Turning Points

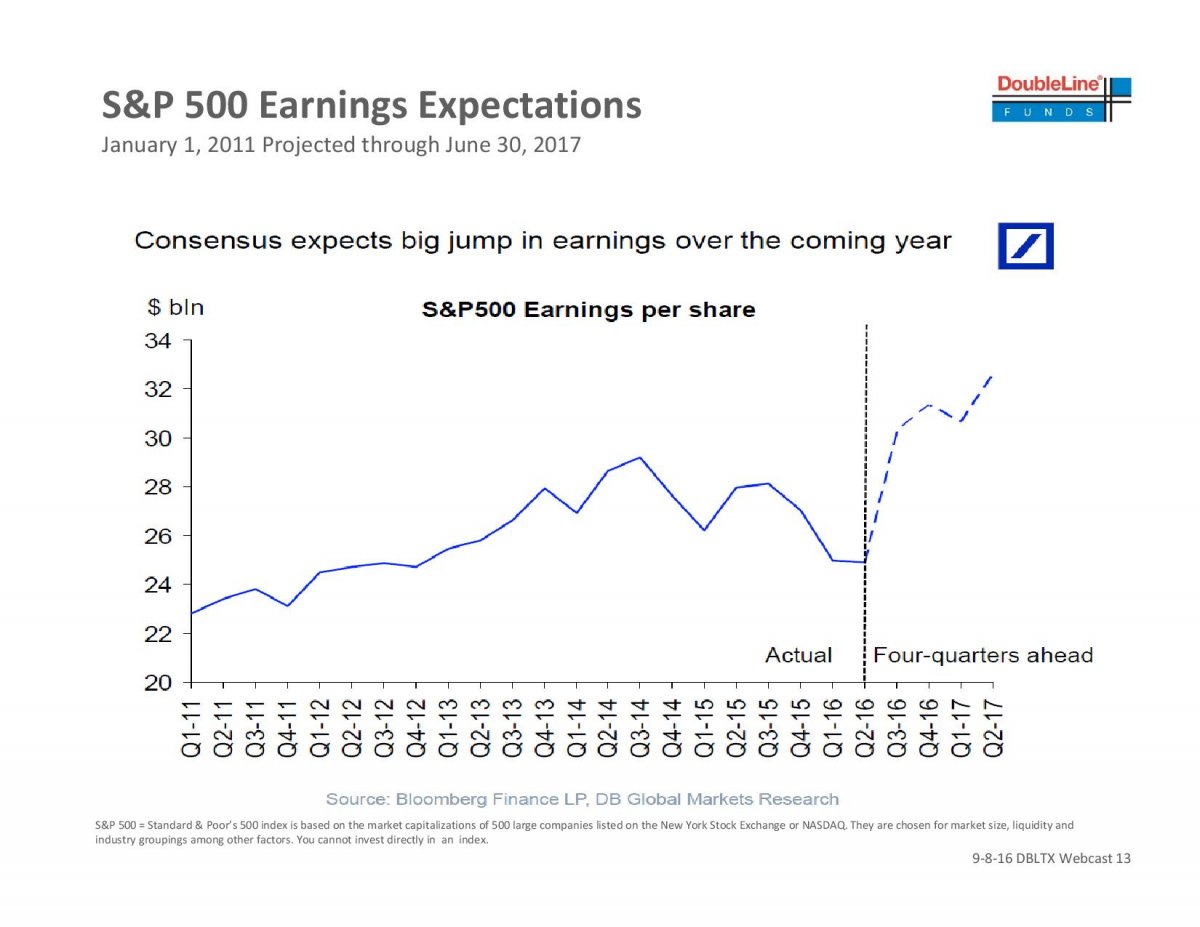

Thanks to a subscriber for this link to Jeff Gundlach’s most recent presentation. Here is one of the more interesting slides:

More than any other chart this gives us a graphic illustration for why Wall Street continues to trade close to historic highs. If earnings do in fact rebound then valuations will retreat and investors will have some rational justification for paying all-time high prices.

Of course the flip side is that if earnings do not rebound in nearly the same fashion as expected. That would contribute to a great deal of navel gazing mong investors and would lead to less appetite for shares at these prices.

That helps to explain why markets are so sensitive to interest rate expectations. Considering the stock market has been well supported by liquidity over the last seven years, higher rates without commensurate growth in earnings is not great news for stocks.

In the subscriber’s Audio I have been discussing the possibility that the incredibly inert condition evident on the S&P 500 could easily be resolved by a sharp swift pullback to the region of the trend mean and today’s downward dynamic lends credence to that view. A clear countermanding upward dynamic would be required to question potential for a further test of underlying trading.