The role of volatility in position sizing

Imagine for a moment that we were setting up an algorithmic trading system. We would first need to formulate a strategy for what financial vehicles to include in our sample space and develop codified rules on which we could build the strategy. Once completed, we would need to decide how much leverage to use in order to size positions.

One of the few ways to do this is using an average of volatility. When volatility is low, the program can be told to increase positions because the potential drawdown is low. When volatility increases positions would necessarily need to be reduced in order to minimise a potential drawdown on the portfolio.

Of course there is a competing strategy that will use the exact opposite strategy so that short positions will be increased as volatility increases

Next, let’s ask ourselves whether algorithmic trading strategies are popular? The answer has to be that the sector’s growth has been nothing short of remarkable over the last few years.

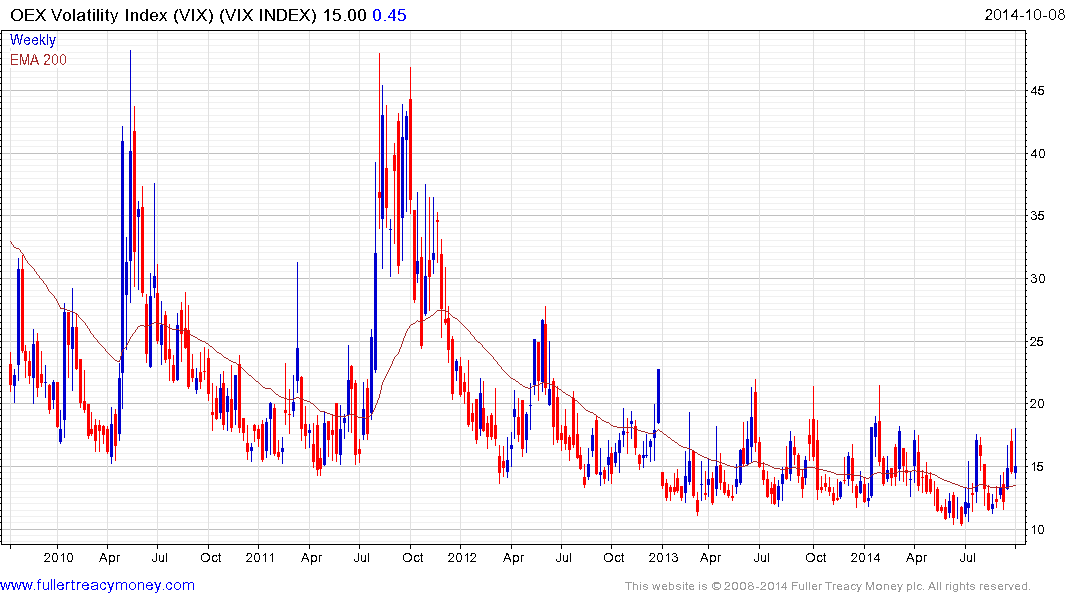

Let’s look at volatility.

S&P 500 volatility measured by the VIX Index has been relatively depressed since early 2012. It is no coincidence that the consistency of the Index’s uptrend has been supported by its low volatility because traders have been able to employ a leveraged trading strategy that bought the dips. This chart tells us how near-term volatility has been perceived.

.png)

This chart of the 3rd VIX future depicts how perceptions of future volatility have compressed over the last few years. In other words as volatility has remained low for a prolonged period, the belief that low volatility will persist indefinitely has increased. Three-month volatility trended lower from late 2011 and posted its first higher high last week. The break of the trend is not yet conclusive but the move has lost consistency so the risk has increased. A sustained move above 18 would confirm the move and would probably coincide with a drop below the 1900 level on the S&P.

At the Contrary Opinion Forum last week I described this environment as a Taylor Swift market. Here is a YouTube link to her song “Shake it Off”

But I keep cruising

Can't stop, won't stop moving

It's like I got this music

In my mind

Saying, "It's gonna be alright."

There is a temptation to believe that the good news will keep coming but the reality is that VIX futures suggest traders are beginning to reassess. With the ECB on the cusp of easing and the PBOC reversing its tightening bias there is little prospect of a meaningful monetary crunch but the prospect of increased volatility, similar to that posted in 2011 is increasing.

.png)

1900 on the S&P500 remains a meaningful level to watch for signs of trend deterioration. In the event that this level continues to hold, and volatility does not break out, the Nasdaq’s upward dynamic today suggests that while breadth might be contracting the benefit of the doubt is still being given to large cap growth stocks.

Back to top