The China Mini Stimulus Starts To Work

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section on copper

The copper market is showing the classic signs of tightness in the near term, with diminishing exchange inventories, widening spreads and high regional premia. However, we think SRB purchases have given the impression of a tighter market than is actually the case. The SRB bought nearly 500kt of metal in January and again in March/April, and has stated that its intention is to increase inventories to 2Mt, which implies a further 400 – 500kt of purchases. Given our view of a cumulative surplus of 1.4Mt, the purchase of c.1Mt certainly goes a long way to “balance” the market and would be supportive of prices.

?Our view of price support at USD6,000 – 6,2000/t is based on the 90th percentile of the all-in-cash cost, but if SRB buying behavior continues when prices fall, there is perhaps a further reason to suggest support below USD6,500/t. In our view there are perhaps four key motives for SRB behaviour in supporting prices. The first may be as simple as the expectation of continued strong demand, and the need to stock up when there is perceived value in the metal. However, we expect the main reason is to keep prices at a reasonable level in order to continue incentivizing new production, support domestic production and also to keep a lid on price volatility for China’s downstream consumers, essentially acting as a buffer.

Figure 17 shows the drawdown of exchange stocks, with a con-current increase in China bonded warehouse stocks. The most recent drawdown in exchange stocks has seen bonded warehouse stocks also fall, suggestive of SRB buying. SRB purchases were also timed with sharp falls in the LME price. The current SHFE – LME arbitrage has closed suggesting higher exports in the coming months.

I suspect that SRB stands for Strategic Reserve Buying by China which represents a significant potential demand driver and has likely been boosted by the fact that stockpiles were not as large as previously expected.

I thought that since copper prices continue to bounce from the lower side of their three-year range it might be an opportune time to re-highlight copper mining shares. I have recreated the copper miners section from my Favourites in the Chart Library and the View All Charts function is now also available in these sections.

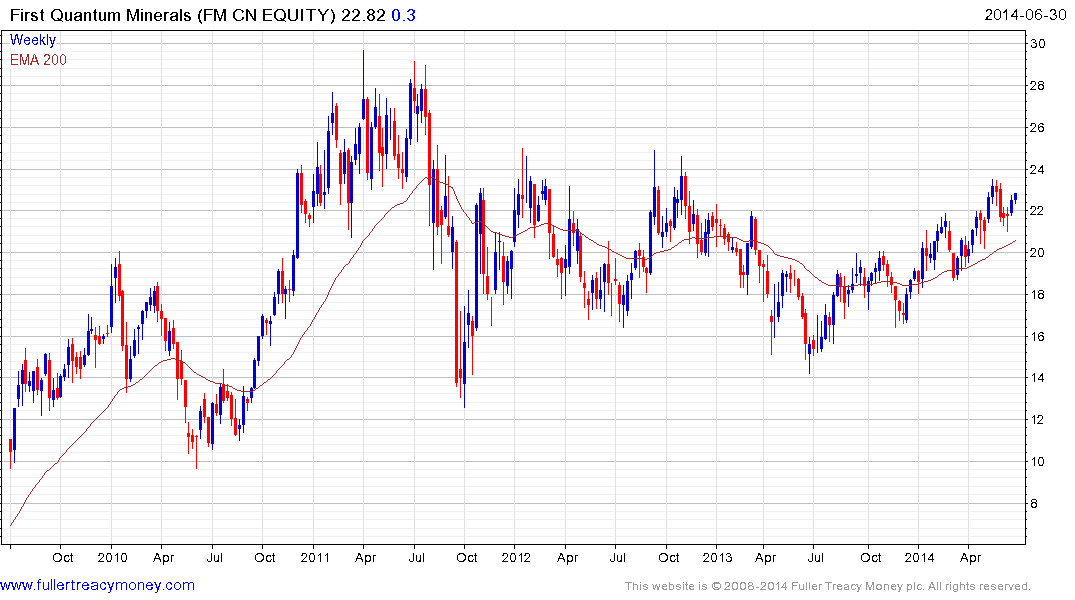

Canadian listed First Quantum Minerals has held a progression of higher reaction lows since June 2013 and a sustained move below the 200-day MA would be required to begin to question medium-term scope for continued higher to lateral ranging. Hudbay Minerals has a similar pattern.

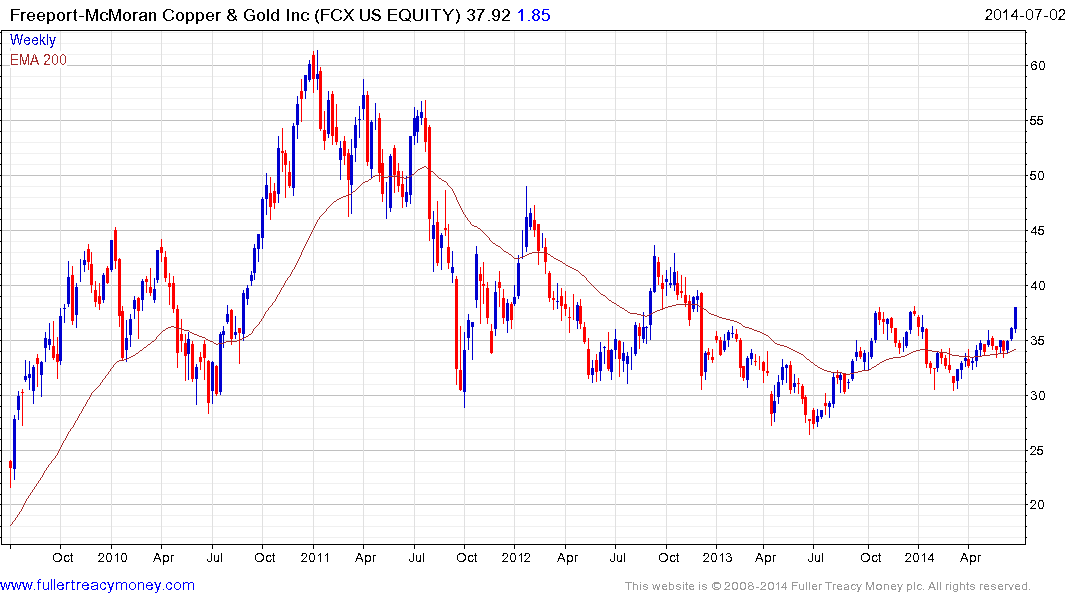

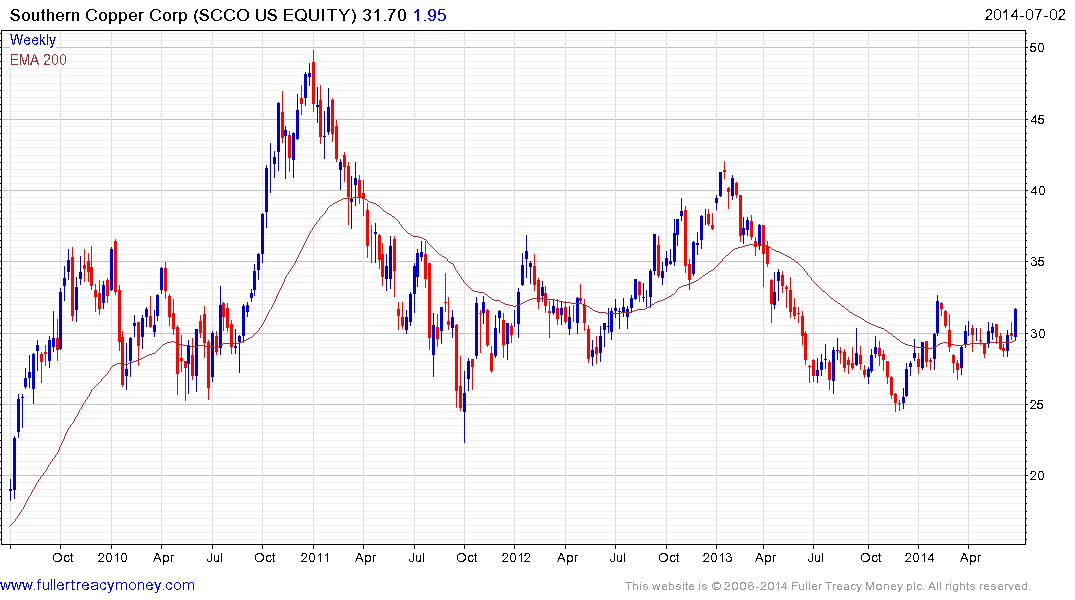

US listed Freeport-McMoran Copper & Gold failed to sustain the break below $30 last year and found support at that level in March. It is now testing the more than three-year progression of lower rally highs but a sustained move below the $34 area would be required to question current scope for continued upside. Southern Copper is firming within its base.

Hong Kong listed Jiangxi Copper has found support in the region of HK$12 on five occasions since 2011 and has rallied to challenge the three-year downtrend. A clear downward dynamic will be required to question current scope for additional upside.

.png)

UK listed Kazakhmys fell by 90% between 2011 and late January. Following the announcement that the company’s higher cost projects would be split off into a separate company, the share rallied to break its downtrend. It found support above 200p in May and a sustained move below 225p would be required to question recovery potential.

Australia listed OZ Minerals also fell by 90% between 2011 and late 2013. The share has held a progression of higher reaction lows since and a sustained move below A$4 would be required to question medium-term potential for continued higher to lateral ranging.

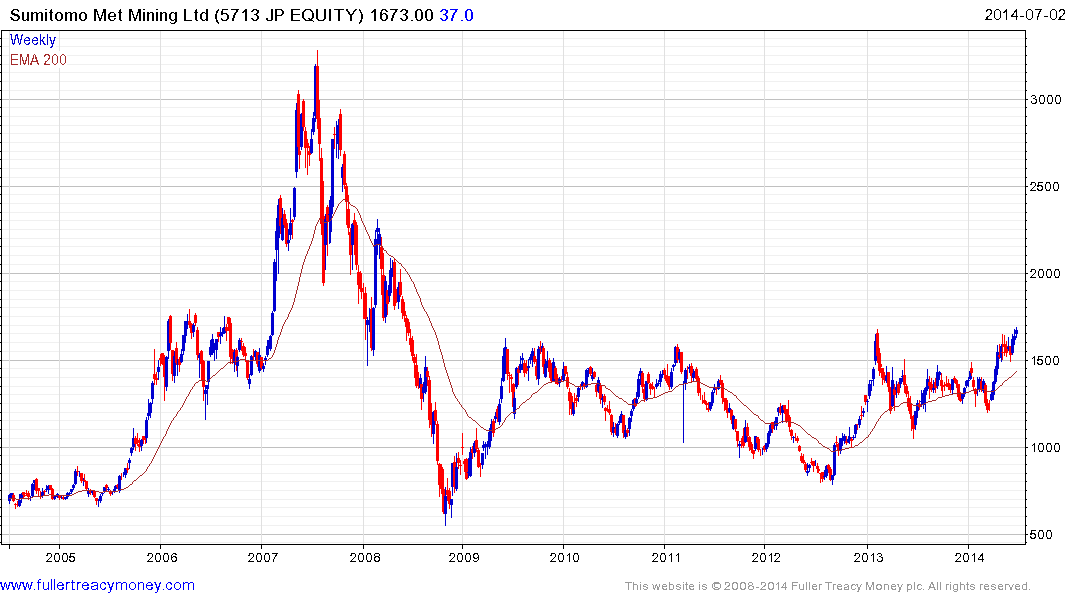

Japan listed Sumitomo Metals & Mining appear to be in the process of completing a more than five-year base.

Here is a link to Comment of the Day on May 8th which may also be of interest.

Back to top