This Time, 3D Printer Makers Think They Found a Sweet Spot

This article by Olga Kharif for Bloomberg may be of interest to subscribers. Here is a section:

HP’s technology may usher in a new era for the industry. Production applications for 3D printing could eventually grab at least 5 percent of the worldwide manufacturing economy, and translate into $640 billion in annual sales, according to Wohlers Associates, which has tracked the 3D printing market for 28 years.

Evolving Business

“It’s one of our anchor businesses we’ll divert money on,” HP Chief Technology Officer Shane Wall said in an interview. “It’s a very high strategic value for us.”?3D Systems Chief Executive Officer Vyomesh Joshi, who joined the Rock Hill, South Carolina-based company in April after more than three decades at HP, said on a conference call Wednesday that his business is evolving from prototyping to “light production.” The shares rallied 18 percent after the company posted second-quarter earnings that beat analysts’ estimates and said its profit margin increased from a year earlier partly as it shifted away from consumer products.

A few years ago, the industry had banked on putting a 3D printer in every home -- yet that market never materialized as consumers found the devices fragile, expensive and snail slow. That bet proved torturous to 3D Systems and Stratasys, both of whose shares plunged about 85 percent since the beginning of 2014. More recently, the stocks have been under pressure by a slowdown in sales for prototyping applications as customers delay purchases to evaluate new products from companies like HP, said Robert Burleson, an analyst at Canaccord Genuity.

3-D Systems and Stratasys went on a buying spree between 2012 and 2014 that saw them become the dominant players in the sector. It also left them with the problem of how to integrate all the competing pieces of technology into a cohesive product offering. At same time rapid demand growth for their products from the retail segment has not evolved as quickly as anticipated and their shares collapsed. The entry of much larger companies like HP and Autodesk represent additional threats.

3-D Systems hit a medium-term low in January and staged an impressive rally to break the two-year downtrend. A process of consolidation has been underway since May and a sustained move below $12 will be required to question medium-term scope for additional upside.

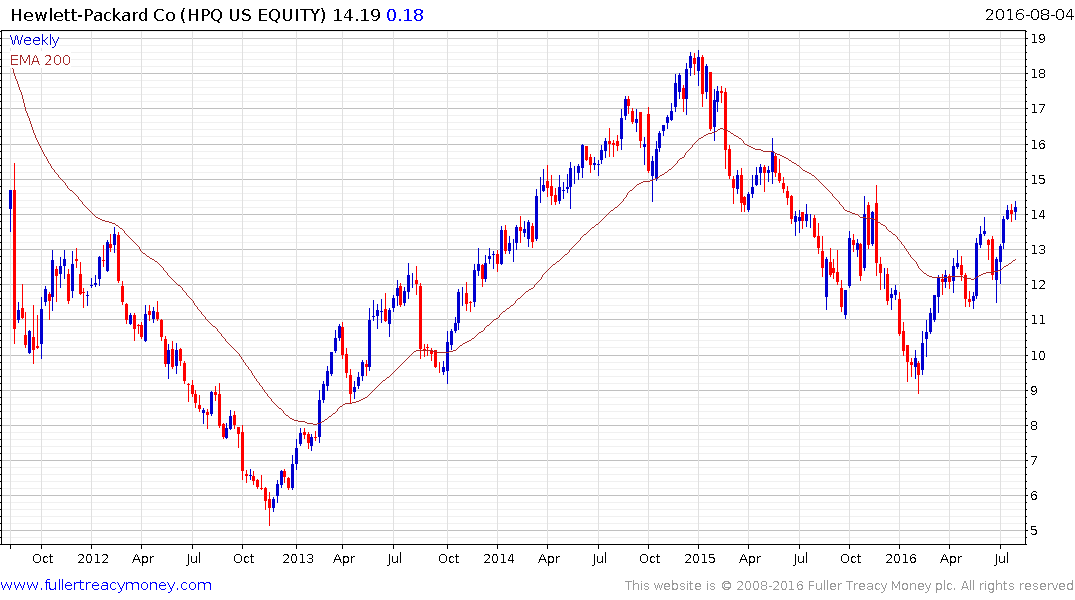

3-D printing represents a fresh growth trajectory for HP beyond its dominance of the desktop printer sector. The share also found support in January and continues to hold a progression of higher reaction lows.

3-D printing represents an add-on business for Autodesk, considering its dominance of the computer aided design (CAD) software sector. The share has been ranging for nearly two years and is now rallying towards the upper boundary.