The Dollar Is a Haven in Sea of Uncertainty

This article by Gary Shilling for Bloomberg may be of interest to subscribers. Here is a section:

Trump has the upper hand since the U.S., the primary buyer in a world of ample supply, has the advantage over the seller, China. Besides, where else could China sell $534 billion in products it sent to the U.S. last year? The pragmatic Chinese will no doubt import more U.S. products, demand less technology transfers as the price American firms pay for operating in China and steal fewer U.S. trade secrets.

That will reduce the chronic U.S. trade and current-account deficits. The $500 billion current-account deficit is the number of dollars the U.S. pumps into foreign hands. Some 87 percent of all global transactions involve the U.S. dollar. So a lower deficit will result in a global dollar shortage and a higher value for the greenback will no doubt result.

Meanwhile, the Federal Reserve is shrinking its balance sheet assets at an accelerating pace. One byproduct of the Fed’s decision to cut its holdings of Treasuries and government-related securities is that it absorbs dollars from domestic and foreign investors, further reducing the supply of greenbacks.

One of David’s maxims that is most memorable in this currency market environment is “No country wants a strong currency, but some need a weak one more than others” President Trump has made no secret of his desire to have a weaker currency but Europe and China need weaker currencies more.

The Dollar Index broke out of a 10-year base formation in 2015 and retested the upper side early this year. Since then it has rallied to break a 12-month sequence of lower rally highs has been consolidating above the trend mean since June.

It firmed from the upper side of that range this week and a sustained move below 96 is the minimum required to question scope for additional upside.

The Dollar’s relative strength has also been most pronounced against the currencies of commodity producers and the countries where a lot of Dollar denominated borrowing has occurred.

Meanwhile the relative strength of the Indian rupee today is a standout as it benefits from lower commodity prices.

Silver fell today to test the lower side of its ten-week range. It needs to hold the $14 area if support building is to be given the benefit of the doubt.

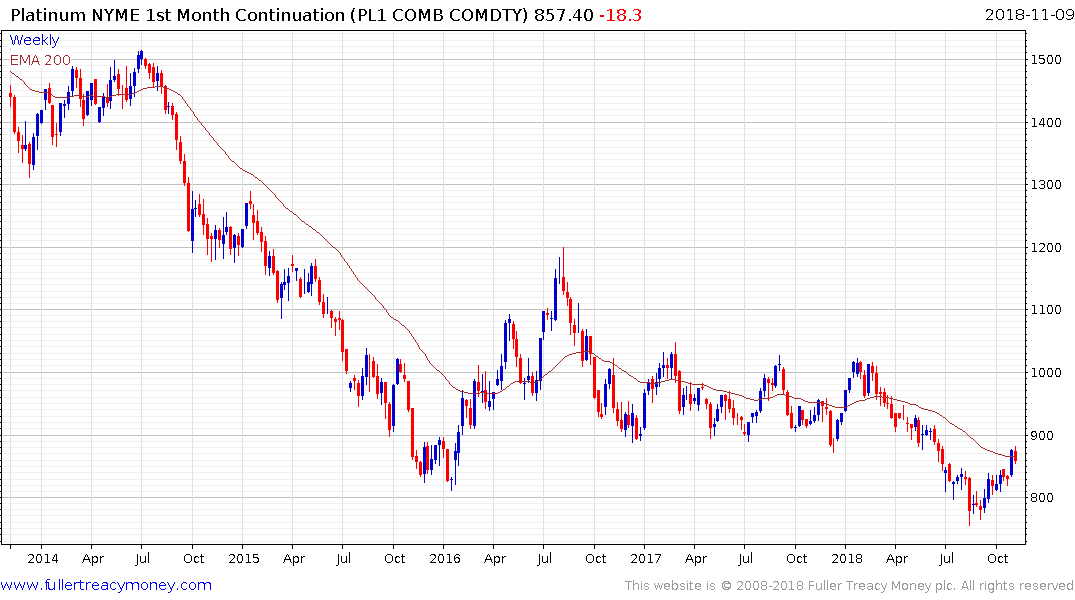

Platinum is coming back test the $850 area which will need to hold if the three-month recovery is to continue to be consistent.