Welcome to Rustenburg, Mr. Froneman

This article by Warren Dick for Mineweb may be of interest to subscribers. Here is a section:

Speaking at the announcement of the deal yesterday, Froneman said, “we were very disciplined and structured. We had to make sure our first entry into platinum was significant, but we haven’t rushed into it.” Froneman demonstrated that discipline when he walked away from a deal with Amplats in October last year with those immortal words, “Well if they [the assets up for sale] are so good, they should keep them.”

In response to a question from an analyst on how the two parties came to agree on the price the second time around, Froneman revealed why he has a reputation as a skilled dealmaker. “Initially we had very different ideas of value [for the assets]. But when we took a different view in terms of sharing the risk, it allowed us to come together on getting the deal done.”

That last part of his statement around “sharing the risk” is the nub. By convincing Amplats to share the risk, he turned the haggle over price into a more cordial engagement involving mutual benefit. And by doing so, Froneman could then – with a little more maneuvering – take a potentially large and risk-fraught transaction for Sibanye, and make it congruent with the company’s strategy of delivering returns to shareholders via dividends.

Sibanye announced more than a year ago they were seeking to enter the platinum business and this is the realisation of that goal. In doing so they hope to achieve the efficiency gains with the Rustenburg assets they achieved with the legacy assets at the Beatrix gold mines. They have a solid record but the big question is going to be how they handle relations with the unions they are inheriting.

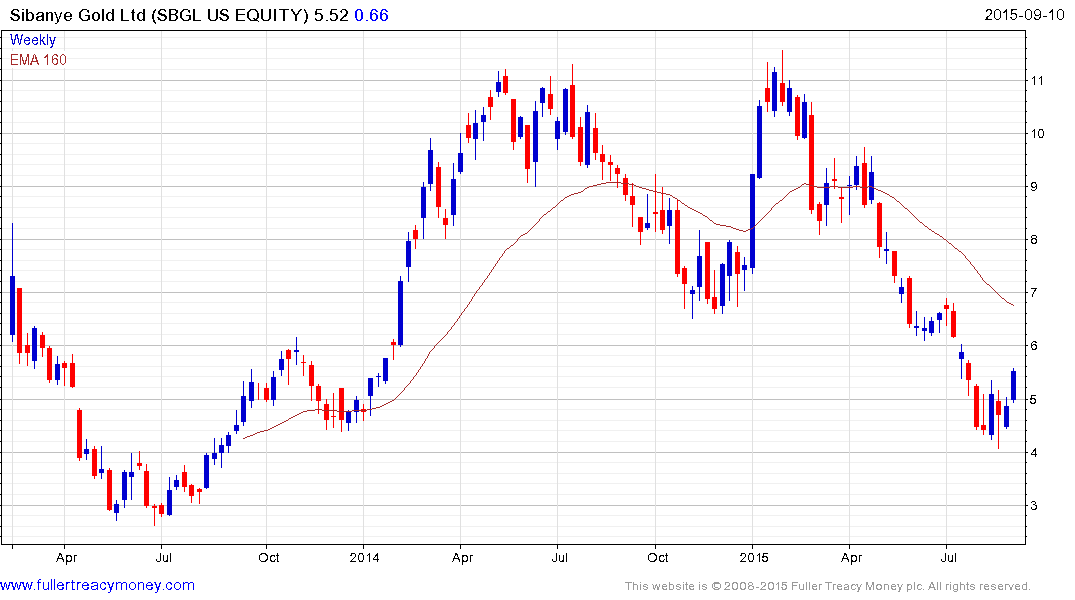

Sibanye’s US listing found at least near-term support in the region of $4 from late August and a sustained move below that level would be required to question current scope for additional mean reversion.

South African listed Angloplat bounced from the psychological ZAR25,000 level in August but the medium-term progression of lower rally highs remains in evidence and a sustained move above ZAR35,000 will be required to signal a return to demand dominance beyond the short term.