This Is Not QE; Focus on the Fundamentals

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

According to the Fed’s weekly release of its balance sheet on Wednesday, the Fed was lending depository institutions $308B, up $303B week over week. Of this, $153B was primary credit through the discount window, which is often viewed as temporary borrowing and unlikely to translate into new credit creation for the economy. $143B was a loan to the bridge banks the FDIC created for Silicon Valley Bank and Signature. Only $12B was lending through its new Bank Term Funding Program (BTFP), which is viewed as more permanent but also unlikely to end up converting into new loans in the near term. In short, none of these reserves will likely transmit to the economy as bank deposits normally do. Instead, we believe the overall velocity of money in the banking system is likely to fall sharply and more than offset any increase in reserves, especially given the temporary/emergency nature of these funds. Moody’s recent downgrade of the entire sector will likely contribute further to this deceleration. Herein lies the ultimate question for equity investors, in our view—will the Fed/FDIC backstop of deposits lead to a reversal in the plummeting M2 growth or will the concurrent fall in velocity of money from the credit crunch more than offset the increase in the Fed's balance sheet?

Crisis-era swap lines were reopened over the weekend to ensure Europe has sufficient liquidity to deal with its unfolding banking crisis. Credit Suisse will not be the only bank caught on the wrong side of bonds with negative yields suddenly having positive yields.

The Fed’s balance sheet jumped last week in response to the actions to support the US banking sector. While this is not technically QE, it is certainly confidence boosting. The conclusion is clear. If they are willing to unwind half of the quantitative tightening program to deal with the collapse of several mid-sized banks, what will they do when unemployment rises and earnings roll over?

The challenge in the short-term is inflationary pressures are still present. The Bank of England’s solution continues to look like the most likely. They supply liquidity to quell the shock from the pensions implosion and continued to raise rates to get ahead of inflation. There is a good chance that is exactly what the Fed is thinking about doing.

Bond yields steadied today to suggest a short-term peak in prices ahead of the beginning of the Fed meeting tomorrow. Nerves are frayed so it would be rash to draw firm conclusions ahead of the Fed meeting.

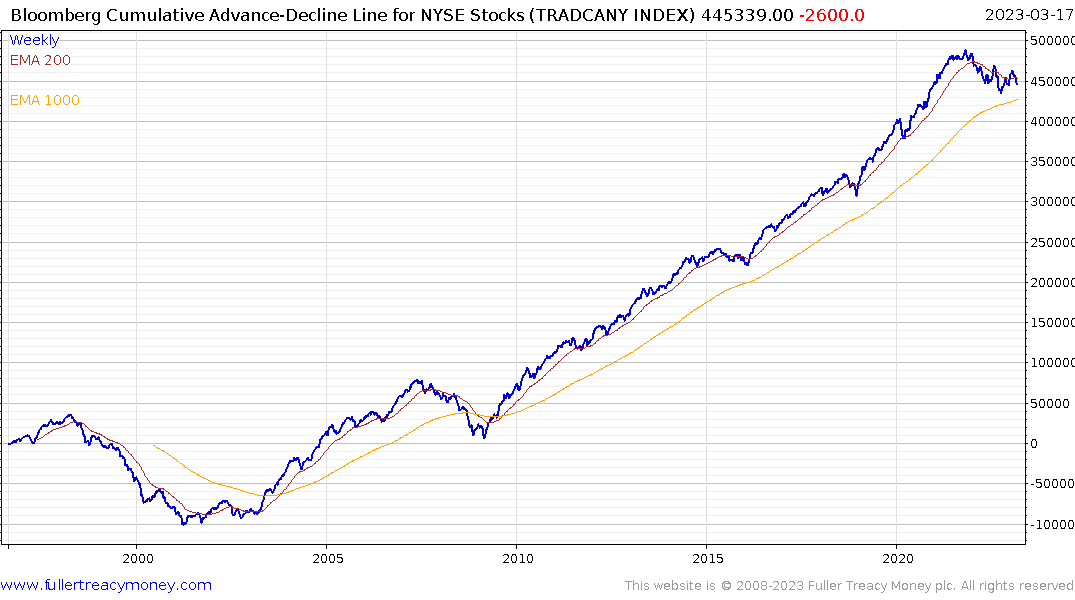

However, the Advance-Decline for the NYSE has rolled over and is testing the short-term sequence of lower rally highs. That confirms narrowing breadth. In secular bull markets, the Index does not trade below the 1000-day MA.