Email of the day on firearms manufacturers

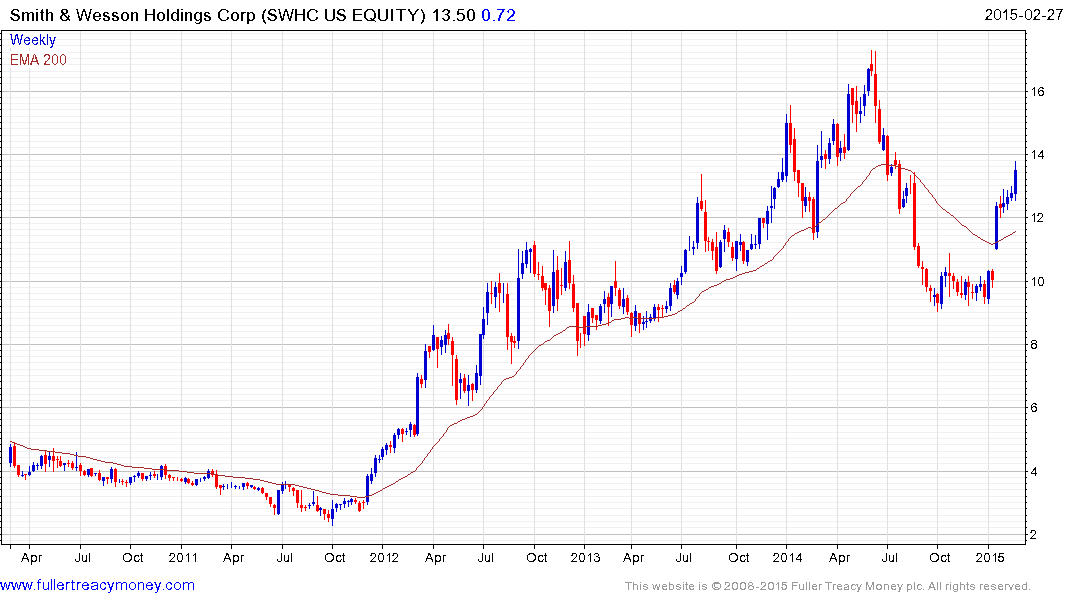

Good old Sturm Ruger - good management, no debt, unusual dividend policy, good products - but the 2013 mania about potential government interference in gun sales sent everyone and their hunting dog to the gun stores to buy guns, so they didn't have the cash to buy more guns in 2014. That yielded a spectacular 2013 for Ruger, and a pretty crummy 2014. (Ditto for Smith and Wesson and other similar companies).

Up over 30% since Jan 30 (when I bought, based on the shares stepping above a base - see Dilbert cartoon). Up 14.5% today, based on a really ho-hum earnings report, albeit better than expectations. 4 major institutions (Blackrock, among them) have filed SEC papers on holdings > 5%, adding up to almost 1/3 of the outstanding, all since mid-Jan. Interesting...

Seems out of the ordinary...

Thank you for this informative email and the links to Dilbert are very humorous. As a sector susceptible to the vicissitudes of political whim, small firearm manufacturers are subject to occasional bouts of volatility. Aside from the dubious arguments about promoting personal safety, one of the primary selling points they have is that target shooting is a fun pastime for a lot of people.

Both Sturm Ruger and Smith & Wesson share similar patterns. For the reasons you outline they both pulled back sharply in 2014 and are now staging rebounds. Provided they find support in the region of their respective 200-day MAs on the next pullback, recovery potential can continue to be given the benefit of the doubt. With institutional investors taking large positions, one wonders if the sector is to become the subject of M&A activity.

One of the primary manufacturers of bullets Alliant Technologies merged with Orbital Sciences earlier this week and spun off its sporting brands into Vista Outdoor. The new share VSTO will appear in the library once it has a week of history. Prior to the merger and spin-off Alliant Technologies had a similar pattern to the above gun manufacturers.

Taser International also made headlines this week when it missed analysts’ estimates for earnings. The share had accelerated to test the $28 area before losing momentum and this week’s massive reaction against the prevailing uptrend has Type-2 top formation characteristics. It will need to find support in the $21 area if this correction is to be limited to mean reversion.

Back to top