The Great Nevada Lithium Rush to Fuel the New Economy

This article by Paul Tullis for Bloomberg may be of interest to subscribers. Here is a section:

Although electric vehicle adoption has been slower in the U.S. than expected, the price of battery packs has been dropping fast, to the point that auto industry observers see electric cars as poised to become cost-competitive with gas-powered vehicles—and thus to become popular outside the specialty markets of luxury buyers and those seeking green cred. Tesla’s soon-to-arrive Model 3 and the Chevy Bolt now in dealerships are priced at about $30,000 after subsidies, but a battery assembly that a few years ago might have cost Tesla $300 per kilowatt hour (a Model S uses 60 to 90 kilowatt hours’ worth of lithium ion batteries) today costs General Motors $145 per kilowatt hour for its Bolt. And the figure is hurtling toward $100, the number that HSBC Securities (USA) Inc. and consultant Wood Mackenzie Ltd. agree will make electric vehicles as cheap as gas-powered cars, freeing mass-market EVs from their current dependence on subsidies.

Lithium represents a “supply inelasticity meets rising demand” market. Higher prices are having the anticipated effect of encouraging investment in new supply but it takes time to build a brine or mining operation and the vagaries of developing operations in Argentina, Chile and Bolivia represent challenges for newcomers to the sector. That is why some smaller companies are focusing on more expensive plays closer to home such as in Nevada. China is also the fourth largest producer of lithium and its ability to achieve scale quickly in terms of manufacturing represents a significant wild card for the sector.

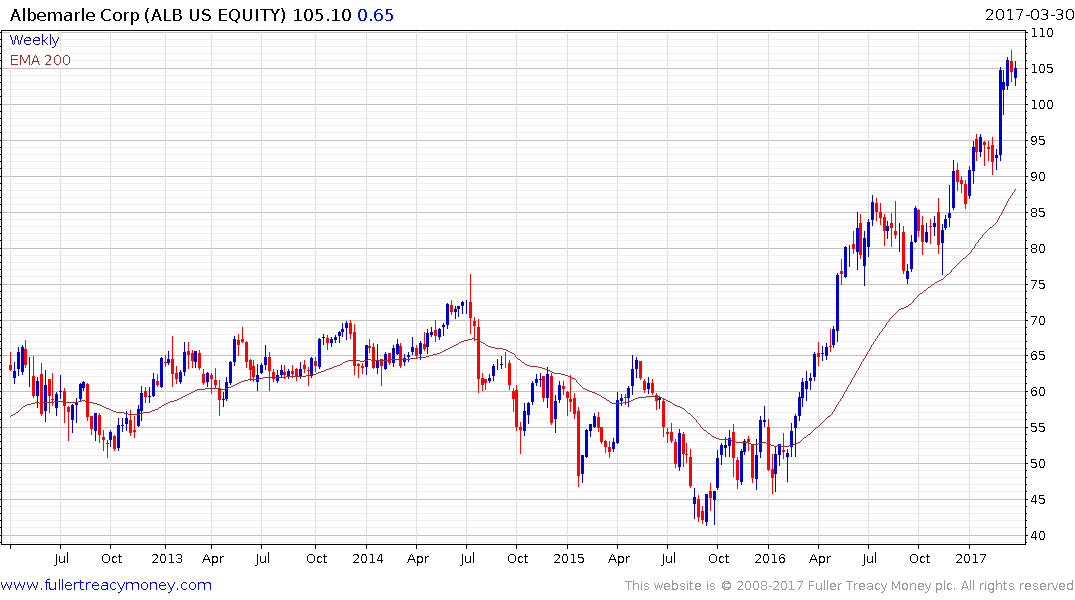

Albemarle generates approximately 39% of revenue from “lithium and advanced materials”. The share remains in a consistent uptrend and while somewhat overbought relative to the trend mean, a sustained move below it would be required to question medium-term upside potential.

FMC Corp remains in a consistent medium-term uptrend but has underperformed Albemarle not least because lithium only represents about 8% of the company’s revenue.

Sociedad Quimica y Minera de Chile (SQM) has held a progression of higher reaction lows since early 2016 and generates about 26.5% of revenue from lithium.

Orocobre is ramping up production at its Olaroz Project in Argentina but its high valuation relative to the above shares as well as some delays in achieving scale have resulted in a sharp sell-off. The share has stabilised at $2.50 and a sustained move below that level would be required to question current scope for at least a reversionary rally.