Vivendi to Return $6.4 Billion to Shareholders After Asset Sales

This article by Marie Mawad for Bloomberg may be of interest to subscribers. Here is a section:

Vivendi said its board approved an agreement to sell its remaining 20 percent stake in cable and wireless carrier Numericable-SFR to Altice SA for 3.9 billion euros.

Chairman Vincent Bollore has been leading the discussions on how to spend Vivendi’s cash pile as it scouts potential acquisitions. The company, based near the Arc de Triomphe in Paris, has divested telecommunications assets including a stake in Maroc Telecom and its French mobile unit SFR, with the latter sold to billionaire Patrick Drahi for 17 billion euros. In September Vivendi agreed to divest its Brazilian broadband business GVT to Telefonica SA for about 7 billion euros.

Vivendi reported fourth-quarter net income of 2 billion euros, compared with 556 million euros a year earlier. Sales rose 0.4 percent to 3 billion euros, in line with analysts’ estimates.

?Of its remaining assets, Universal Music Group is the world’s largest music company, while pay-TV provider Canal Plus mainly targets the French market.

In April last year, after Vivendi agreed to sell SFR, it said it would return as much as 5 billion euros to shareholders in 2014 and 2015 through dividends and share buybacks. Since then, it’s sold more assets including GVT as well as stakes in Activision Blizzard Inc. and Apple Inc.’s Beats.

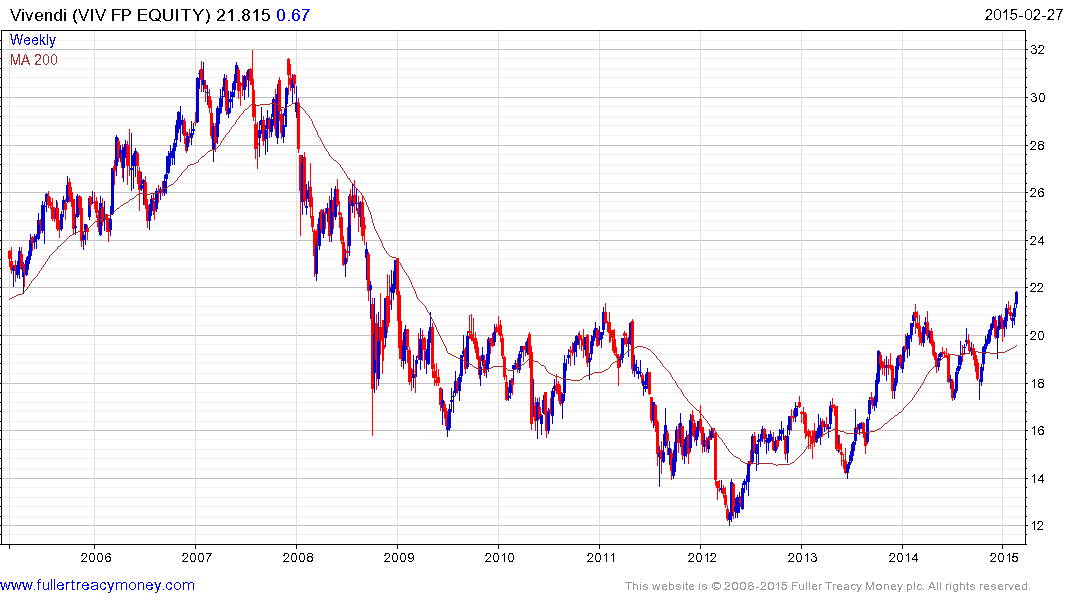

Vivendi’s dividend is probably intact after its spat of sales which has left it with its French pay TV channels and music assets as well as a substantial cash pile. It remains to be seen just what management’s ambitions are regarding growth.

The share (P/E 12.88, Est P/E 38.27, DY 4.58%) completed a six-year base this week and a sustained move below €20 would be required to question medium-term scope for additional upside.

Elsewhere among French companies:

Veolia Environnement is another French company which has gone through a painful process of transformation. The share (Est P/E 23.29, DY 4.04%) remains on a recovery trajectory and a sustained move below the trend mean, currently near €14.50, would be required to question medium-term scope for additional upside.

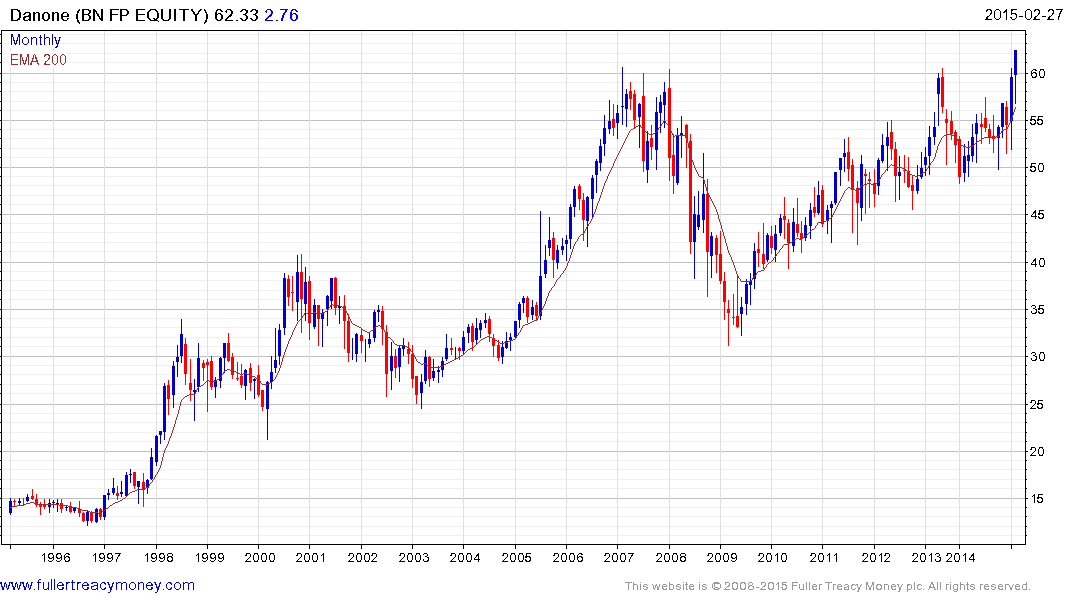

Danone (Est P/E 21.54, DY 2.41%) broke out to new all-time highs this week.

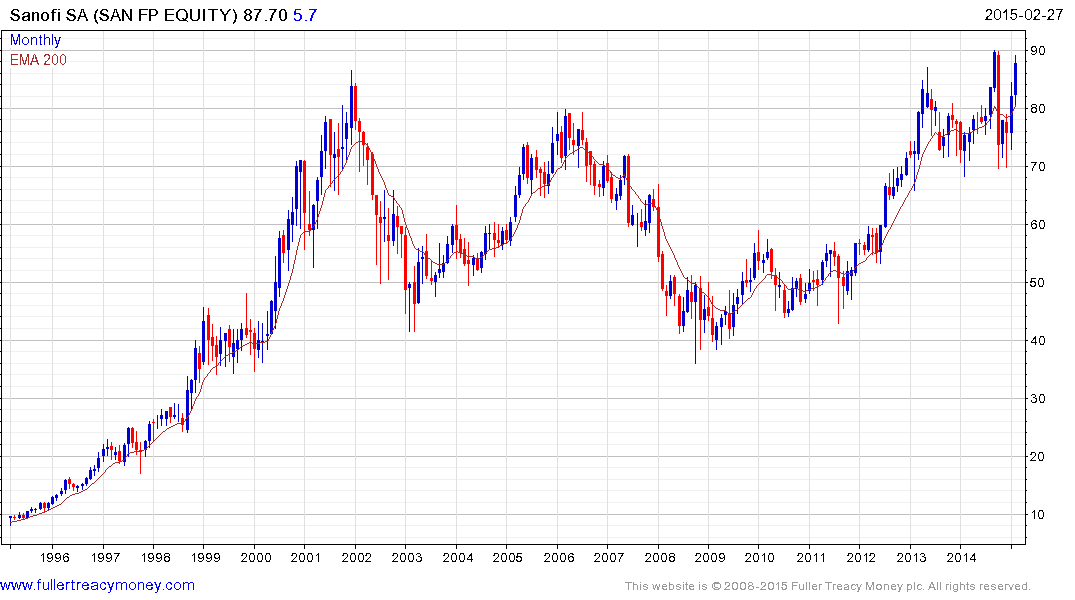

Sanofi (Est P/E 15.97, DY 3.25%) is still testing the upper side of a long-term range.

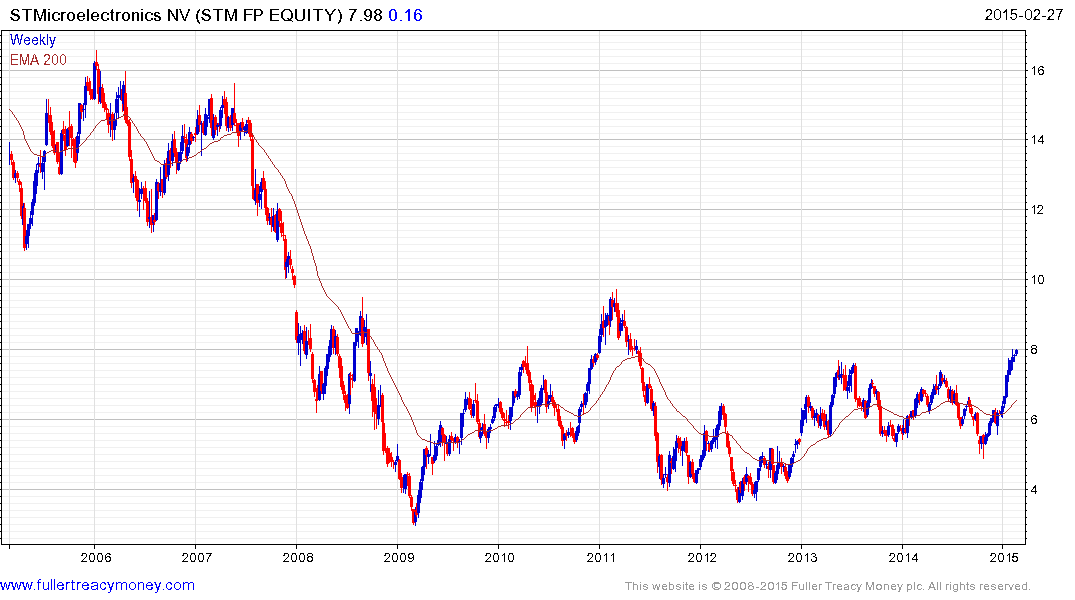

STMicroelectronics (Est P/E 23.45, DY 4.47%) is testing the upper side of a six-year base.

Alstom (Est P/E 24.34, DY N/A) is testing the upper side of a three-year base.

GDF Suez (Est P/E 15.53, DY 5.03%) has a similar pattern.

Back to top