As Britain Exits, India Gets Single-Market Religion

This article by Andy Mukherjee for Bloomberg may be of interest to subscribers. Here is a section:

Currently, selling across the borders of India's 29 states means paying a central sales levy, which can't be set off against tax paid on raw materials procured from within a company's home jurisdiction. Those input credits will now be available under a GST.

This would do two things: One, given enough competition, most manufactured goods should get cheaper, stoking demand. Two, more companies will want to engage in interstate commerce, which they avoid at present by moving goods (without selling) to their own small, inefficient warehouses around the country.

Smaller Indian industrial firms -- those with less than $1 billion in revenue -- end up carrying more than five times their annual sales as inventory, compared with just 36 percent in China. A narrowing of this gap would boost profitability. More centralized warehousing would also boost demand for higher- tonnage trucks made by Tata Motors Ltd. and Volvo AB.

But GST is also causing some anxiety. As Gadfly wrote last year, India is planning to employ Jeff Bezos of Amazon Inc. as its tax collector. All e-commerce marketplaces will deduct 2 percent from what they pay sellers of merchandise and deposit the money with the government. Sellers would then have to claim input-tax credits. The increase in working capital may be problematic for small businesses working on thin margins. Amazon India estimates that 180,000 jobs could be at risk.

India has a dismal record of collecting taxes which has led to all manner of levies on transactions to pad out state coffers. This has created an environment where business is penalised and interstate trade is less appealing than attempting to embark on overseas expansion.

The introduction of GST is not a fix-all solution but it represents a major step forward for the ability of the state and federal government to fund themselves and at least helps to mitigate some of the antibusiness measures that have been part of the economic landscape for years. It will take time but now that the infrastructure of taxation is in place there is scope for it to be expanded in future to encompass more areas of the economy.

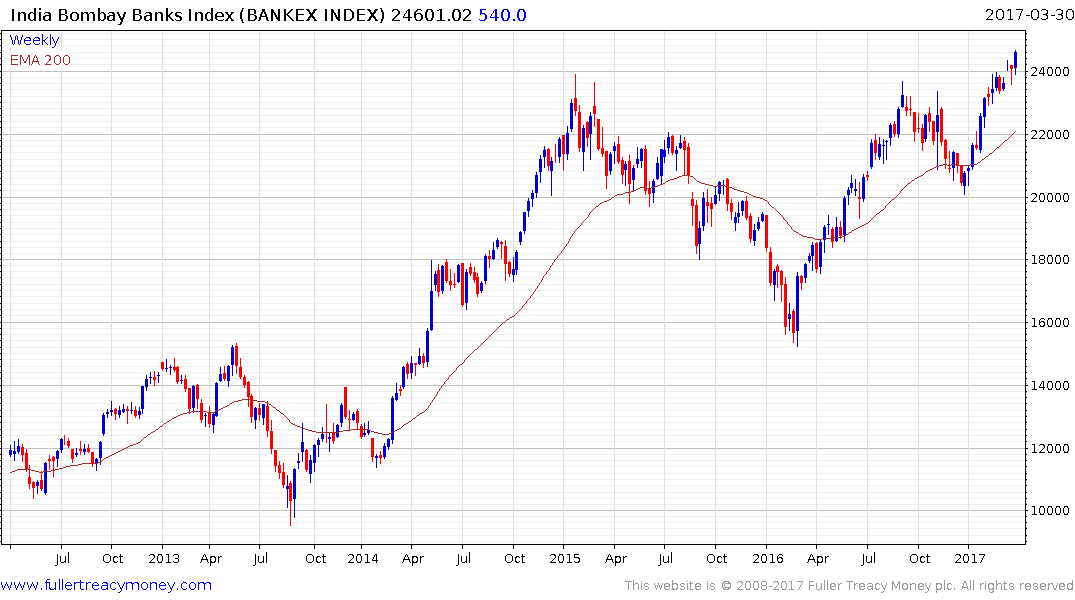

The Bombay Banks Index continues to lead and moved to a new high today as it extends the breakout from a two-year range.

The Nifty Index has firmed from the psychological 9000 area and a sustained move below it would be required to question medium-term scope for additional upside.