UK Industrial Revolution 2.0

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Potential GDP growth slowed in the UK after the debt crisis and Brexit is another structural shock. Monetary policy does not have the ability to correct these impairments. A structural policy is required, for example, the priority being given by new British PM, Theresa May, to the industrial sector within economic policy. An industrial renaissance is the objective.

We motivate the need for industrial strategy through the new information based theory of economic growth. Over time, knowledge and knowhow is created and embodied into products. The more specialized these products and the broader the range produced, the more complex the economy. Complexity is a medium- to long-term predictor of economic growth.

The UK is not coming from a standing start. The UK has retained or created industrial strengths in sectors from cars and industrial machinery to aerospace and defense. The sizeable depreciation of sterling and relatively low production costs give UK industry an advantage. These cyclical benefits can be secured with a structural policy aimed at maximizing R&D (knowledge) heavy, high-skill (knowhow) manufacturing.

A modern industrial strategy is about creating the right environment for new products and markets to emerge and jobs and income to grow. A successful neo-industrial policy requires a holistic approach. We discuss four areas likely to appear within an industrial strategy: infrastructure (including digital), energy, skills and innovation. Policies here could enhance complexity and the economy’s capacity to generate, share and use information. A consistent policy approach with long-term commitments could counterbalance Brexit-related uncertainty.

The Chancellor, Philip Hammond, is expected to ease the UK’s austerity policy by year-end. We argue the fiscal adjustment needs to be seen through the lens of industrial strategy. Public sector funding costs are extremely low and the Bank of England has re-started gilt-based QE. After the referendum the government has a reason and opportunity to maximize the benefits via an industrial policy.

Here is a link to the full report.

As we pointed out ahead of the referendum, the UK had a big choice to make. It could become a vassal state subject to an increasing autocratic central government or it could throw out the rule book and refashion itself into a free market example of dynamism that would benefit from its proximity to, but separation from, a much larger neighbour. I described this latter option as the Hong Kong solution and it would appear to be what the UK is now moving towards.

The Pound has at least stabilised near $1.30 as economic news confirms relative resilience among consumers. However it is hard to make a compelling bullish case while the Bank of England is still engaged in quantitative easing.

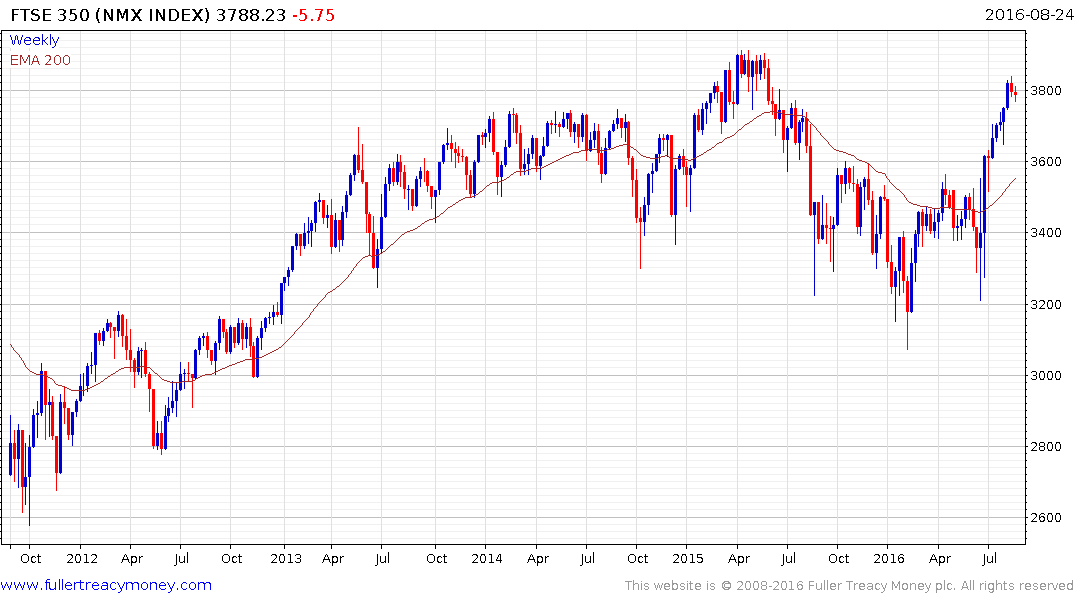

The FTSE-350 Banks Index continues to hold the move above the 200-day MA and rallied today on news of improving consumer loan growth. A sustained move below 3250 would now be required to question the recovery trajectory.

The FTSE-350 has regained the entire decline posted since April 2015 but is overbought in the short-term and susceptible to some consolidation. However, a sustained move below the trend mean would be required to question medium-term scope for continued upside.