Brexit is already proving to be a huge victory for global free trade

Thanks to a subscriber for this article by Lawrence Solomon for The Financial Post may be of interest. Here is a section:

Canada has long wanted free trade with the United Kingdom, a fellow G7 country that became the world’s fifth-largest economy in 2014 after overtaking France. According to the Centre for Economics Business and Research, a premier U.K. consultancy, the fast-growing U.K. will overtake Germany over the next two decades to become Europe’s largest economy and the world’s fourth largest.

But until Brexit, Canada was shut off from this economic powerhouse, our only path to profitable U.K. trade wending through the EU bureaucracy in Brussels, which controls trade access to every EU country. And as a frustrated Canada knows only too well from almost a decade of interminable, ongoing jockeying in aid of sealing a Canada-EU trade deal, the EU is the world’s largest closed shop. No one gets to trade with the EU on preferential terms without either joining the union or trading away national sovereignty for the privilege.

Now the world, Canada included, is beating a direct path to the United Kingdom. U.S. Secretary of State John Kerry, after talks this week with U.K. Prime Minister Theresa May, declared it was imperative that the U.S. move “as fast as possible” to “maximize the economic opportunities” of Brexit. Kerry’s views echoed those of Australian Prime Minister Malcolm Turnbull who, after his own discussions with May, stated: “So as Britain leaves the EU, what we will need to do is negotiate direct arrangements with Britain … we need to get moving on that quickly.”

It’s an awfully big world out there. While the EU represents a powerful trading bloc and affluent internal market, the price of abiding by the rules necessary to gain access to it means that trade with much of the rest of the world needs to be ignored. By choosing to plot a new path the UK has the potential to revitalise the Commonwealth as a trade network in a way that has not been possible for decades. In fact that would be much more in keeping with the country’s global ambition and history as a major trading nation.

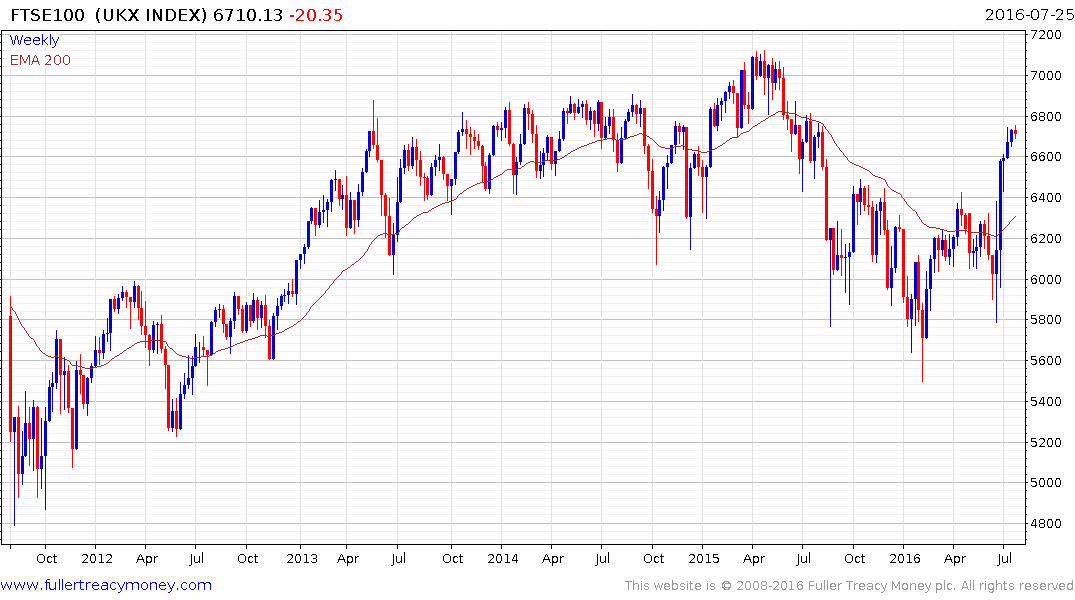

The geographical diversity of the FTSE-100 meant it benefitted in nominal terms from the Brexit plebiscite. While somewhat overbought in the short-term a sustained move below the trend mean, currently near 6300, would be required to question medium-term scope for additional upside.

The FTSE-250 Midcap Index is probably more indicative of what is going on in the domestic economy and over the last month has returned to test the yearlong progression of lower rally highs. A sustained move above 17,400 would signal a return to demand dominance beyond short-term steadying.

Interestingly the AIM100 Index of small caps hit a new two-year high today and a clear downward dynamic would be required to question medium-term recovery potential.

It is being led higher by Asos, its largest constituent, occupies over 8% of the Index.

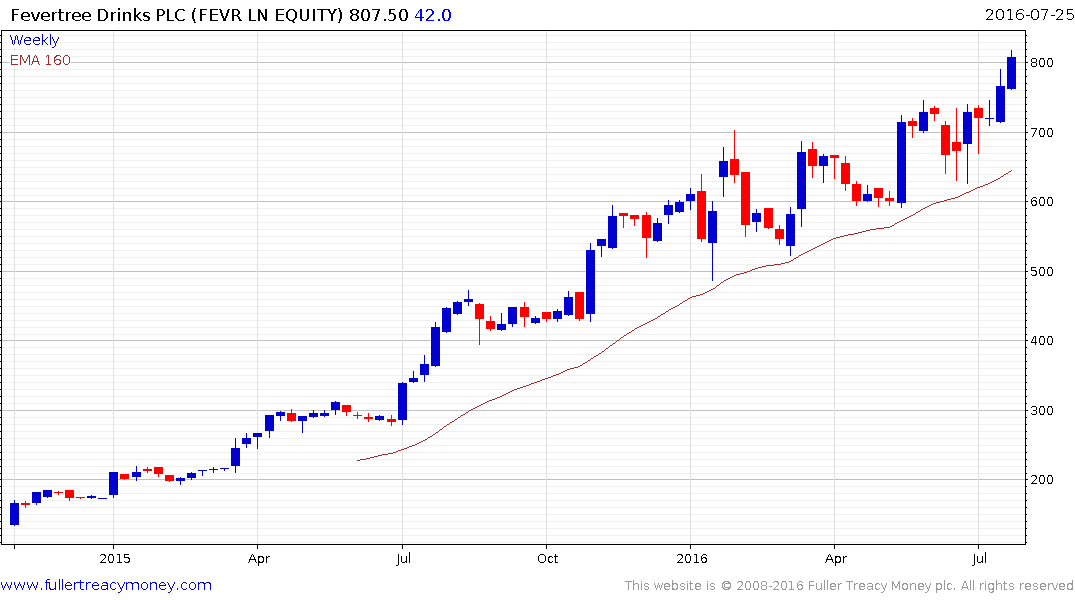

Meanwhile Fevertree Drinks which IPOed in 2014 remains in a consistent uptrend and now occupies 2.6% of the Index.