Draghi Unveils Revamped QE Program as ECB Downgrades

This article by Jana Randow Craig Stirling for Bloomberg may be of interest to subscribers. Here is a section:

The increase in the limit for purchases of each bond issue is subject to “a case-by-case verification” of the circumstances involved. It should not create a situation whereby the ECB would have blocking minority power, in which case the issue share limit would remain at 25 percent, Draghi said.

Stimulus is programed to continue “until the end of September 2016, or beyond, if necessary,” Draghi said, in a tweak to language that hints more strongly than before on officials’ readiness to expand purchases.

The euro dropped 0.9 percent to $1.1129 at 2:29 p.m. London time

and touched $1.1107, its weakest level since Aug. 20.“Draghi is assuring very clearly that if the turmoil gets any worse, the ECB would do all it takes to keep the recovery on track,” said Holger Schmieding, chief economist at Berenberg Bank in London. “It would not take much further to elicit the ECB response.”

Having embarked on QE the ECB has little choice but to continue on its projected trajectory. Even in an era of currency devaluations €60 billion a month is still alot money and represents a medium-term headwind for the Euro. This is an important consideration for leveraged traders seeking cheap funding for carry trades.

Last week’s sell-off and Tuesday’s pullback resulted in bounces for the Euro as some of these leveraged traders were put under pressure. By the same token, the weakness of the Euro in response to the widening of the ECB’s QE program is a tailwind for risk assets particularly in Europe.

Medium-term the Euro failed to sustain the move above $1.15 last week and has now fallen back towards the lower region of its range. It is no coincidence that the ranging consolidation which has allowed the Euro’s deep oversold condition to be unwound has occurred at the same time as a corrective phase in stock markets.

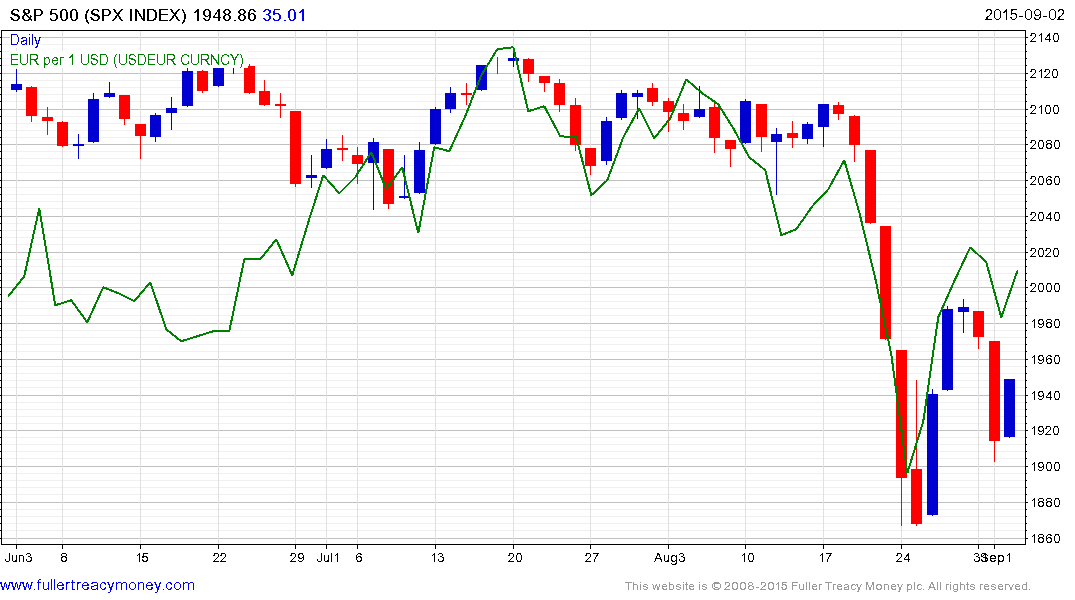

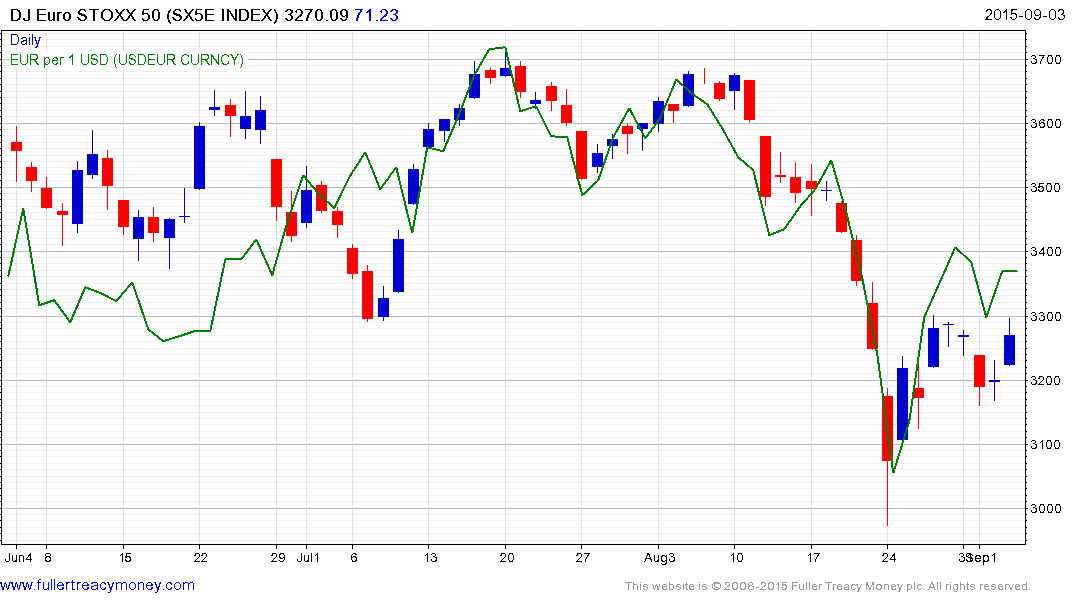

Here are two charts showing the high correlation between the performance of the S&P 500 and DJ Euro STOXX 50 with the Euro over the last three months. The message here is that Euro weakness represents a greenlight for leveraged traders.

Returning to the chart of the Euro above, the $1.08 level represents an area of potential support and a sustained move below it would be required to signal a return to supply dominance for the Euro. Against that background the most likely scenario remains a period of ranging with occasional bouts of higher volatility which will act as a support building phase before higher levels can be sustained on stock markets.

The relative strength of the Yen is an additional contributing factor to the above argument.