Chinese Stocks Rise to 19-Month High on Property Easing Measures

This article from Bloomberg may be of interest to subscribers. Here is a section:

Vanke, the nation’s biggest listed property developer, gained the most since July 24 while Poly Real Estate’s advance was the biggest since Aug. 4. China Merchants Property Development Co. added 2 percent.

?People applying for a loan to buy a second home may get lower down payments and mortgage rates that were previously only available to first-time home buyers so long as they have paid off their initial mortgage, the People’s Bank of China said in a statement on Sept. 30 after the market closed. The central bank also eased a ban on mortgages for people buying a third home.

The action marks a reversal in a four-year tightening campaign, as slowing property investment and industrial production raise risks that 2014 economic growth will drift too far below Premier Li Keqiang’s target of about 7.5 percent.

Every morning I click through approximately 200 charts of country indices, bond futures, currencies and commodities to get a feel for how the market is performing. Today I decided to note every country index making a new high. It was a short list. China’s Shanghai A-Shares Index was the only one on it.

The Chinese engineered a property slowdown in order to avoid a dangerous bubble and now need to stimulate the market if they are to avoid a crash. With property developers offering deep discounts on developments and confidence deteriorating it can only be viewed as good news that the restrictions on the property market are being lifted. The credit squeeze which has affected a good many more sectors than property is easing which is positive for the stock market generally.

The CSI300 Index represents the benchmark for the stock index futures market. The majority of sectors posted a relatively lacklustre performance in the first half but the utilities and telecoms sectors took off in July. Across the strait in Hong Kong, the utilities sector found support in the region of the 200-day MA this week following last week’s sharp pullback.

The Healthcare sector was the best performer on the mainland today rallying by 4% and taking it into positive territory for the year. I went through the constituents of the sector and only two are dual listed outside of China. These are Fosun Pharmaceuticals and Guangzhou Baiyunshan Pharmaceuticals.

Fosun Pharmaceuticals continues to find support in the region of the 200-day MA.

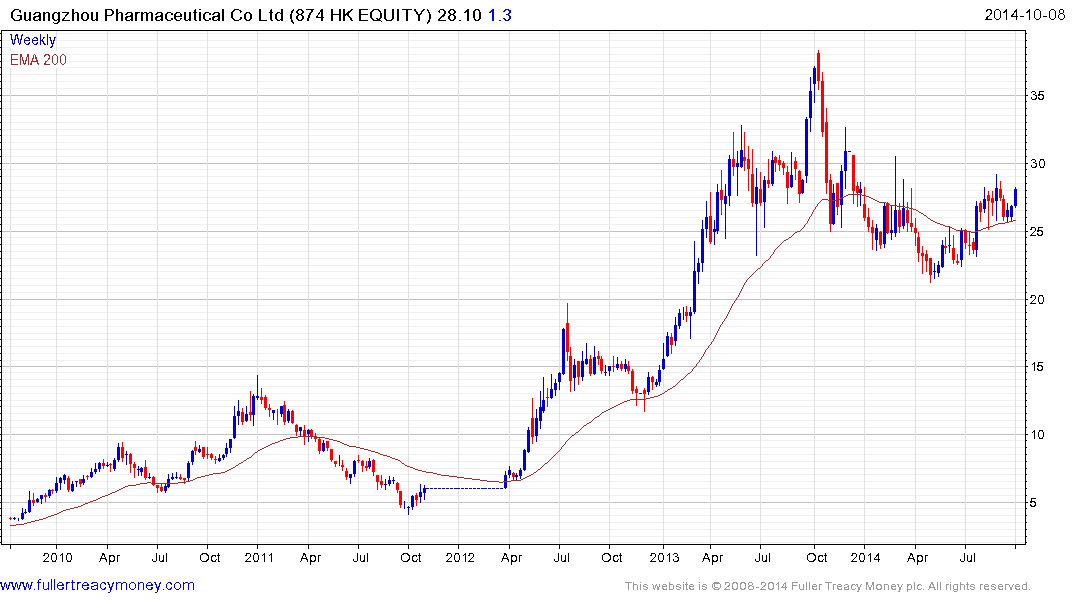

Guangzhou Baiyunshan Pharmaceuticals rallied in July to break the progression of lower rally highs evident since late last year and found support in the region of the 200-day MA this week.

I’m in the process of compiling a list of the Chinese healthcare companies listed in Hong Kong and once complete will add it the library. The sector offers a good example of how the Chinese market could benefit from the opening up of the exchange link between Shanghai and Hong Kong. Foreign investors will want to gain access to the mainland market where the majority of state owned companies still reside and where performance has been more attractive. On the other hand mainland investors will want to gain access to high profile companies they have not previously had exposure to.

Back to top