Global Economics and Strategy Day

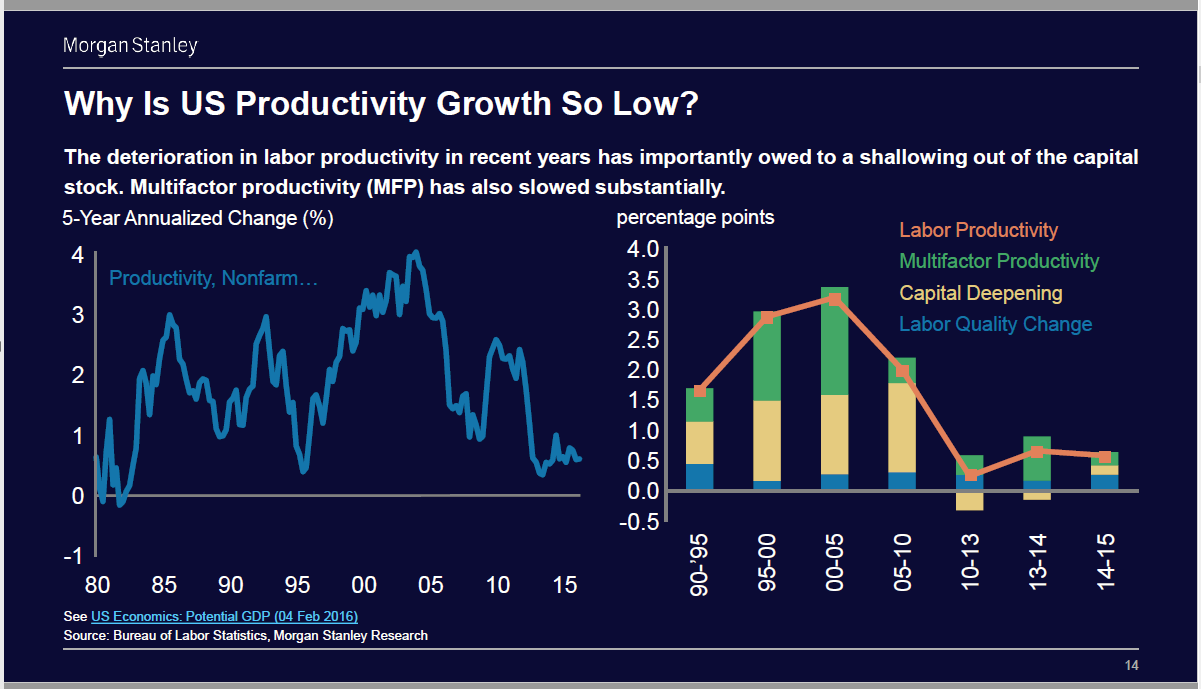

Thanks to a subscriber for this report from Morgan Stanley covering a number of macro topics. Here is an important slide highlighting how economists compute productivity figures:

Here is a link to the full report.

I’m sure I’m not the only one to puzzle over how our opinion of future productivity growth and that of many economists can differ so widely and thought the above chart was highly instructive.

To my mind technological innovation is sharply deflationary but it also contributes to productivity gains by ensuring that every worker can produce more. However the decline in Multifactor Productivity questions that hypothesis. Therefore we have to ask the question whether the deflationary impact of technology on the velocity money, which is a symptom of the wider disintermediation of the internet, is reducing the multifactor contribution to how productivity in measured.

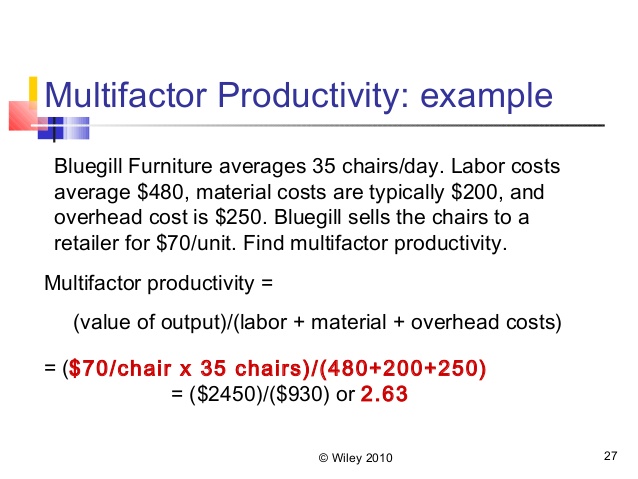

After all the evolution of ecommerce has reduced the prices of many products and kept a lid of wage inflation, which are direct inputs in how multifactor productivity in calculated. The following slide from Wiley highlights the calculation.

Capital Deepening has also decreased over the last decade and this may also be a factor of how technology is affecting the calculation. Software and automation have become much more important factors in many sectors but spending on cybersecurity, for example, does not deepen the capital stock to the same extent. Additionally disintermediation means there are fewer companies making investments in capital stock because many resellers have been eliminated from the market and general speaking capitalism trends towards consolidation.

A core criticism of quantitative easing has been that it encourages companies to participate in financial engineering rather than invest in capital stock. The slack in the economy following the credit crisis will also have been a contributing factor in this decision.

This all leaves economists with a problem in how they calculate productivity because as you can see from the above chart labour quality represents an insignificant portion of the whole. It would appear that the only way to move the needle in terms of productivity would be to reverse the downtrend in the velocity of money which would create additional demand and force companies to invest in order to boost profit margins. The argument for fiscal stimulus is growing increasingly poignant as a result.