to the full report and here is a section from it:

As the EM universe is scattered, it is important to focus on countries with lower external vulnerability and fiscal / monetary room for manoeuvre to deal with further possible economic deterioration.

China is already bearing the burden of trade disputes and this is a risk to monitor in EM. The external sector is the most vulnerable to weaker economic momentum, while domestic-driven sectors show more resilience. The transition towards a more balance growth model- with China climbing the value chain - is ongoing and should make the economic model more sustainable.

China represents such a large weighting in emerging markets indices that its stimulus efforts are likely to have a positive effect on the broader sector just from a weight of money and positioning argument. Nevertheless, there is a clear argument for looking at the countries with the clearest fuel to stimulate against a background where central banks generally are moving to a more stimulative perspective.

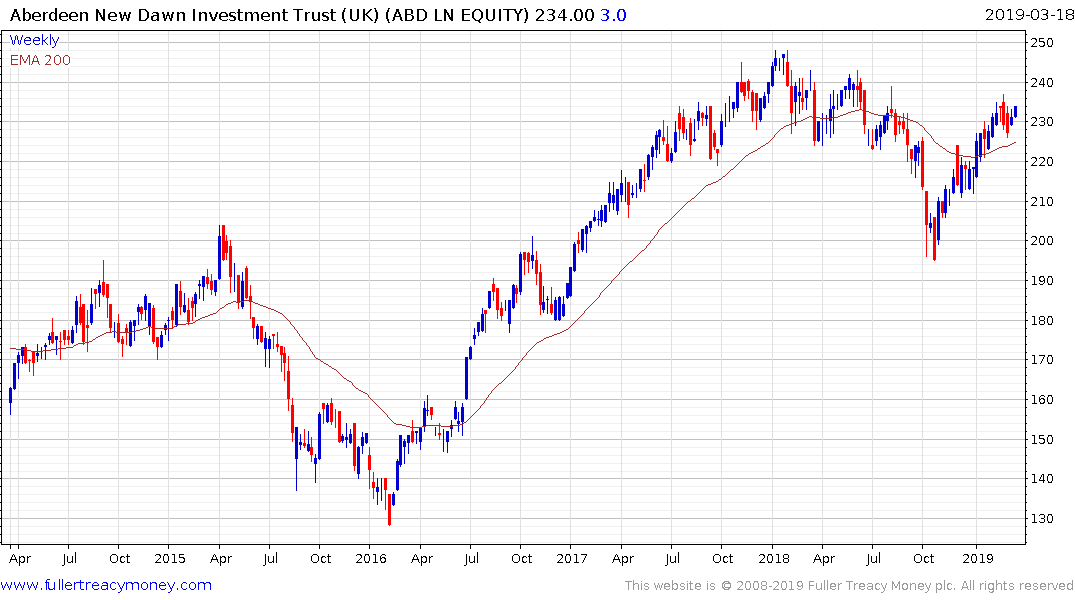

The Aberdeen New Dawn Investment Trust is trading at a discount to NAV of 9.3% and is firming from the region of the trend mean.

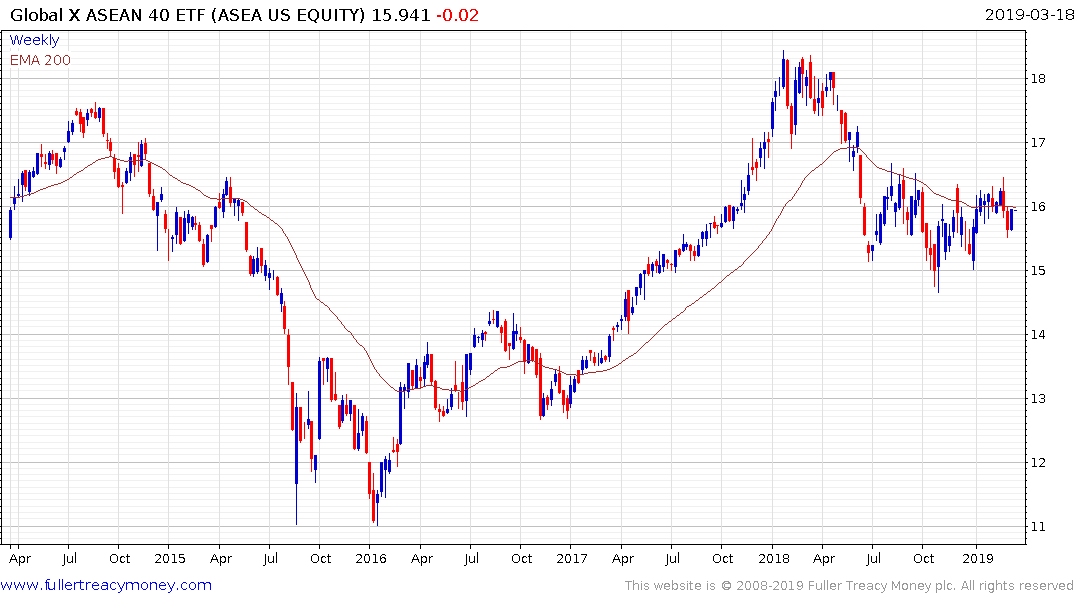

The Global X ASEAN ETF has been ranging for a year but has held a progression of higher reaction lows for the last six months and it is now pressuring the upper boundary. The fund is weighted by Singapore (29%), Thailand (24.3%), Malaysia (20%), Indonesia (19.8%), Philippines (5.22%).