Weekend Reading September 4th 2015

Thanks to a subscriber for this list of mostly academic reports, contributed in the spirit of Empowerment Through Knowledge, which we can reasonably assume constitute at least part of the weekend reading of policy makers.

Important comments from Torsten Slok of Deutsche Bank on China

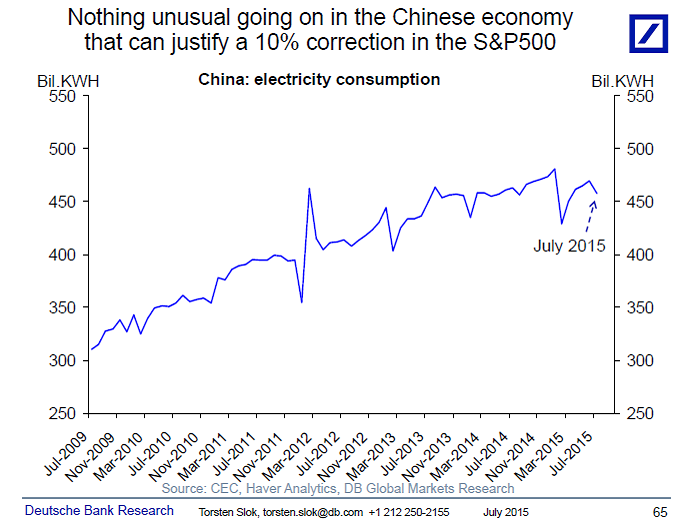

In the mid-1990s I worked at the IMF in the Asia and Pacific Department in the division covering China and we used to spend a lot of time debating the Chinese data, and when I look at the latest numbers for electricity consumption I just don’t see any signs that the Chinese economy is experiencing a hard landing, see chart below. Instead, I think markets are gyrating because of investor worries about valuations, combined with low liquidity in markets for regulatory reasons. The Fed, ECB, BoJ, SNB, and PBOC have printed so much money in recent years and that has pushed asset prices, in particular in the US and Europe, to high levels. Unfortunately, the wealth effects on the real economy of higher stock prices, higher bond prices and higher home prices have been very weak and as a result central banks have continued to keep interest rates low. But low interest rates and QE for seven years have resulted in more and more upward pressure on asset prices and investors are beginning to ask if asset prices have increased so much that they have become disconnected from expected future cash flows of assets. Or put differently, with asset prices going up not because of better fundamentals but because of central banks printing more money investors have over time become more and more uneasy about valuations and in many client discussions over the past year I have heard talk about when we will get a correction. Now the correction is here and “something in China” is a convenient excuse for having a correction in the stock market. Looking ahead, the real test to both stock prices and bond prices is what happens when central banks globally stop printing money and begin to raise interest rates

I have two problems with the ongoing global stock market sell-off:

1) Betting against China has been a losing proposition for decades, why should now be different?

2) Despite this being a client conversation for several months, I still haven't seen a smoking gun chart showing why a slowdown in China will have a significant impact on the US expansion. If you have one then please send it along.

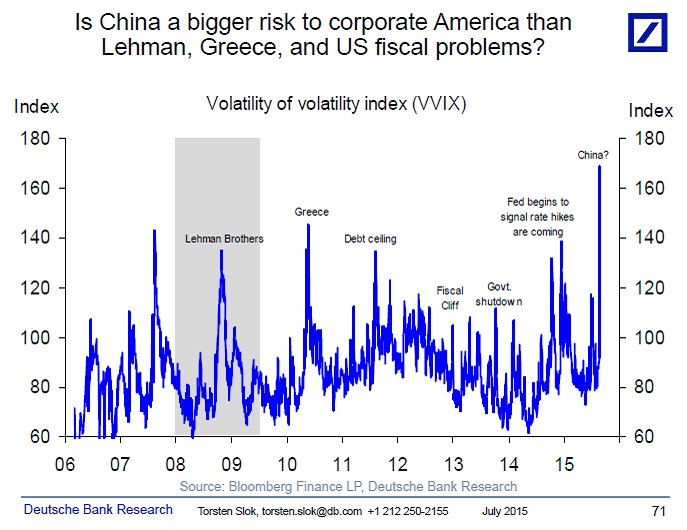

As a result, I conclude the following: When uncertainty about corporate America reaches an all-time high – see chart below – because of "something in China" then it looks like a buying opportunity to me; wait for your 5-day moving average to stabilize and it will likely be a good entry point.

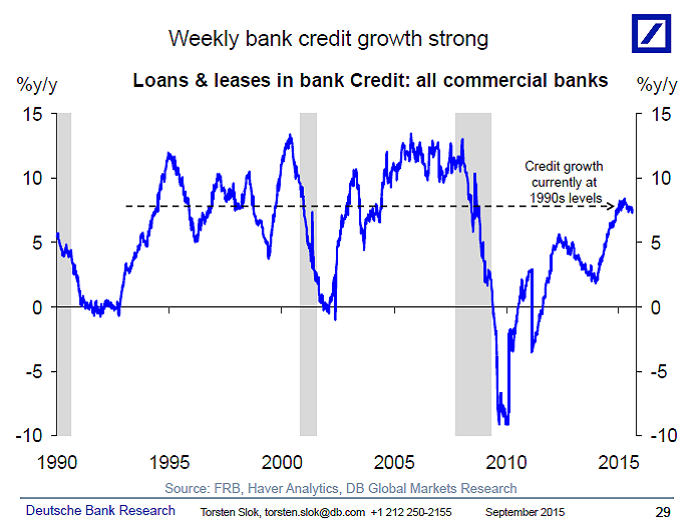

For clients who worry that China and EM will drag down the US economy. Commodity prices started falling 12 months ago and many emerging markets have been in trouble over the past year. Still, the US economy continues to do very well, see also the latest weekly bank lending data below, which came out on Friday. It shows credit growth of a healthy 8% year over year, this is the same level of credit growth we saw in the second half of the 1990s. Combined with last week’s data for GDP, durable goods, jobless claims and consumer confidence this does not look like an economy that is about to enter a recession. I understand that the US data can slow down going forward but all I’m pointing out here is that up to this point the slowdown in EM does not seem to have had much impact on the US.

Fed (New York): What Drives Buyout Booms and Busts?

IMF: Lower for Longer: Neutral Rates in the United States

We use a semi structural model to estimate neutral rates in the United States. Our Bayesian estimation incorporates prior information on the output gap and potential output (based on a production function approach) and accounts for unconventional monetary policies at the ZLB by using estimates of “shadow” policy rates. We find that our approach provides more plausible results than standard maximum likelihood estimates for the unobserved variables in the model. Results show a significant trend decline in the neutral real rate over time, driven only in part by a decline in potential growth whereas other factors (including excess global savings) matter.

Fed (Minneapolis): Coordination and Crisis in Monetary Unions

We study fiscal and monetary policy in a monetary union with the potential for rollover crises in sovereign debt markets. Member-country fiscal authorities lack commitment to repay their debt and choose fiscal policy independently

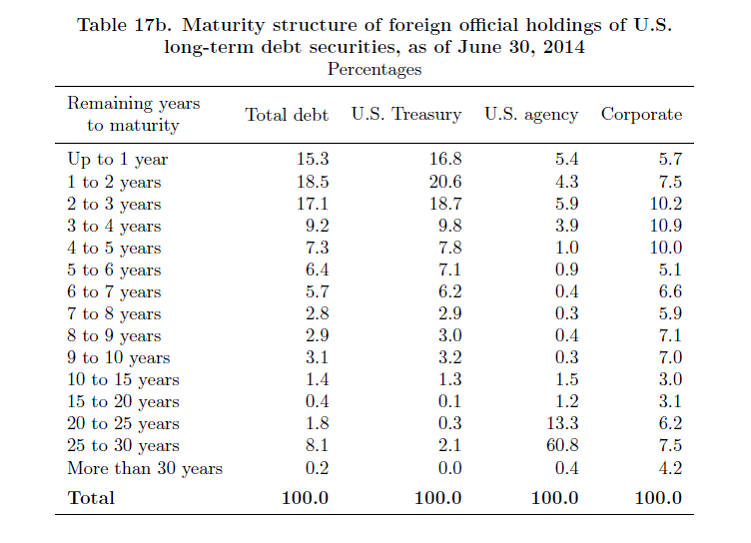

The maturity structure of foreign official holdings of US Treasuries, agencies, and corporate bonds can be seen here:

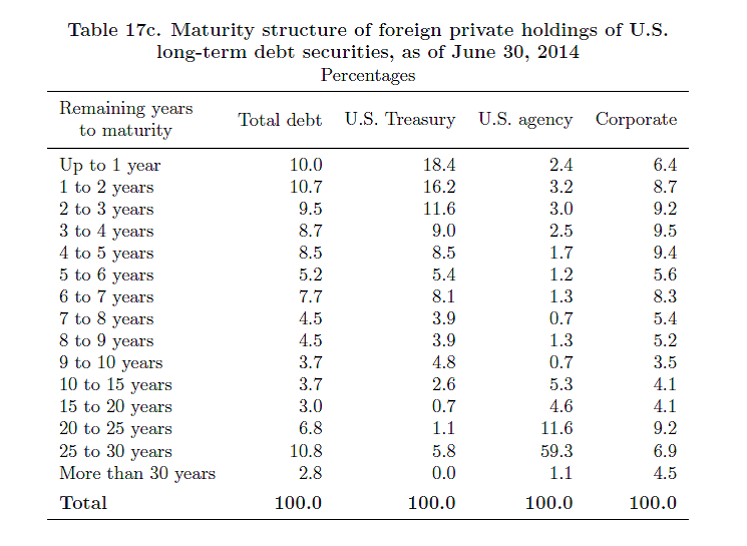

And here is the maturity structure of foreign private holdings of US fixed income:

It all comes from here:

Back to top