The EU economy after COVID-19: Implications for economic governance

This article from VoxEU may be of interest to subscribers. Here is a section:

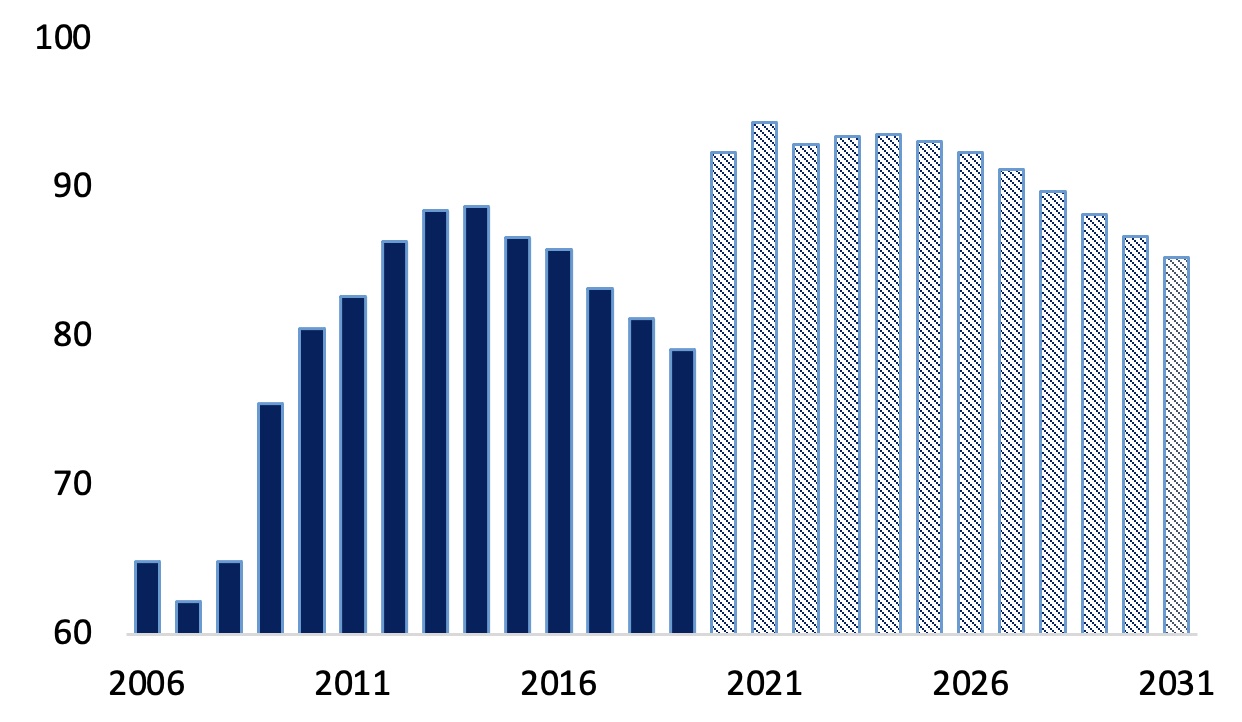

Public finances have taken a considerable hit and fiscal divergence between Member States has increased. Deficit and debt ratios have soared in all Member States (Figure 3). High debt ratios are expected to persist, remaining above pre-pandemic levels over the next decade (Figure 4).

Investment needs are pressing. The additional investment needed to achieve our climate and digital goals amounts to €650 billion per year over the next decade (public and private combined).

The COVID-19 crisis has aggravated a number of pre-existing vulnerabilities. Internal imbalances related to high government and private debt have increased, driven by the recession and measures taken to address the COVID-19 crisis. Pre-pandemic dynamic house price trends persisted and mortgage debt continued to grow significantly in some countries. Current account deficits widened in countries dependent on tourism revenues and the correction of current account surpluses has stalled. Moving forward, new risks may emerge as a result of structural transformations accelerated by the COVID-19 crisis.

The challenge of boosting socioeconomic resilience has become more apparent. Less-resilient Member States, territories and sectors found it harder to withstand and respond to the crisis. Differences in resilience across the EU have a bearing on social, economic and territorial cohesion, as well as convergence within the euro area and the effectiveness of the single monetary policy.

Addressing these challenges offers transformative opportunities but requires major investment and reforms. The €2 trillion firepower of the new Multi-annual Financial Framework and Next Generation EU, in particular the RRF, will support the recovery, while making our economies and societies more resilient. Good policies are also needed to strengthen resilience: effective and well-designed active labour market policies and social protection systems; investment in education and skills; and sound public finances.

The EU’s determination to avoid the fiscal austerity response deployed following the sovereign wealth crisis is a positive development. It reflects an awareness that debt deflation is an extremely painful process and particularly so when it is unevenly dispensed. The trajectory of fiscal correction will be slower in the post pandemic world and should help to support growth.

The Euro has been trending lower, in part because the ECB is reluctant to raise rates. This is a very different environment from the post GFC world for the Eurozone. We have outsized monetary and fiscal support and clear reluctance to deal with rising inflationary pressures. The Bundesbank has been touchy about inflation for generations so this new found tolerance is a big change.

The Euro has been ranging for six years between €1.05 and €1.25. It is currently oversold as its drops through the middle of that congestion area, but a clear upward dynamic will be required to check the slide.

The longer the Euro remains weak, the better that will be for the region’s competitiveness. The next big question will be in whether there will be political arbitrage between European governments for access to China’s markets. The new Scholz government in Germany appears to be eager to adopt a more strident approach toward China. That may salve the sensibilities of Germany’s chattering classes but it’s not good for business. https://www.bloomberg.com/news/articles/2021-11-25/china-warns-olaf-scholz-s-incoming-german-coalition-over-taiwan?sref=g4EhC0E7

Germany’s DAX Index also remains in a reasonably consistent uptrend.

Germany’s DAX Index also remains in a reasonably consistent uptrend.

France’s cosmetics/luxury goods-heavy CAC40 remains in a reasonably consistent uptrend.

Italy’s industrials’ focused FTSE MIB is completing a 12-year base formation.

Italy’s industrials’ focused FTSE MIB is completing a 12-year base formation.

The relative attraction of Europe from the perspective of international investors is unlikely to be particularly appealing until the Euro finds supports. At present the first nominal price performance is being driven by currency depreciation.

Back to top