The Letter That Stock Exchanges Should Write To Investors

Thanks to a subscriber for this article from Themis Trading which may be of interest. Here is a section:

We think many of today’s market structure problems were actually caused by poorly designed regulations, most notably Reg NMS. Prior to Reg NMS, the NYSE relied on specialists to provide a fair and orderly market in return for the right to have a franchise for a particular stock at the exchange. Reg NMS made this model obsolete and a new competing DMM model was developed. This DMM model does not rely on customer orders and has very few obligations leaving the market vulnerable in times of stress. To make matters worse, on the recent volatile days of the past few weeks, the NYSE has chosen to invoke Rule 48 since they do not have enough employees to effectively handle the opening process which is one of their most important functions.

Signs of stress are also building within our own stock exchange community. Just like when the SIP crashed a few years ago, we in the exchange community are once again pointing fingers at each other. Chris Conacannon, CEO of BATS, is not a fan of the quasi-human model that NYSE employs and told the WSJ that “NYSE Group’s process for opening trading on stocks listed at the exchange was “broken” and that major changes needed to be made to protect investors from future problems. He said:

In Crowd Money I argued regulation should evolve from first principles where whatever promotes confidence in how a market functions should be considered permissible but that anything which represents a threat to confidence should not be permissible. This cuts to the essence for why HFT trading systems should be heavily regulated. They are very good at ensuring ample liquidity when there is ample liquidity but fail the duty of a market maker when prices are falling. The potential for groupthink in algorithmic trading systems when volatility rises should also be considered by regulators. Without change we can anticipate occasional bouts of extreme volatility to be the rule rather than the exception.

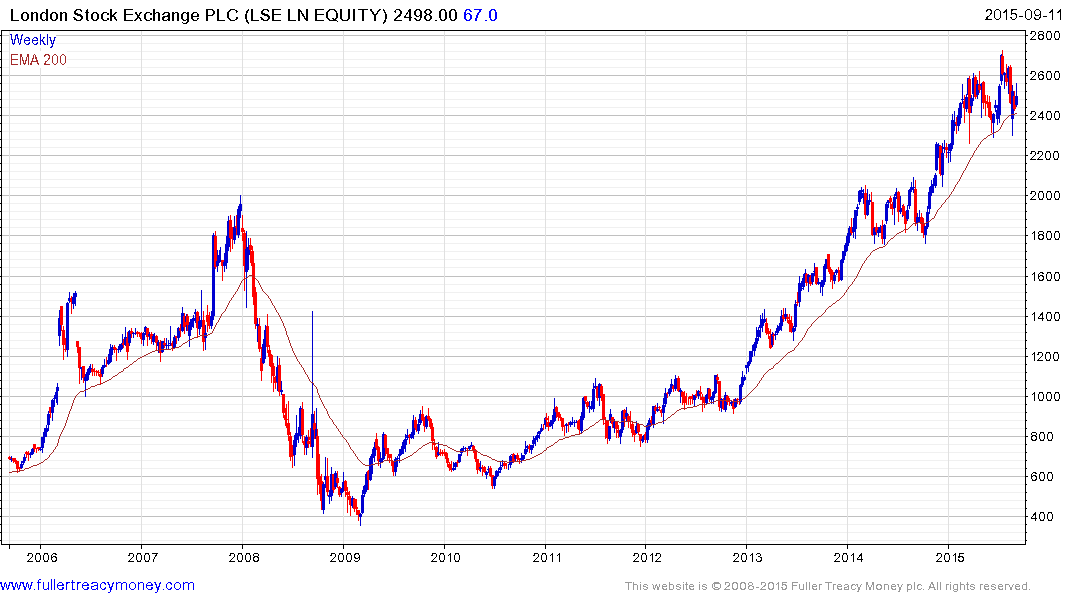

Stock exchanges continue to do very well from the fees they generate from HFT firms. For example the London Stock Exchange remains in a consistent medium-term uptrend and a sustained move below the trend mean would be required to question potential for additional medium-term upside.

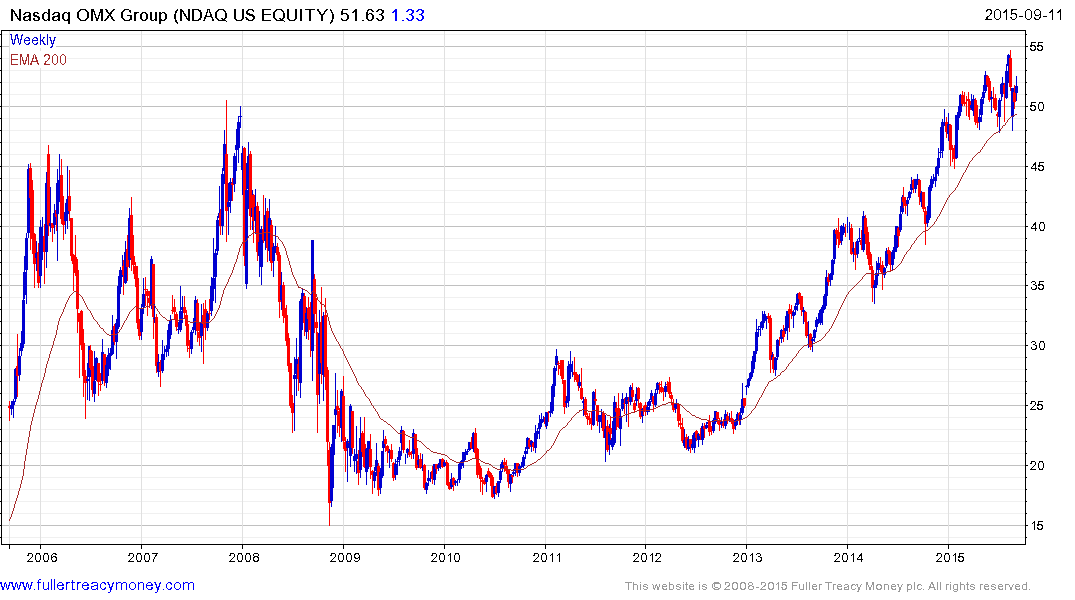

Nasdaq OMX hit a new all-time high in February and has been ranging with a mild upward bias since. It will need to hold the region of the trend mean if medium-term scope for continued higher to lateral ranging is be given the benefit of the doubt.

Both shares have a high degree of commonality with European and North American Exchanges while Asia exchanges have pulled back with their respective markets.Perhaps the biggest risk for both shares is if regulators decide to tackle the risk to confidence presented by HFT firms.

Back to top