China Has More Distressed Corporate Debt Than All Other EMs

This article by Selcuk Gokoluk for Bloomberg may be of interest to subscribers. Here is a section:

China’s debt, both distressed and otherwise, account for a quarter of all securities included in the gauge, which tracks about 660 dollar notes with a par value of at least $500 million. The Asian nation is home to the developing world’s biggest bond market.

The jump in China’s distressed bonds helped fuel an increase in borrowing costs for emerging-market companies to the highest level in more than two years. The impact of the trade war on the Asian nation has compounded pressure on developing assets, already reeling under the strain of higher U.S. interest rates and Treasury yields.

In markets with well-developed corporate bond markets we can come to some estimation of what to expect from the default rate. It’s going to be based on history and may or may not be accurate but at least there is some historical context. China is a country with no history of defaults because everyone always got bailed out.

The moral hazard of always creating a backstop for even the most egregious lending behaviour is obvious and virtually ensures that the financial system is going to be overleveraged and weighed down with bad loans. However, the bigger point is that a system like that can persist for a lengthy period as long as there are no defaults. When you change the system and introduce the risk of default it creates an undercurrent of uncertainty that can’t be eliminated because it is impossible to know what the natural default rate is in such a highly leveraged system.

Asian high yield spreads are trending higher and have the clearest signs among global benchmarks of tightening credit conditions.

Today’s news that state-owned banks are being directed to lend more money to private sector firms which do not enjoy a government backstop is represents a significant additional source of risk for the sector. While the big four continue to enjoy state sponsorship since they are essentially financing arms of the government, that is not great news for shareholders.

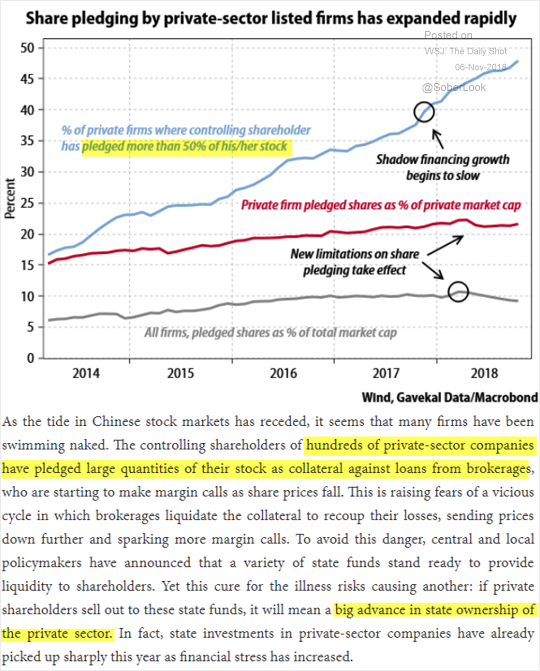

This graphic from GaveKal may also be of interest. It highlights the fact that the state is becoming an increasingly large shareholder in the private sector. The practice of companies posting shares as collateral for access to capital was common until quite recently and the decline in the stock market means the posted shares are worth less. Banks have been acquiring the shares as companies welch on the payments which effectively means the state is taking increasingly large stakes in private companies. Little wonder then that they have an interest in supporting the private sector.

The original bad banks created after the financial crisis in the early 1990s are also under pressure and importantly failed to rally meaningfully with the market over the last few months.

China needs to intervene soon to stop the rot in the stock market because there is scope for significant additional downside.

Back to top