Tencents WeChat App to Offer Personal Loans in Minutes

This article by Juro Osawa may be of interest to subscribers. Here is a section:

Using the new Weilidai feature, WeChat users can receive money in just a few minutes after submitting their applications. They apply for loans by giving their traditional bank account information and other basic personal data, and Weilidai assesses their credit based on its own data as well as individual loan status information from the People’s Bank of China, according to people familiar with the matter. The credit assessment process could take less than a minute. While interest rates vary based on the user’s credit levels, on average, the daily rate is 0.05%. The terms for the loans are up to 20 months.

In late July, WeBank said its outstanding personal micro loans amounted to 800 million yuan, without disclosing the number of borrowers.

Still, how far Tencent and WeBank can expand will depend in part on Chinese authorities. WeBank uses facial recognition technology to verify users’ identities before allowing them to bundle their traditional bank accounts with WeBank’s online accounts. Because regulators are still concerned about the technology, there are limitations to what users can do with the online accounts, a person familiar with the matter said. For example, users cannot transfer money from their online WeBank accounts to other people’s bank accounts.

“Internet finance is still at its early stage, and the regulatory framework is still evolving,” Ms. Meng said.

Both Google and Facebook have been investigating entering the banking sector. For Apple the logical next step from ApplePay would be to offer credit products not least because it would be a useful employment of the company’s substantial cash reserve. Well-heeled Chinese companies are further along in developing their own products.

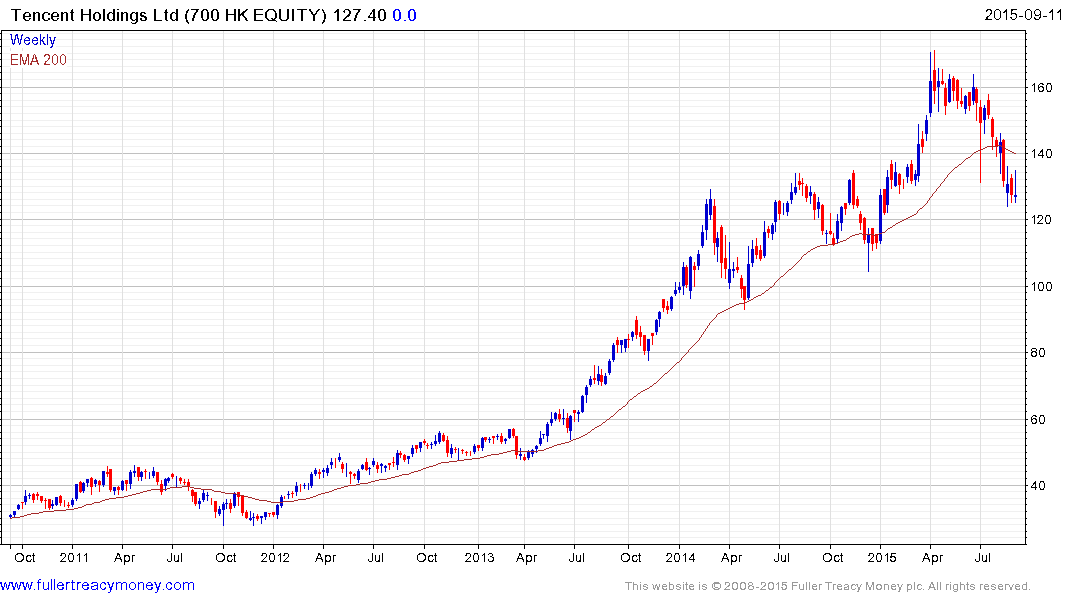

An important consideration for investors is that Alibaba’s US listing does not include its finance arm while Tencent’s Hong Kong listing represents its 30% share in WeBank. Tencent Holdings has experienced its deepest correction in at least the last five years but this is relatively shallow compared to the declines posted by so many Chinese shares. Prices will need to hold the HK$120 if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.

Alibaba has intimated it is considering a separate listing for Ali-pay but I suspect that is more of a medium-term ambition. The share steadied this week near $60 but will need to at least break the progression of lower rally highs to begin to suggest more than a temporary return to demand dominance.