U.S. Employers Shaking Off Global Risks With Broad-Based Hiring

This article by Victoria Stilwell for Bloomberg may be of interest to subscribers. Here is a section:

“We’re not leaning on one or two or three industries to support the job market,” which is “very encouraging,” said Ryan Sweet, a senior economist at Moody’s Analytics Inc. in West Chester, Pennsylvania, whose forecast for payrolls was among the closest in the Bloomberg survey. “We’re creating more than enough jobs to reduce the slack in the broader labor market.”

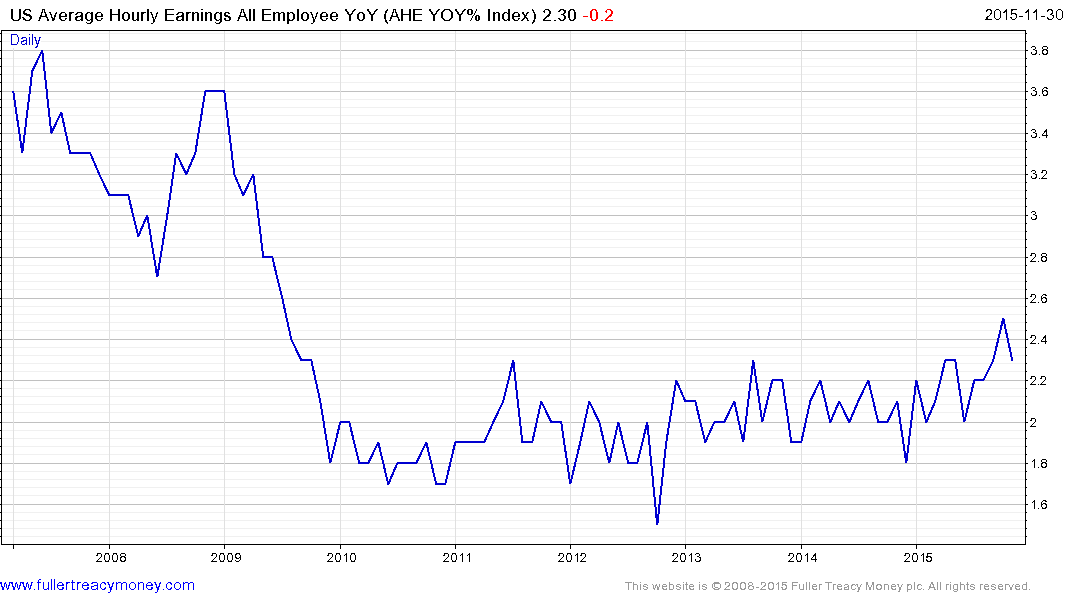

The figures underscore Fed Chair Janet Yellen’s view that slowdowns in emerging markets or Europe won’t derail the U.S. expansion, clearing the path for officials to raise the benchmark interest rate this month for the first time since 2006. The pace of future rate increases will be contingent on progress toward the central bank’s inflation goal and probably depends on how quickly wage pressures mount as the job market tightens.

Considering the fact many US inflation measures exclude both energy and food, the role wages play in the calculation tends to be exaggerated. Hiring remains on a steady upward trajectory as the economy recovers from the credit crisis recession in about the same amount of time as Rogoff and Reinhart predicted.

One of the unintended consequences of Obamacare was to disincentivise low income and lower middle income families from working for fear of losing eligibility for attractive health insurance benefits. This means wages have to be higher to entice people back into the workforce.

Wages are rising and broke out of a four-year base at the October update. Meaningful deterioration would be required to question the medium-term upward bias not least as a growing number of cities seek to implement minimum wages rates in the region of $15.

Against that background the Fed is running out of reasons not to raise rates. It’s been a long time since there has been such a disparity in interest rate outlooks between the world’s largest economies and this is contributing to volatility in the currency markets.

However while the Dollar was firmer today it has not unwound yesterday’s Euro rally. In the absence of a sustained move to new lows that move can continue to be viewed as the beginning of a reversionary Euro rally.

The Nasdaq-100 on the other hand experienced a sharp rally which has almost completely unwound yesterday’s move and offset the developing weekly key reversal that had formed by yesterday’s close. This remains a fairly volatile range in the region of the historic peak and a sustained move below yesterday’s low would be required to check momentum.