Thought Leadership

Thanks to a subscriber for this note from DoubleLine which may be of interest. Here is a section:

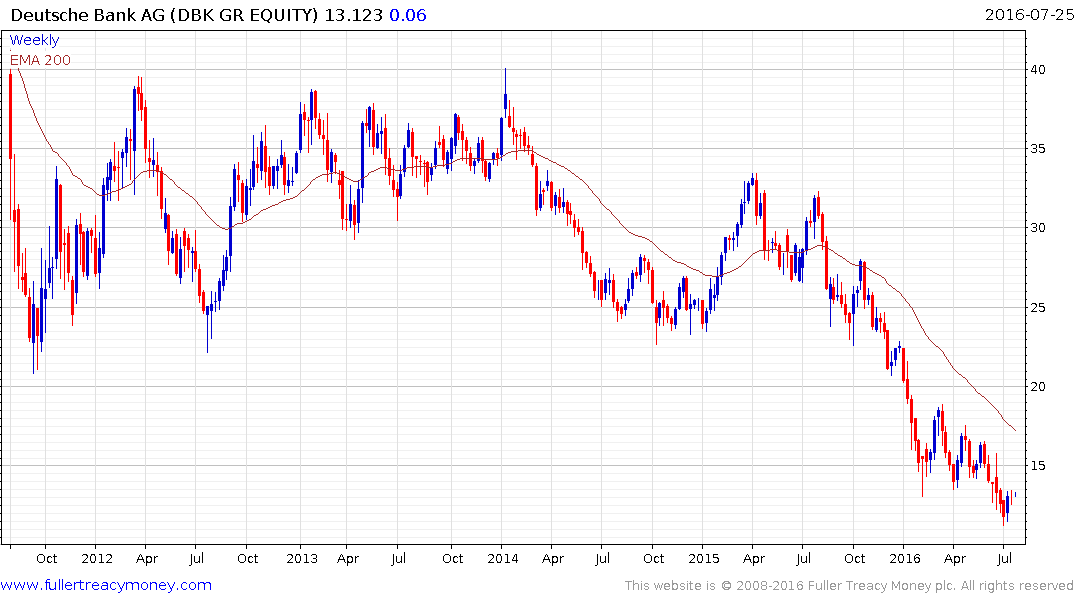

The real problem I believe for the European Union is the banks. If we compare Bank of America stock performance leading up the credit crisis and Deutsche Bank stock performance from July 2013 through last week, we see a very similar situation where the performance is very stable, slightly appreciating and then a total collapse. Deutsche Bank has really accelerated to the downside, not at $14. When it gets into single digits you’re going to see a similar concern about the European baking system. We have seen talk from Italian officials about the need for a bailout and eve n from German officials saying there may be a EUR150 billion bailout required to get the German bank in order. The response to these banking insolvencies will probably be things that are bond unfriendly in terms of inflationary or fiscal pressure and will catch most people by surprise. It could completely change the game.

The need for real stimulus in either bank bailouts , helicopter money or large fiscal stimulus will be deemed to be massive. And this will be a preferable solution, based upon negative interest rate experiments which have not worked. In fact they have produced the opposite of the desired effect. They have not helped stock markets and have weakened the currencies both the Yen and the Euro are stronger now than when their central banks first went negative.

Here is a link to the full report.

The European banking sector has not had the write downs that were such a prominent feature of the USA’s response to the credit crisis and as a result remain considerably weaker than might otherwise have been the case. The USA learned from the Savings & Loan crisis in the early 1990s that the cost of delaying the write-off and recapitalisation process multiplies the eventual cost rather than reduces it. Europe would appear to be experiencing a similar problem today. The question remains whether they will learn from it.

Most of Germany’s banks have been nationalised within the last decade. For example none of the landesbanks are still listed. In fact only two banks are still actively traded. These are Deutsche Bank, Commerzbank. Deutsche Postbank was delisted in December. If the issues described in the above item prove too overwhelming for the bank to deal with, then it too could be nationalised.

Deutsche Bank has fallen from €50 in 2010 to an early July low near €11. There is some scope for a reversionary rally but a sustained move above the trend mean will be required to begin to question the medium-term downward bias.

Commerzbank remains in a steep but reasonably consistent downtrend.

Considering how aggressively Eurozone banks expanded within the currency union, it is reasonable to expect that major creditors like German banks have substantial bad loan issues originating in countries like Italy and Spain in particular. The Euro Stoxx Banks Index, which is heavily weighted by Spanish and Italian lenders, shares a similar pattern with the above banks.

This also helps to explain the tepid rebound experienced by major Eurozone indices despite the fact Wall Street has been setting new highs.