The Future of Spanish Pensions

Thanks to a subscriber for this report by Javier Diaz-Gimenez and Julian Diaz-Saavedra which may be of interest to subscribers. Here is a section:

Three recent articles have studied the 2011 Reform of the Spanish pension system. Conde-Ruiz and Gonzalez (2013) and De la Fuente and Domenech (2013) simulate two individual life-cycle models and they conclude that the 2011 Reform will reduce the expenditure in pensions somewhat, but that it is insufficient to solve the middle and long-term sustainability problems faced by the Spanish pension system. And a report published by economists form the Spanish Finance Ministry (MEH, 2011) simulates an aggregate accounting model economy and reaches a similar conclusion.

The 2013 Delay. In 2013, when the 2011 reforms were starting to be implemented, the Spanish government enacted a further gradual delay of the first retirement age. This delay increases the first retirement age from 63 to 65 years, one month per year starting in 2013, for workers who retire voluntarily.

In the second model economy that we study in this article we simulate the 2011 Reform and the 2013 delay simultaneously and we find that this reform extends in five years —from 2018 to 2023— the duration of the pension reserve fund, that it reduces the total debt that would have been accumulated by the pension system until 2050, from 212 to 124 percent of that year GDP, and that it reduces the consumption tax rate needed to finance the pensions from 45 percent to 39 percent. Consequently, we conclude that this reform is insufficient to solve the sustainability problem of the Spanish pension system.

?The 2013 Sustainability Factors. The 2011 Reform made provisions to add a sustainability factor to Spanish pensions. This factor would take into account the expected duration of retirement and would reduce the real value of pensions as needed to ensure the financial sustainability of the system, effectively changing the Spanish pension system from a defined-benefit system to a defined-contribution system.

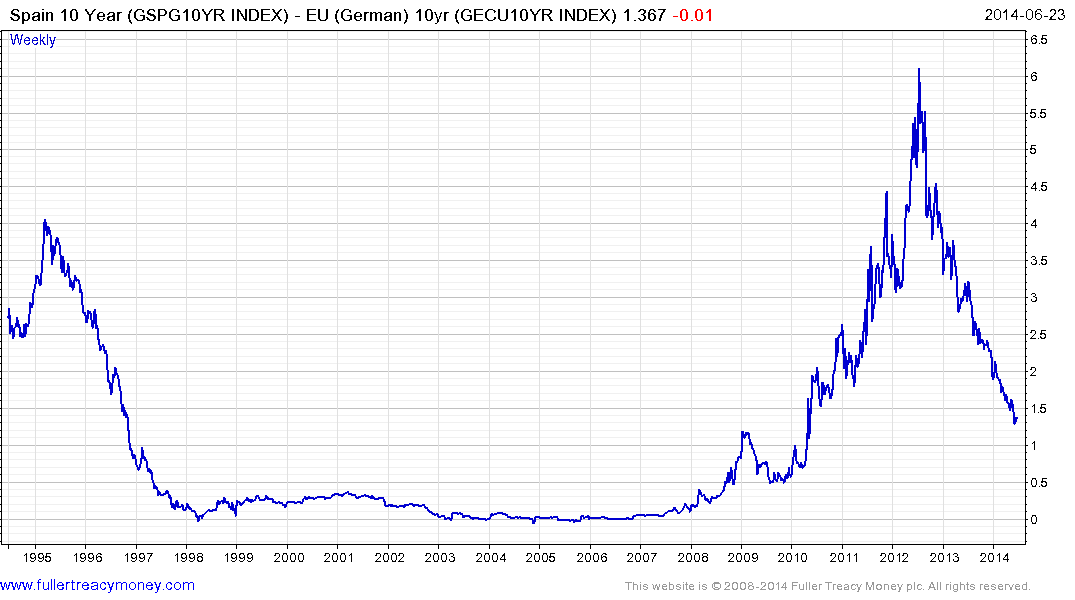

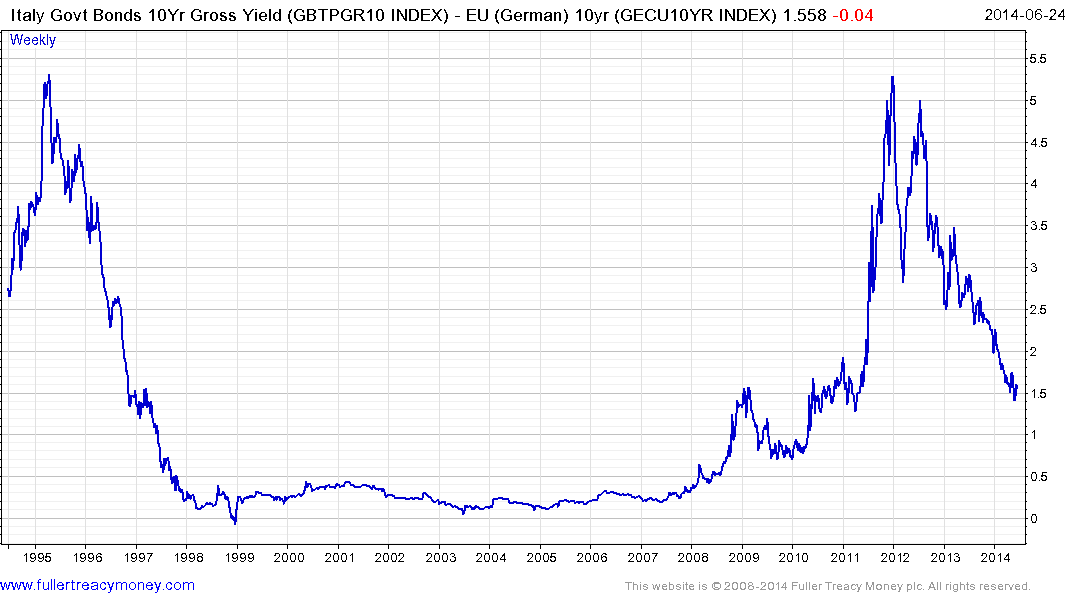

Spain isn’t the only country with a hole in its pension program. Considering the propensity of politicians to delay painful decisions until they have no other option we can anticipate that the majority of these issues will rumble on for quite some time to come. For the moment fixed income investors are more than willing to give the sovereign debt of countries like Spain and Italy the benefit of the doubt.

This highlights that at least for the moment, the ECB’s backing for these markets trumps just about any other consideration. Spanish and Italian spreads have almost completely unwound their collapses relative to German Bunds. While somewhat overbought in the short term, breaks in the progression of lower rally highs would be required to question the pattern of spread tightening.

Back to top