Key calls for 2018

Thank to a subscriber for this report from Oxford Economics, on Australia, which may be of interest. Here is a section:

Although rate normalisation has begun in the US, UK and Canada, we expect the RBA to stay on hold until the end of 2019. The Board are facing near-term weakness in domestic demand and continued sluggish wage growth, which will result in GDP growth undershooting productive potential and core inflation remaining around 2%. Against this backdrop, loose monetary policy is needed to support the economy2, and we expect the cash rate to remain at 1.5%.

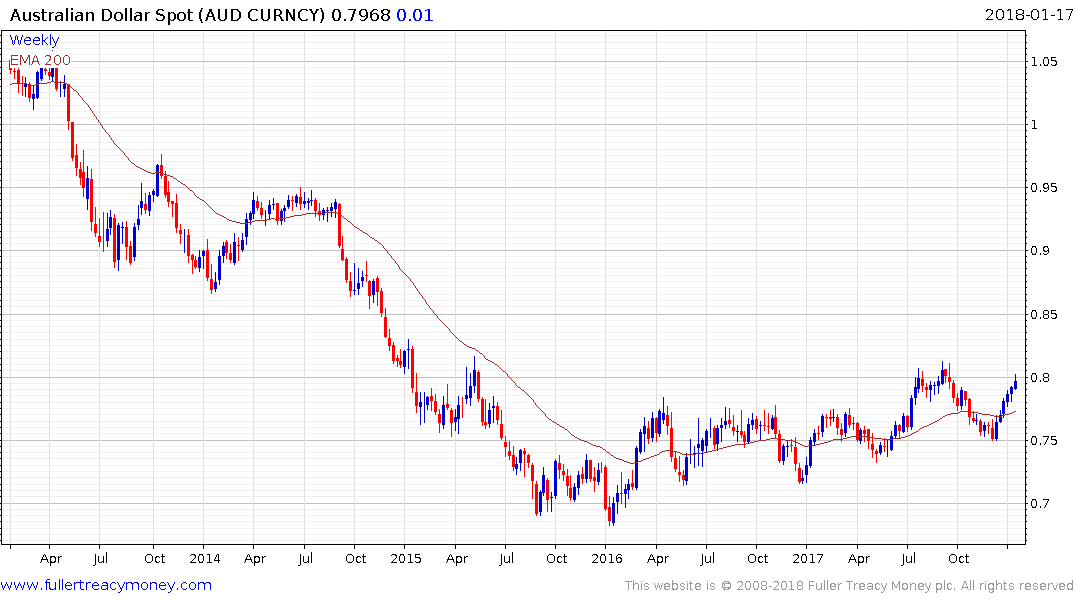

The Australian dollar displayed its usual volatility in 2017, starting the year at below US73 cents, then rising and peaking above US81 cents in September, before drifting back to US75 cents in early December. The AUD finished 2017 at US78 cents, driven up in the last few weeks of the year by rises in key commodity prices. Moving through 2018, we expect this position to gently unwind. Iron ore and coal prices are expected to fall, with supply increases from major producers (including Australia) coming together with slower demand growth for both commodities. Coupled with this, our current macroeconomic outlook is significantly below consensus (2.5% v. 2.8%, Consensus Economics December 2017 survey), and we expect market sentiment to move against Australia as the economy underperforms current expectations and it becomes clear that the RBA won’t be raising rates in the near term (in contrast to the US, where we expect to see three rate rises this year). As a result, we expect to see the AUD drift down towards 75 US cents per dollar as we move through 2018.

Here is a link to the full report.

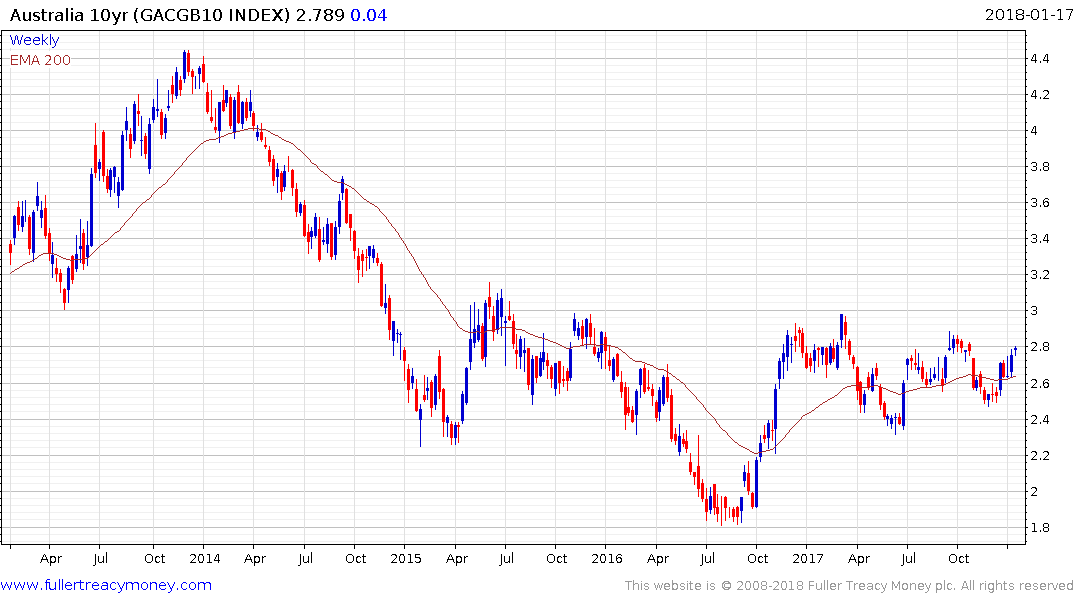

The medium-term chart has Type-3 (inverse head and shoulder) bottoming characteristics, with 3% representing an important psychological level. If breached on a sustained basis, it would signal a return to medium-term supply dominance.

Australia avoided recession during the global financial crisis but was unable to avoid the downward pressure on rates and yields that synchronized global monetary expansion engendered. It would appear unlikely that it will avoid an uptick in rates the return of synchronized global economic expansion is now prompting.

The Australian Dollar has held a progression of higher reaction lows since early 2016 and is now back testing the 80¢ level. A clear downward dynamic would be required to check momentum while a break able 75¢ would challenge the medium-term upward bias.

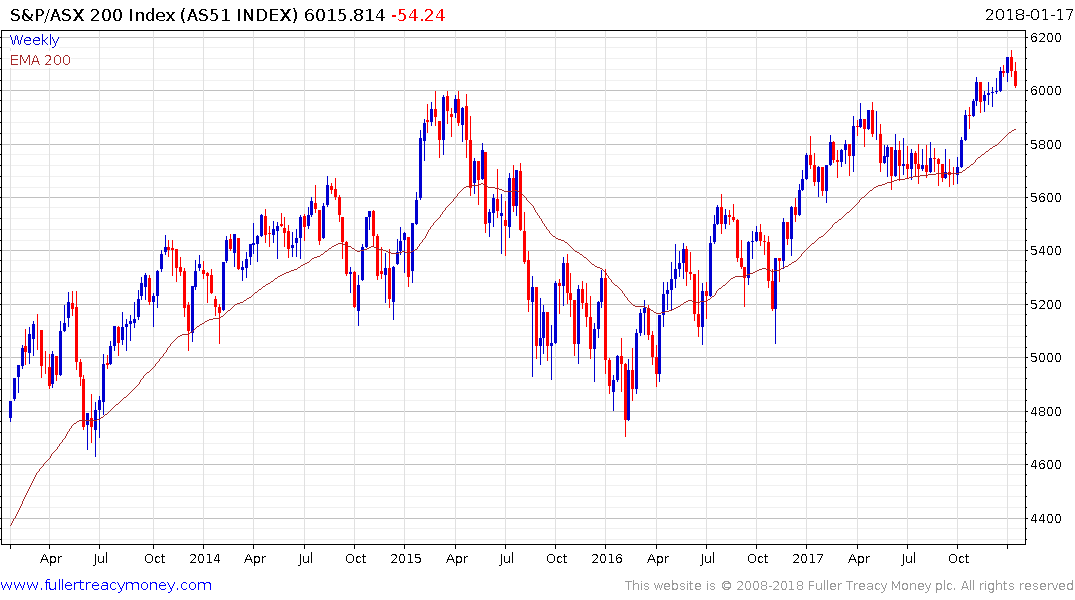

The S&P/ASX 200 Index appears to now be consolidating the move above 6000 and it will need to demonstrate support above or in the region of the trend mean if medium-term scope for additional upside is to be given the benefit of the doubt.

The continued strength of the US Dollar denominated iShares MSCI Australia ETF highlights how much of an influence the currency is having on nominal stock prices.