Dairy Farmers at the Barricades

This article by Bruce Einhorn, Alan Bjerga and Whitney McFerron for Bloomberg may be of interest to subscribers. Here is a section:

Fonterra, New Zealand’s largest dairy cooperative, announced on Sept. 1 that it would offer interest-free loans to farmers. Hope Dairies, a unit of Hancock Prospecting, which is owned by Australian resources billionaire Gina Rinehart, has shelved plans to open an A$500 million ($349 million) dairy farm and milk powder facility in Queensland. Agri-Mark, a New England cooperative with $1.1 billion in sales last year, began dumping milk in June for the first time in a half-century.

Paul Doton, owner of a 130-cow dairy farm near Woodstock, Vt., is keeping production steady. Prices aren’t covering his costs, but he still needs to sell milk to make his loan payments. “Everyone anticipated there’d be more supply, but we didn’t think we’d see the demand drop the way it did,” he says.

The dairy downturn has added an obstacle to the Trans-Pacific Partnership free-trade negotiations. New Zealand is demanding greater access to markets in Canada, Japan, and the U.S., which are feeling pressure from local farmers to hold on to protections that limit imports. During the latest round of TPP talks, in August, the government of Canadian Prime Minister Stephen Harper, facing a tough re-election battle in October, led the opposition to market liberalization. The meeting ended without an agreement.

The imposition of production limits on European grain producers was a contributing factor in the run-up in prices a decade ago. By the same token, the removal of quotas on milk production has had the anticipated consequence of depressing prices.

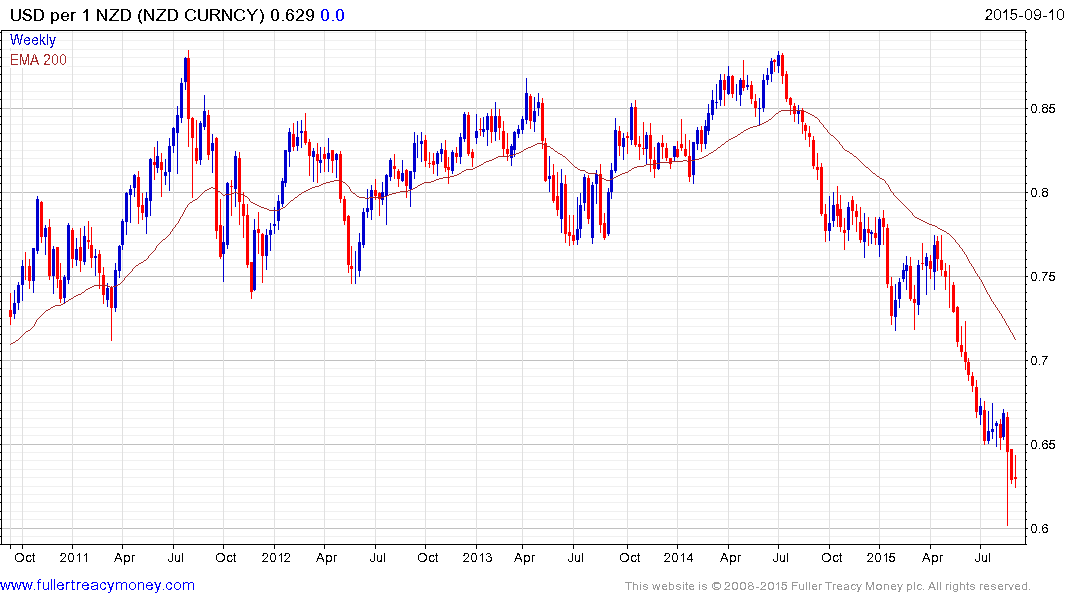

The New Zealand economy had been relatively insulated from global issues at least until Chinese demand for its exports moderated. The New Zealand Dollar has been trending lower since failing at 88¢ in July 2014. It accelerated to the late August low near 60¢ but will need to break the medium-term progression of lower rally highs to confirm demand is returning to dominance beyond a short –term bounce.

In Europe, Danone has pulled back sharply and Ireland’s largest dairies, Kerry Group and Glanbia, remain in reasonably consistent uptrends.

China’s main infant formula producer China Mengniu Dairy did not participate in the run-up earlier this year but accelerated lower over the last few months. It found at least near-term support in the region of HK$24 last week and will need to hold that level if potential for a reversionary rally is to be given the benefit of the doubt.

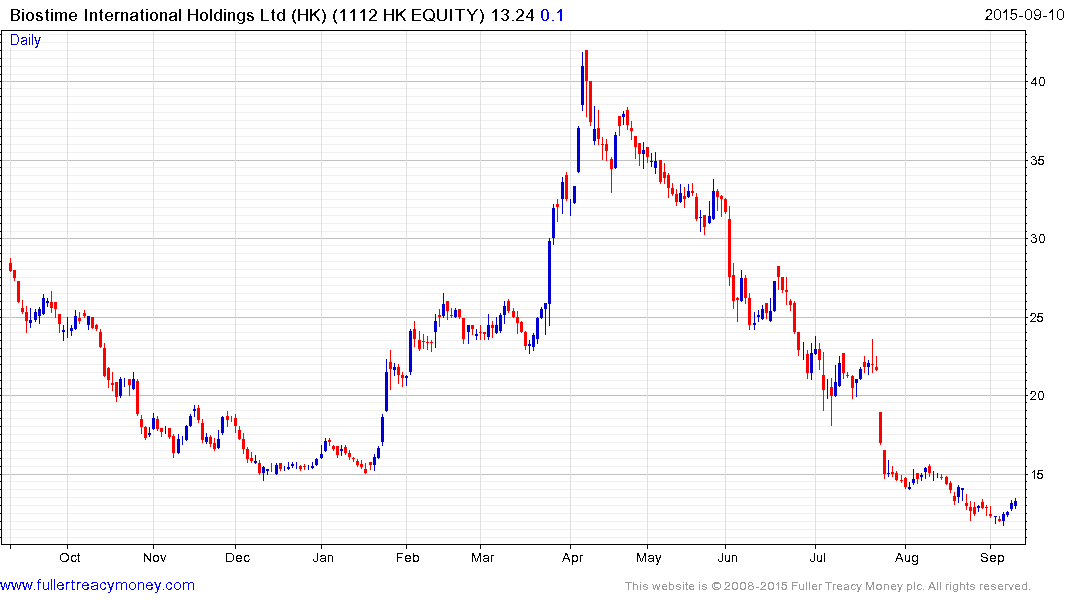

Biostime International has given up more than its earlier advance but is now working on a weekly upside key reversal. This would be its first weekly advance since June. Upside follow through next week would confirm a low of at least near-term significance.