Bank of England's 'Exceptional' Stimulus: Winners and Losers

This article by Simon Kennedy and Namitha Jagadeesh for Bloomberg may be of interest to subscribers. Here is a section:

U.K. bank stocks as a group headed for their highest level since the Brexit vote in part because the BOE mitigated the pain of lower rates with a 100 billion-pound loan program. Standard Chartered Plc led the rally, set to close at its highest price since November, with a 5.6 percent jump. HSBC Holdings Plc, up 2.5 percent, was poised for its highest close since January. Both Standard Chartered and HSBC have international businesses which should benefit from the weaker pound. Still, HSBC said beforehand that it would lose $100 million of net interest income from 2016 from a 25-basis point cut, while Lloyds Banking Group Plc said such a move would cost it 100 million pounds over the next 12 months.

3) Homebuilders

The Bloomberg U.K. Homebuilder Index rose as much as 3 percent on expectations that lower borrowing costs will feed through to mortgage rates and boost demand. Persimmon Plc, Redrow Plc and Taylor Wimpey Plc all gained. The rate cut “can only be positive for the U.K. Property market,” said Ben Madden, managing director of London estate agents Thorgills.

Here is a link to the full statement from today’s press release.

£70 billion Pounds in quantitative easing (£60 billion Gilts + £10 billion corporate bonds) is a substantial number and represents the beginning of an open-ended purchase program that is likely to remain in place until the Bank of England (BoE) has proof the UK has emerged from the uncertainty surrounding the renegotiation of its relationship with the EU.

There are two important segments in the press release worthy of additional consideration. The first is:

expansion of the asset purchase scheme for UK government bonds of £60 billion, taking the total stock of these asset purchases to £435 billion.

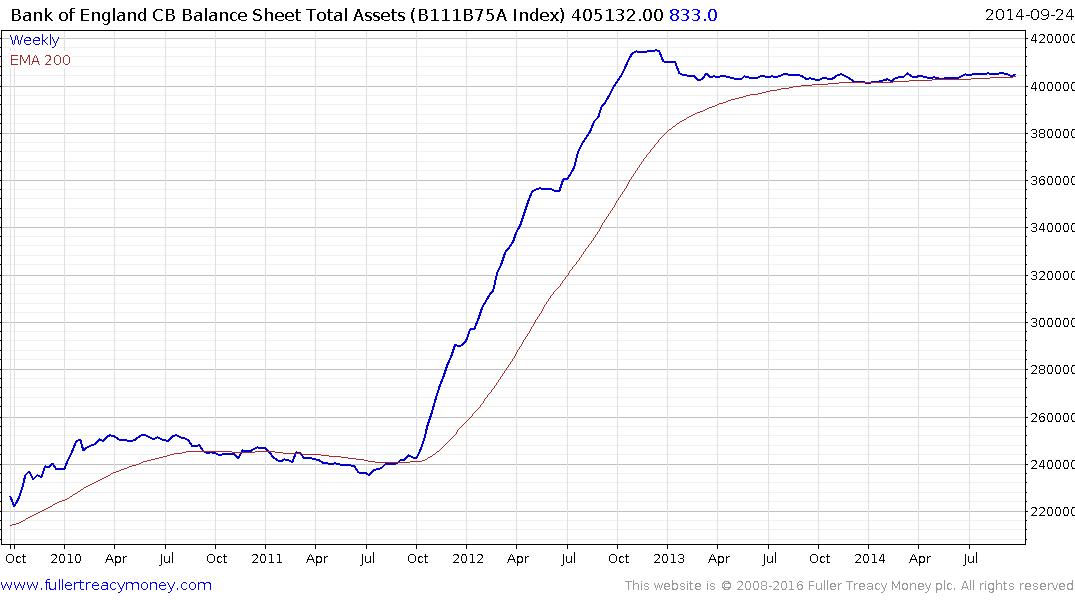

Bloomberg stopped updating its chart of the BoE’s balance sheet total liabilities in 2014 when it stood at £386 billion. We can only conclude that if following £70 billion in purchases it will total £435 billion that the BoE had been gradually reducing its holdings of Gilts in an attempt to begin to normalise policy without raising interest rates. That policy has now been abandoned and it removes an important support for the Pound which dropped 2¢ following the announcement.

The Pound needs to hold the $1.30 area if short-term support building is to be given the benefit of the doubt.

The second portion comes from the concluding paragraph:

announced that it will exclude central bank reserves from the exposure measure in the current UK leverage ratio framework. This latter measure will enhance the effectiveness of the TFS and asset purchases by minimising the potential countervailing effects of regulatory requirements on monetary policy operations.

Central banks and politicians are highly effective at creating markets for the securities they wish to sell and by removing Gilts from the leverage buffer requirement they are creating an incentive for financial institutions to speculate on government bonds.

.png)

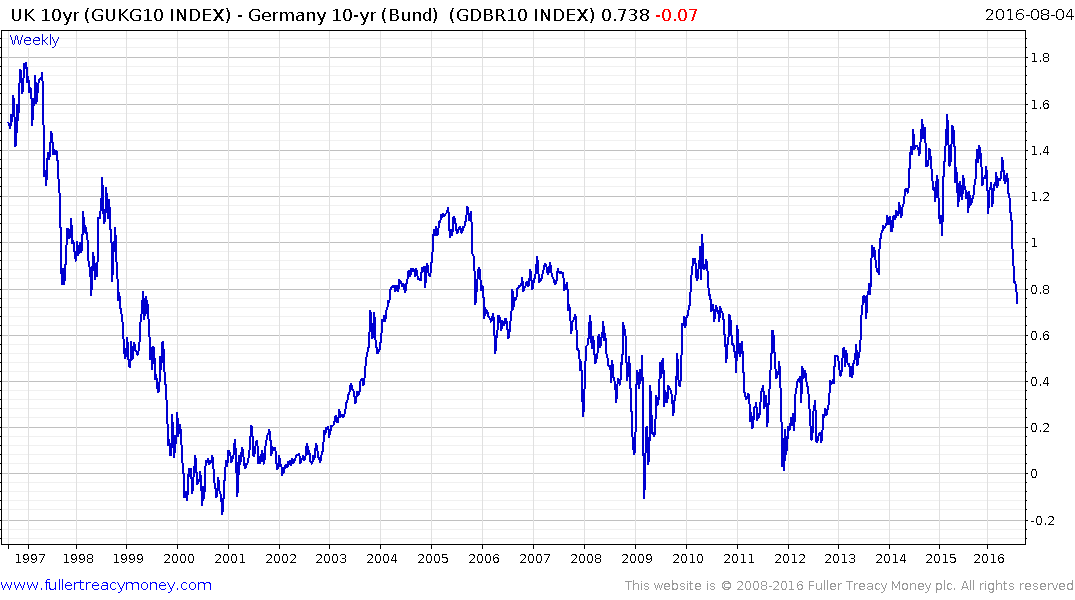

Gilts have among the highest yields in Europe but seeing that spread contract might be among the BoE’s objectives as it hit another new low today. This represents a steep contraction but without a break in the progression of lower rally highs there is no reason to question the trajectory.

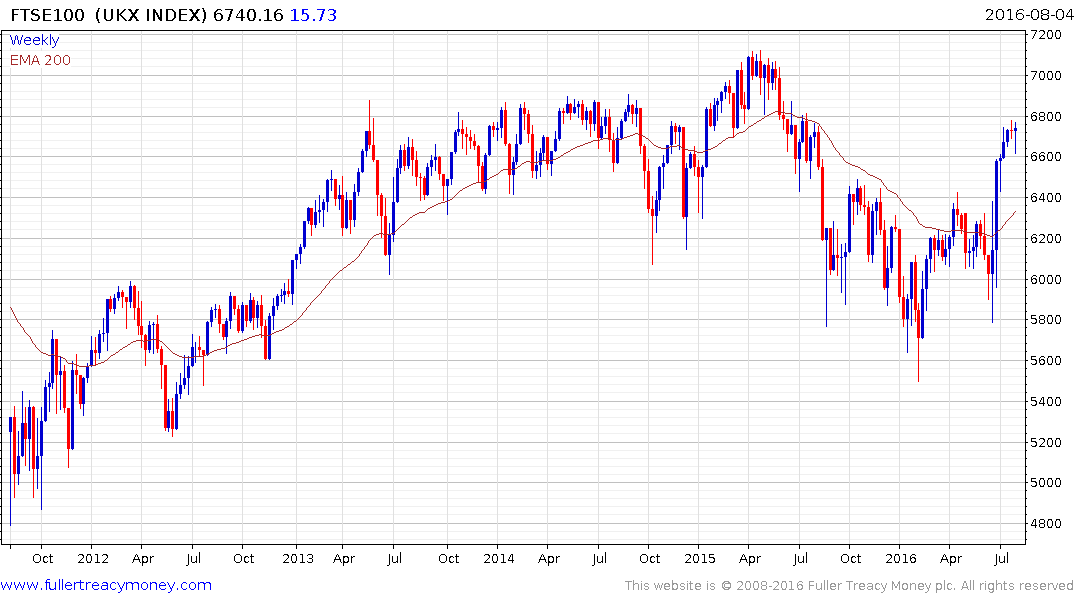

Lower interest rates and greater availability of credit are positive for stocks and the FTSE-100, with its international focus, rallied today from the 6600 level to confirm a short-term low.

The FTSE-250 Midcaps Index, which has a greater domestic focus, also rallied and is now back testing last week’s high. A sustained move below the trend mean, currently near 16,800, would be required to question potential for a successful upward break.

The US listed Dollar denominated iShares MSCI UK ETF has been largely inert over the few weeks but a sustained move above the trend mean, currently in the region of the $16, would signal a return to demand dominance beyond short-term steadying.

With its own currency and ability to set monetary policy appropriate for its own economy, the UK has the tools required to overcome the short to medium-term challenges it faces so it is likely to be an increasingly interesting market for international investors to monitor not least once the Pound clearly demonstrates it has found support. This article by Charles Gave highlights the fact that the Eurozone continues to face an existential threat and the UK by moving first to insulate itself is a potential beneficiary, along with the US Dollar.

Back to top