Week in China, Ant problem

Thanks to a subscriber for this article focusing on Chinese overseas acquisitions which may be of interest. Here is a section:

But where Chinese acquisitions in the US are now concerned, any nuances as to the buyer’ background seem to be getting lost in a broader hysteria. Robert Pittenger, a Republican congressman, told Politico last year, for example, that he’s wary of Beijing leveraging MoneyGram’s database “to harass dissidents, journalists and human rights activists who dare challenge the Chinese Communist Party”. The Politico report noted that much of MoneyGram’s infrastructure lies inside or within a few miles of some of the largest US military installations, where soldiers, their families, and defense contractors wire money regularly.

Pittenger’s immediate association of Ant and the Chinese government is likely framed by the discussions surrounding China’s new cyber-security law. The regulation, which came into effect last June, requires network operators in China to cooperate with the country’s crime or security investigators. That effectively grants Chinese authorities access to data owned by private enterprises as well as foreign companies operating in China.

Here is a link to the full magazine.

Huawei’s deal with AT&T to sell its phones in the USA has also fallen on hard times and suggests the Trump administration is willing to take a tougher line on Chinese overseas acquisitions. The arrest yesterday of a former CIA agent, suspected of leaking the identities of US agents in China, is another branch of what is a continually developing story of competition between two great powers.

The harsh reality is that so called privately held companies share information with the Chinese government. Communications and financial services companies have access to detailed personal information for large numbers of people and it is reasonable to assume we all might feel uncomfortable with it falling into the hands of a foreign government.

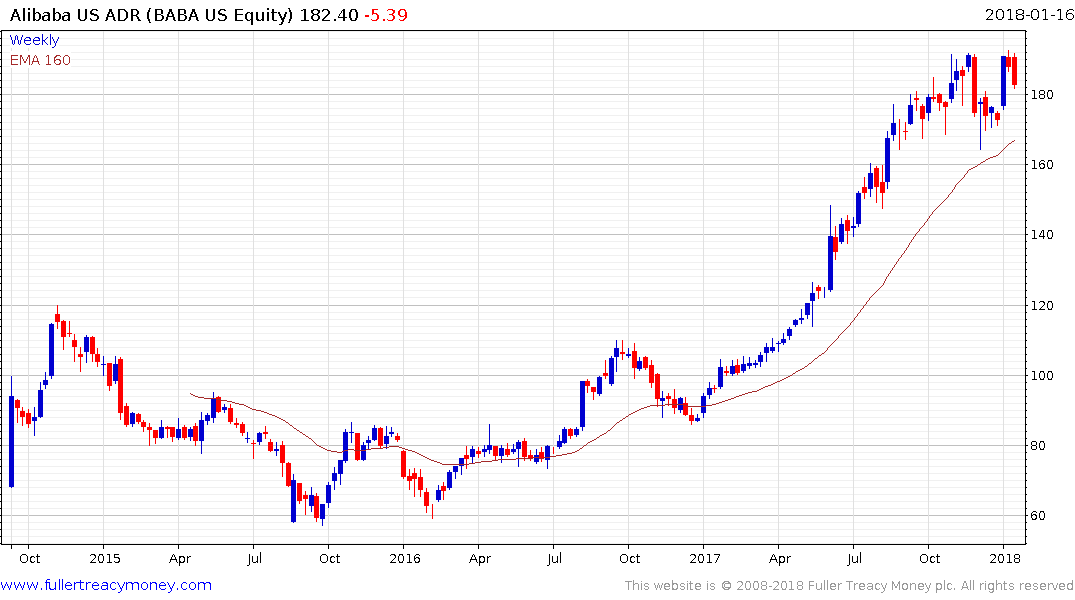

While ANT Financial is not part of the Alibaba listing the share has lost momentum over the last month in what has so far been a reasonably steady process of mean reversion.